Advanced services on way to improve warehousing

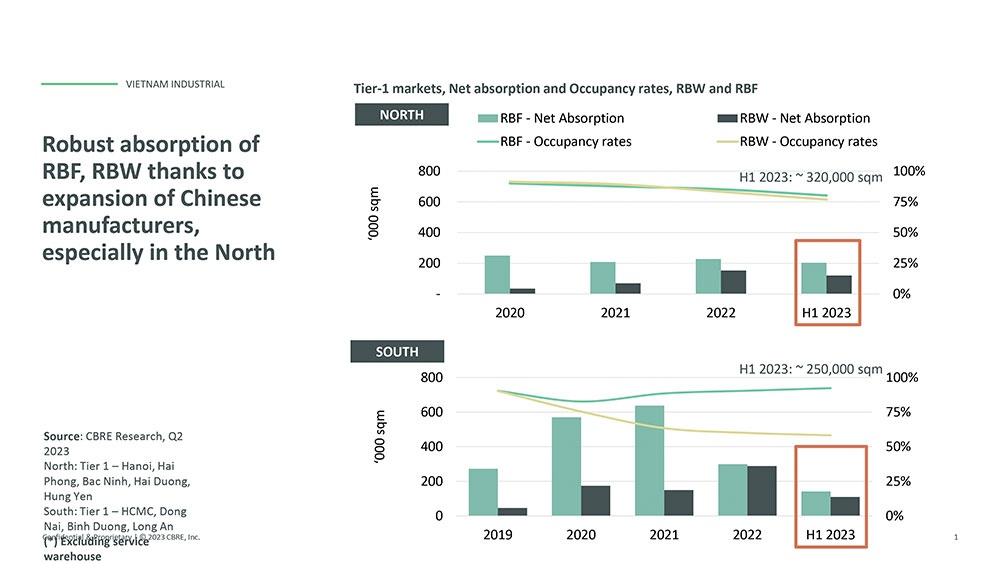

The demand for such facilities was substantially larger in the south, as reflected in figures in 2020 and 2021. However, leasable volume in North Vietnam started to catch up and surpassed southern numbers in the first half of 2023.

|

| Hieu Le - Senior director, CBRE Vietnam |

Having said that, leasable warehouse space in South Vietnam always accounts for a lion’s share of the total volume, which suggests that it remains the stronger hub for warehousing space.

The demand in the north this year has been driven mainly by expansion from Chinese manufacturing investment, which often requests big-size single-story factories, ranging 10,000-20,000sq.m.

The demand in Ho Chi Minh City’s greater area is more balanced, allocated among US, European, Japanese, Chinese, and Vietnamese investors. While the market is still leaning towards single-story facilities, double-story facilities are still being promoted and leased out at a slightly more competitive rent to entice demand. Sizing in South Vietnam is smaller, ranging around 1,000-10,000sq.m.

