Export of iron and steel soaring sharply

|

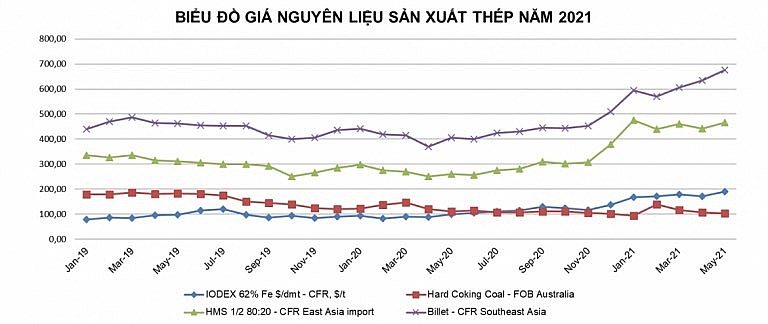

| The chart of steel material price during 2019-2021. Source: Vietnam Steel Association |

According to the Ministry of Industry and Trade, the iron and steel export value surpassed the $1 billion mark in the first four months of 2021. Exports of iron and steel soared by nearly 88 per cent to $2.7 billion and rose 47 per cent in volume to 3.8 million tonnes. The export of products made from steel also increased by 20.9 per cent to $1.2 billion.

The latest report by the General Department of Vietnam Customs highlighted that in the second half of April 2021, steel exports rose by $173 million, equivalent to 58.1 per cent compared to the first half of the month.

Thereby, manufacturing industrial products in the first four months of 2021 rose significantly on-year, while rolled steel products increased 61.8 per cent, and crude iron and steel rose 17.4 per cent.

The Vietnam Steel Association (VSA) reported that steel production reached more than 10.4 million tonnes in the first four months, up 38.3 per cent on-year. Sales reached 9.4 million tonnes, up 40.3 per cent on-year, and exports were 2.1 million, a rise of 67.8 per cent on-year.

Over the past months, local steel prices have increased sharply by 40-45 per cent over the last quarter of 2020. The steel sector heated up due to the consecutive rises in input material prices, while Vietnam's steel production mainly depends on import materials like iron ore, scrap steel, graphite electrode. Delays in delivery and the interruption of global logistics have also contributed to the increase in steel prices.

Specifically, the VSA reported that the price of iron ore (Fe 62 per cent) on May 4, 2021 was at $189.4-189.9 per tonne, a $19 over early April, and increased to $210-212 per tonne on May 7, 2021.

Premium hard coking coal exported from Australian ports on May 4, 2021 was at $103.75 per tonne, down $5 over early April, while in China it rose high.

Heavy melting steel (HMS) I/II 80:20 imported through East Asian ports cost $466, a rise of $24 over early April. The price of HSM in the US has increased slightly, while in Europe and Southeast Asia it remained stable.

Hot-rolled coiled steel (HRC) on May 4 was at $925 per tonne at East Asian ports, up $130 over early April.

"Generally, the world market of HRC has been fluctuating, so the local market faces a lot of challenges because enterprises that produce flat steel (galvanised sheet, steel pipe) use HRC as manufacturing material," VSA reported.

In order to adjust the supply of steel and stabilise prices, reduce speculation and price pressure, in early February 2021, the Ministry of Industry and Trade (MoIT) in collaboration with relevant ministries and agencies submitted Document No.724/BCT-CN to the government.

The MoIT also asked the ministry's units to check and build some technical barriers and quality standards to improve competitive climate and ensure customers' rights, and apply some trade remedies for steel products in accordance with trade regulations and international laws.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Agency of Foreign Trade warns of trade disruption due to Middle East conflict (March 02, 2026 | 17:11)

- Vietnam manufacturing sees improved growth (March 02, 2026 | 16:27)

- Businesses bouncing back after turbulent year (February 27, 2026 | 16:42)

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Ho Chi Minh City launches plan for innovation and digital transformation (February 25, 2026 | 09:00)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

Tag:

Tag:

Mobile Version

Mobile Version