Heavy Singapore investment rolls on through new normal

|

On July 15, Crown Beverage Cans Vung Tau Co., Ltd. from Singapore received an investment certificate for its $130 million project. With this, Crown Beverage Cans aims to become the leading supplier of beverage cans to major producers in Vietnam.

As a developing country with a sizeable population that lies very close to Singapore, Vietnam has been approached by hundreds of Singaporean enterprises like Crown Beverage Cans which have left their major footprints here, earning strong confidence of locals.

Commenting on Singaporean investments in Vietnam, Tan Soon Kim, assistant CEO of Enterprise Singapore, which is the government agency championing enterprise development, told media that Vietnam has a fast-growing middle class and has attracted many Singaporean firms, including caterers and retailers in recent years.

“Select Group, Jumbo Group, and Mr. Bean have all expanded to Vietnam, for example,” he said, adding that Singaporean investors are also found in many other key areas in Vietnam like infrastructure, and technology-related industries.

He said that in the context of Industry 4.0, the Vietnamese government is actively promoting smart city and e-government projects. “This is a particular strength of Singaporean enterprises and they are seeking opportunities in this trend in Vietnam. We hope to contribute to digitalisation here,” he said. “Singapore’s smart city solution providers can meet the needs of various development projects related to logistics and smart infrastructure.”

Deeper investment schemes

In late June, JR22 Vina Singco Pte., Ltd. from Singapore signed an MoU with Hanoian authorities to build a smart city with a hotel and office complex in Tay Ho district. Accordingly, JR22 would invest an additional VND220 billion ($9.57 million) to develop smart infrastructure there.

Besides this, JR22 has also just attained an investment certificate for a complex of luxury apartments, commercial centre, and hotels in the city with the total investment capital of VND4.2 trillion ($182.35 million).

With these two projects, JR22 officially entered the Vietnamese real estate market, along with compatriots VNSL Holdings Pte., Ltd. which plans to invest VND4.2 billion ($182.35 million) into a complex of mall, office, and cultural area; Twin Peaks, which is expanding investment by $246 million in its office project in Ba Dinh district; and a dozen other Singaporean investors.

Roland Ng, president of the Singapore Chinese Chamber of Commerce and Industry, told media that more Singaporean enterprises, especially small- and medium-sized ones (SMEs), tend to expand their businesses into neighbouring countries like Vietnam.

He also said that the abundance of young and skilled workers and the rise of the middle class has helped Vietnam’s consumer economy strongly flourish, which has accelerated urbanisation and the development of infrastructure.

According to data from the Ministry of Planning and Investment (MPI), in the first seven months of 2020, Singapore had one major project in the country valued at $4 billion of registered capital. This is the Bac Lieu liquefied natural gas (LNG) power plant under the Bac Lieu LNG thermal power centre.

Meanwhile, Sunseap International – the global arm of clean energy provider Sunseap Group in Singapore – last year also reached a new milestone by commissioning one of the largest solar farms in Vietnam with the scale of 168ha, capacity of 168MW peak, and the total investment capital of more than VND4.4 trillion ($191.3 million) in the south-central province of Ninh Thuan. The project generates electricity for 200,000 households in Vietnam.

Another highlight of Singaporean investment in Vietnam are the four water treatment plants carried out by Darco Water Technologies and InfraCo Asia Development, which provides funding, leadership, and experience in designing, building, owning, and operating deal structuring.

This project helps take feed water from rivers and treat it to potable standards to serve 15,000 households in Vietnam. The project is valued at $50 million.

Singaporean groups have also been expanding operations in Vietnam in the field of finance. Major names include Syngience or United Overseas Bank (UOB), which last year opened a new branch in Hanoi, and has been promoting digital banking to improve the customer experience.

E-commerce consultancy Innovative Hub also entered Vietnam’s e-commerce market last year by signing an MoU with Alibaba Group. Particularly, the outbreak of the COVID-19 pandemic has been beneficial to the company’s operations and it is now thinking of widening its profile by introducing digital solutions for SMEs in Vietnam and the wider region.

Preferred funding destination

According to the latest Singapore Business Federation survey, Vietnam is among the most preferred destinations for Singaporean companies thinking of going regional. Along with education, manufacturing and processing, and healthcare, these companies are also keen on investing in startups and innovation.

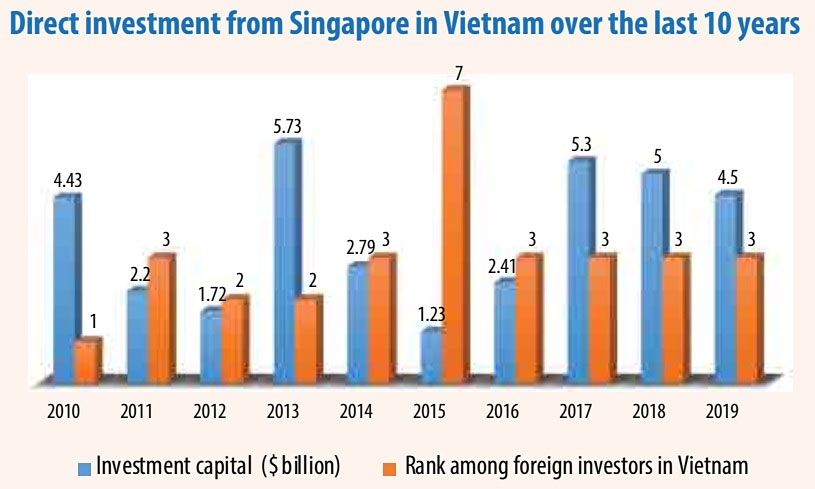

Meanwhile, data from the MPI shows that as of July 20, Singapore was Vietnam’s third-largest foreign investor, with the total registered investment capital of $55 billion for 2,544 projects, operating in numerous types of projects such as property, energy, finance, banking, IT, and tourism.

Studying the Southeast Asian and Vietnamese economies for over two decades, Suan Tek Kin, head of research and executive director of Global Economics and Markets Research at UOB Singapore, said that Vietnam will likely attract further foreign investment in high-tech industries with the operation of smart factories.

“Over the middle to long term, Vietnam is striving to achieve sustainable development that will help to improve the quality of growth and elevate standards of living. These are also requirements of the new generation free trade agreements,” Kin said.

Meanwhile, Joongshik Wang, from Ernst & Young Corporate Finance, pointed out that global geopolitical factors have affected the operations and supply chains of companies across the globe, including those from Singapore, and many businesses are looking to shift their operations to Southeast Asia, particularly Vietnam. “The US-China trade tensions have led some businesses to change their supply chains and shift their manufacturing bases from China, benefiting Southeast Asian markets like Vietnam,” he said.

According to Wang, Vietnam’s achievements in fighting the COVID-19 pandemic has boosted its appeal as a safe destination for strong investment.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version