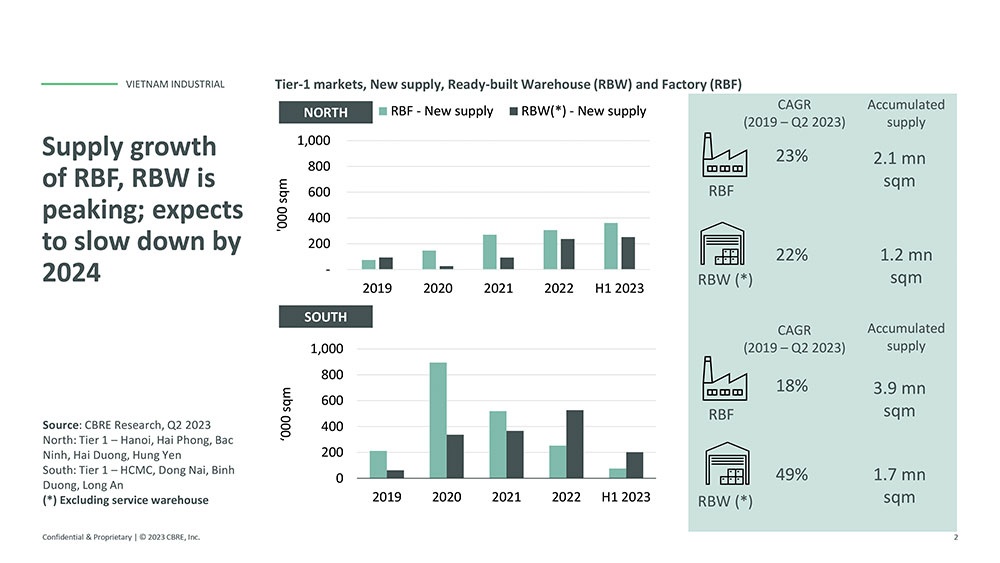

On the supply side, most factory and warehouse developers offer modern specification premises which are requested by their international occupiers.

Manufacturing investment is increasing, and Vietnam is moving up the value chain and aiming to attract more advanced tech manufacturers from the United States and Europe. This has been featured recently by Apple suppliers’ production shipment to Vietnam, as well as reflected in the government’s recent initiative to seek stronger ties with the US semiconductor supply chain.

The modern specification, therefore, is a must-have provision. At this stage, selected developers chose to offer green facilities to position themselves distinctively from the rest and target manufacturing occupiers who place sustainability high in their business model. In the mid-term, sustainability/green-certified facilities are set to become a mandatory trend among industrial developers and logistics operators.

E-commerce has increased rapidly and continues to fuel logistics growth. In fact, driven by high internet penetration, high smartphone usage ratio, and fuelled strongly during the pandemic restriction period, e-commerce has gained big traction in Vietnam and makes the country among the top five growth markets for e-commerce in Asia.

We estimate that Vietnam’s e-commerce sales will increase from $16 billion in 2021 to $39 billion in 2025, which is creating a demand for more than two million sq.m of additional e-commerce dedicated logistics space.

As logistics and labour costs increase, the value proposition for warehouse automation will become more attractive. Demand for higher-class warehouses that can support automation is expected to increase. Based on a CBRE 2021 Asia Pacific Logistics Occupier survey, traditional in-house technologies such as conveyor and sortation systems and goods-to-person picking have already seen relatively high adoption. Complex emerging technologies such as automated storage and retrieval systems and autonomous guided vehicles and robotics arms are gaining popularity.

Robotics as a service is also being touted and likely to emerge as an option in the near future.

At this stage, the multi-floor warehouse and factory are still in its infancy in Vietnam, but this type of facility has the potential to grow as Ho Chi Minh City and Hanoi start to have major land constraint issues that mirror much of the other locations in Asia-Pacific such as Hong Kong and Singapore, which went through a similar pattern.

Logistics land value in Ho Chi Minh City and in prime locations in South Vietnam already surpassed $200/sq.m/month. This is a threshold that only makes multi-floor facilities viable as an investment vehicle for developers and industrial and logistics funds. Additionally, as occupiers seek to stay closer to the consumer, it gives them no choice but to pursue multi-floor warehouses in prime locations near the city centres.

In terms of the cold chain, growing focus on food safety and increasing food exports are driving growth in cold chain logistics, with many companies entering this segment.

Significant investment has been made in cold storage facilities up and down the country, and cold chain transport is gaining more attention. The likes of Ho Chi Minh City and Long An province, being the consumption hub and processing hub for commodities for export, continue to lead the market with regard to new supply and demand.

|

|

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

- Public investment is reshaping real estate’s role in Vietnam (January 21, 2026 | 10:04)

- Ho Chi Minh City seeks investor to revive Binh Quoi–Thanh Da project (January 19, 2026 | 11:58)

- Sun Group launches construction of Rach Chiec sports complex (January 16, 2026 | 16:17)

- CEO Group breaks ground on first industrial park in Haiphong Free Trade Zone (January 15, 2026 | 15:47)

- BRIGHTPARK Entertainment Complex opens in Ninh Binh (January 12, 2026 | 14:27)

- Ho Chi Minh City's industrial parks top $5.3 billion investment in 2025 (January 06, 2026 | 08:38)

- Why Vietnam must build a global strategy for its construction industry (December 31, 2025 | 18:57)

- Housing operations must be effective (December 29, 2025 | 10:00)

Mobile Version

Mobile Version