Eureka Robotics plans to expand operations to Vietnam in July 2022

|

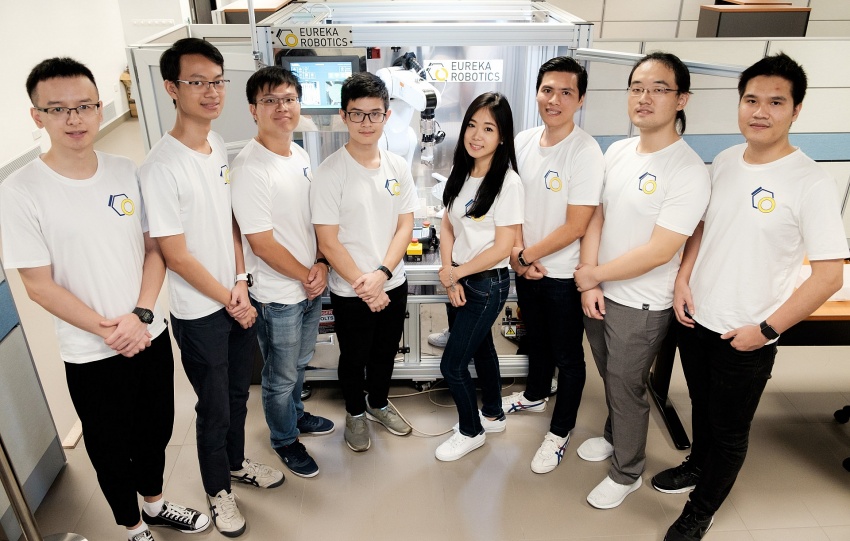

| Eureka Robotics’ CEO and team |

The company plans to use the new capital raised to expand its operations beyond Singapore, where it is headquartered, and Paris, where it maintains an R&D office. The new office will be established in Hanoi in July. Eureka Robotics has also deployed factories in Singapore, China, and Japan.

Touchstone Partners on May 17 announced that it participated in Eureka Robotics’ recently closed a pre-Series A round, which raised $4.25 million from a handful of investors.

In this fundraising round, Touchstone joins the lead investor, the University of Tokyo Edge Capital Partners, and existing investor ATEQ.

Eureka Robotics was founded in 2018 by Pham Quang Cuong and Pham Tien Hung, Eureka Robotics’ CEO, who is also an associate professor of Engineering at NTU and led the team that developed a robot that could assemble Ikea furniture, an achievement that was widely covered by global media in 2018.

Cuong said, “We are extremely gratified by the level of investor interest in Eureka Robotics during this round of fundraising. The capital is key to our ability to accelerate the development of the Eureka Controller, our primary product, as well as several others and to further build out our engineering team. We recognise that Touchstone will be a valuable partner as we bring the company to Vietnam, the home of some of our core team members, and access the country’s vast tech talent pool.”

| Touchstone Partners is a Vietnam-focused venture capital firm that aims to assist talented and driven founders to realise the potential of their businesses by applying their deep understanding of the Vietnamese market and utilising a global network of connections. Current investment areas include deep tech, fintech, real estate, health technology, educational technology, and initiatives that improve the efficiency of the value chains of important industries such as production and agriculture. Touchstone Partners aims to promote positive social development and set high standards for venture capital in Vietnam, proving that Vietnamese startups can deliver significant technology innovation and have a meaningful impact on society. Touchstone Partners’ investment capital comes from Pavilion Capital, Vulcan Capital, and several major governmental and private financial institutions. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Themes: Digital Transformation

- Dassault Systèmes and Nvidia to build platform powering virtual twins

- Sci-tech sector sees January revenue growth of 23 per cent

- Advanced semiconductor testing and packaging plant to become operational in 2027

- BIM and ISO 19650 seen as key to improving project efficiency

- Viettel starts construction of semiconductor chip production plant

Related Contents

Latest News

More News

- Site clearance work launched for Dung Quat refinery upgrade (February 04, 2026 | 18:06)

- Masan High-Tech Materials reports profit: a view from Nui Phao mine (February 04, 2026 | 16:13)

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

Mobile Version

Mobile Version