GDP growth surge coupled with rising indicators in all sectors

|

| Source: UOB |

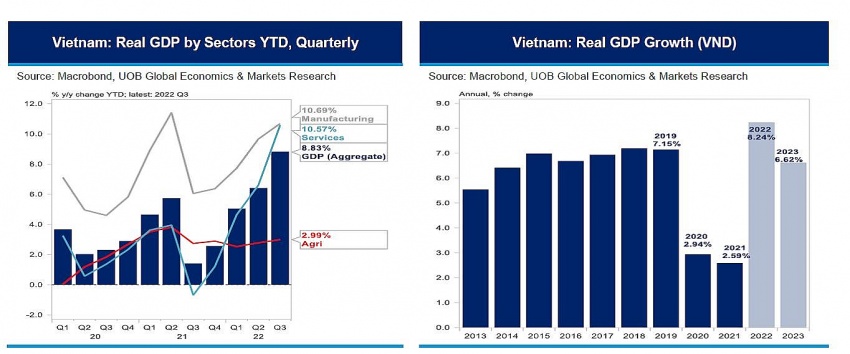

Vietnam’s Q3 real GDP growth surged 13.7 per cent on-year, supported by the low base of 6 per cent contraction in the same quarter last year as well as continued recovery in the manufacturing and services sectors.

Data released by General Statistics Office last week showed Vietnam’s real GDP growth surged by 13.7 per cent on-year in Q3 2022, from an upwardly revised 7.8 per cent in Q2 (prior estimate at 7.7 per cent on-year).

"While the outcome came in below the consensus estimate of 14.4 per cent on-year, it is nonetheless the record quarterly increase for Vietnam and narrowly beats India’s 13.5 per cent on-year pace in the April-June quarter to claim the strongest performance in Asia this year," said an expert of the United Overseas Bank.

The sharp rebound in the third quarter was supported by the low base in the same quarter last year, which shrank by a record 6 per cent on-year as the country essentially shut down during the quarter in response to the Omicron variant of the COVID-19 virus. Meanwhile, the reopening and easing of mobility restrictions since the early part of this year helped to spur business activities in the second quarter, especially in the service sector.

In the first three quarters of 2022, Vietnam’s GDP rose by 8.8 per cent on-year, against 6.4 per cent in the first two quarters of the year. Activities accelerated across the main sectors in the first nine months, including construction (8.6 per cent on-year), manufacturing (10.7 per cent), and services (10.6 per cent).

|

| Source: UOB |

Recovery is particularly discernible in the service sector, as the accommodation and food segment jumped by 41.7 per cent on-year against 11.2 per cent in Q2 while the entertainment/recreation segment surged by 14.5 per cent on-year from 8 per cent in Q2 as restrictions eased and foreign visitors returned.

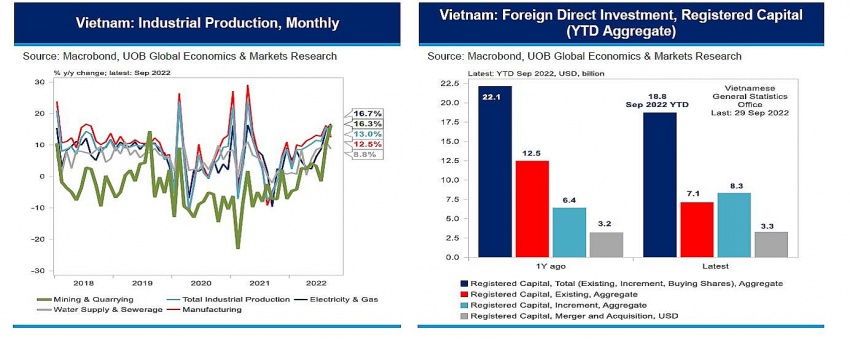

Other monthly data releases also showed that activities have generally returned to normal along with the easing of COVID-19 measures.

Domestically, the retail sector benefited significantly, as it stayed in positive territory for the eighth consecutive month and recorded 15.8 per cent on-year, extending the 11.3 per cent on-year gain in the first half of 2022. Particularly, tourism-related spending surged by 294.9 per cent on-year, from 94.4 per cent on-year as of June.

On the external front, the slowing in both exports and imports could portend to slowing demand ahead as tightened policy from major central banks weigh on sentiment and activities. Exports rose 10.3 per cent on-year, substantially slower than the year-to-date gain of 17.3 per cent while exports value amounted to $29.9 billion in September, lower than the average of $31.3 billion so far in 2022. Similarly, imports gained 6.4 per cent on-year in September. The cumulative trade surplus this year came in at $6.5 billion in September, exceeding the full-year trade surplus of $4.8 billion in 2021.

| "Higher costs of transport, food, and housing are the main drivers for the headline inflation and are likely to remain so for now," forecasted UOB. |

Foreign direct investments (FDI) remained positive, with an inflow of $15.4 billion to September, compared to $10.1 billion in the first half of 2022, for a gain of 15.6 per cent on-year. On an annualised basis, FDI this year looks to be on track to at least match the total inflows of $19.7 billion recorded in 2021.

"However, pledged or registered FDI – which indicate the size of future FDI disbursements continued to underwhelm in 2022," said UOB. The headline registered FDI fell 15.3 per cent on-year to $18.8 billion in September. Of the pledges, 64 per cent are slated for the manufacturing and processing sector, while 19 per cent are targeted for real estate. Singapore was the top source of FDI pledges, followed by Japan and South Korea.

The latest CPI print suggests that upward pressures on inflation remain present. Headline CPI rose 3.9 per cent on-year in September from 2.9 per cent in August, the fastest pace since March 2020 and near the central bank’s top end of 4 per cent. Likewise, core inflation (food and energy) gained 3.8 per cent on-year in September from 3.1 per cent in August, for the second straight month of standing above 3 per cent and at the strongest since the record began in 2015.

"Higher costs of transport, food, and housing are the main drivers for the headline inflation and are likely to remain so for now," forecasted UOB.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- PM sets five key tasks to accelerate sci-tech development (February 26, 2026 | 08:00)

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Citi report finds global trade transformed by tariffs and AI (February 25, 2026 | 10:49)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

Mobile Version

Mobile Version