Vietnam's IFC to target global investment flows

|

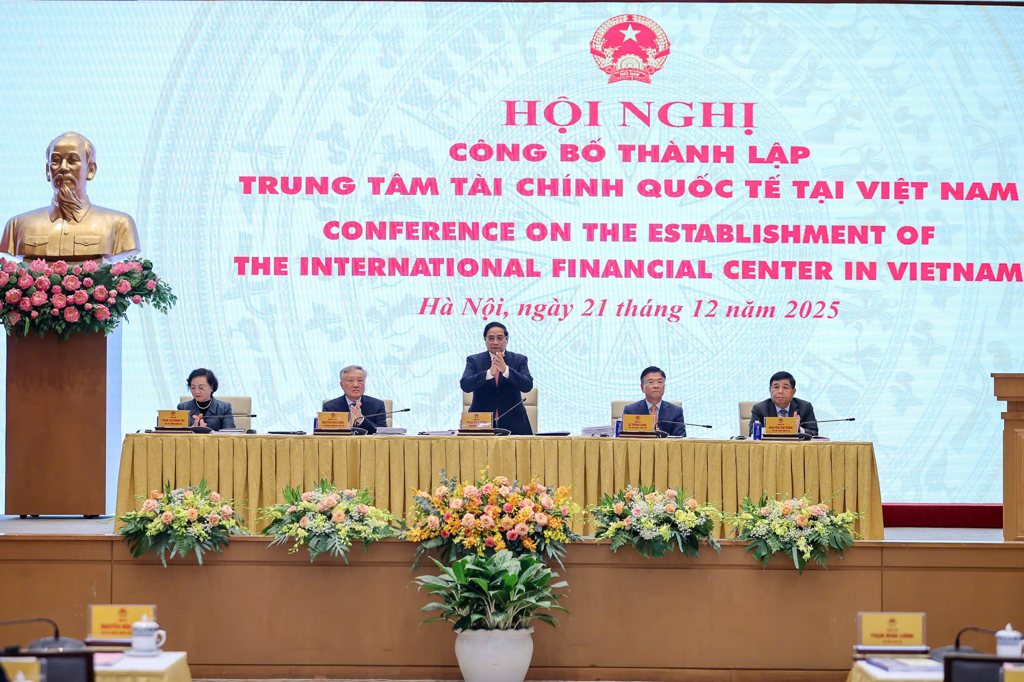

| Prime Minister Pham Minh Chinh chairing the conference on the establishment of the IFC in Vietnam |

At a conference announcing the establishment of the International Financial Centre (IFC) on December 21, Prime Minister Pham Minh Chinh noted that the world is facing strong headwinds, with many regions grappling with conflict, fragmentation and supply-chain disruptions. Against this backdrop, Vietnam has emerged as a rare bright spot, marked by solid economic growth, political and social stability, and a commitment to sustainable development.

According to the Prime Minister, Vietnam remains steadfast in its independent, self-reliant, diversified and multilateral foreign policy, positioning itself as a good friend, a trusted partner, and a responsible member of the international community. The country has established comprehensive strategic partnerships with most of the world’s leading economic powers, including the US, China, the EU, the United Kingdom, Russia, Japan, South Korea, India, and Australia.

“Stability, underpinned by a sound macroeconomic foundation and Vietnam’s development prospects, is the safest and most highly valued asset that global financial investors are seeking,” PM Chinh said.

He observed that the centre of gravity of the global economy is shifting decisively towards the Asia-Pacific region. With its favourable geo-economic position, Vietnam is well-placed to become a natural convergence point for global flows of capital, goods and technology.

The IFC in Vietnam was established pursuant to a resolution of the National Assembly dated June 27. The centre operates under a 'one centre, two destinations' model, located in Ho Chi Minh City and Danang. Ho Chi Minh City will serve as a large-scale financial hub, with a strong focus on equities, bonds, banking, fund management and listing services. Danang will concentrate on financial services linked to logistics, maritime activities, free trade, and industrial-agricultural supply chains. The planned area of the centre is 899 ha in Ho Chi Minh City and 300 ha in Danang.

Chinh described the official announcement of the IFC as particularly significant, marking a turning point in Vietnam’s integration and development journey after 40 years of economic reforms beginning in the 1980s.

“In the digital era and amid deepening global integration, cross-border flows of capital, technology, and knowledge are accelerating rapidly. In this context, establishing an International Financial Centre is an urgent requirement, based on Vietnam’s potential and strengths and aligned with the strategic goal of fast and sustainable development,” said the Prime Minister.

The centre is expected to help draw in investment resources and new growth drivers, elevate Vietnam’s position in the global value chain, and capitalise on a favourable window to draw global capital, goods, technology and talent.

“The country cannot afford to miss this opportunity. We must seize it to create new momentum for rapid and sustainable development and enhance competitiveness at both regional and global levels,” the PM stressed.

|

Local leaders in Ho Chi Minh City and Danang proclaimed their determination to position Vietnam as a credible, attractive, and responsible financial destination in the region and globally. Representatives of domestic and international businesses, investors, and financial institutions committed to channelling international capital into Vietnam, with plans to implement financial and banking mechanisms and invest strongly in digital transformation, green finance, and inclusive finance.

Representing the business community, Nguyen Phuong Thao, standing vice chairwoman of HDBank, said the establishment of the IFC shows that the country is attracting not only capital, but also talent, technology, and sustainable values.

“The IFC is being built on fast, digitalised and interoperable procedures; a competitive yet principled tax incentive framework; regulatory sandboxes for financial innovation; an open but safe foreign exchange environment; and a robust international arbitration mechanism to safeguard investor confidence,” said Thao.

Tyler Brent McElhaney, country director of Apex Vietnam Services IFC Co., Ltd., described the IFC as a reflection of the strategic vision of the country, particularly the two cities. “It is evidence of a nation confidently asserting its position in the global financial system and the future of digital finance, while fostering a transparent and open investment environment,” he said.

| Investor confidence key to attracting capital The International Finance Corporation (IFC) and the World Bank (WB) have praised Vietnam's growth prospects and the growing confidence of investors following numerous positive reforms. |

| Vietnam urged to elevate standards to advance IFC ambitions Vietnam is well-positioned to develop an International Financial Centre (IFC), supported by its fast-growing economy, youthful talent pool, and strong manufacturing base. However, experts note that significant legal, regulatory, and administrative reforms are still needed to turn this potential into reality. |

| Ho Chi Minh City taps Ant International to strengthen fintech and IFC ambitions Singapore online finance firm Ant International is boosting support for Ho Chi Minh City’s bid to become an international financial centre, focusing on digital innovation and talent development. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version