Vietnam’s Apple shipments more than doubled in Q2/2022

|

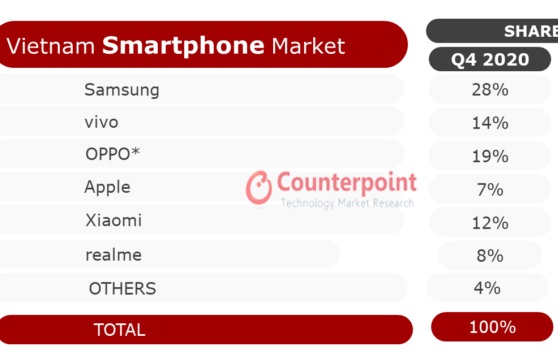

Apple, at 115 per cent on-year, saw the biggest growth among smartphone manufacturers during the quarter with Vietnamese people preferring premium smartphones. Apple is increasing its stores in Vietnam via official distributors, which is helping the brand to expand its customer reach.

Vietnam’s smartphone market is dominated by offline channels. Major Vietnamese distributors are opening mono-stores of major brands, which are driving most of the sales, with Samsung and Apple leading the chart.

Samsung’s growth was nearly flat at 3 per cent on-year as it was struggling with inventories and had to cut production at its Vietnam factory. Samsung launched low-to-mid-end devices in its A and M series, which helped the brand maintain its market share. Its high-end S series models were among the bestsellers in the premium category during the quarter, according to Counterpoint’s latest monthly Vietnam smartphone channel share tracker.

OPPO was the only Chinese player to see positive growth of 25 per cent on-year as its newly launched mid-end models fared well in the market, whereas other players like Xiaomi, Vivo, and Realme

| Apple, at 115 per cent on-year, saw the biggest growth during the quarter with Vietnamese people preferring premium smartphones. Apple is increasing its stores in Vietnam via official distributors. |

Research analyst Akash Jatwala said, “The premium price band (over $400) grew around 75 per cent on-year, driven by the iPhone 11, iPhone 13 Pro Max, and Galaxy S series. Vietnam’s people are passionate about premium smartphones. Besides this, Apple has recently reduced the prices of older iPhone models in Vietnam, making them among the cheapest in the world. Vietnam is becoming one of the major markets for Apple in Southeast Asia.”

On the smartphone manufacturing side, activities are increasing and official distributors are raising their investments in the country.

Xiaomi has started manufacturing smartphones in Vietnam in partnership with DBG Technology, while Apple’s partner Foxconn has expanded the brand’s product line in Vietnam by making AirPods and iPads at its facility in the northern province of Bac Giang.

Samsung, which makes the bulk of its smartphones in Vietnam, plans to increase its investment in the country while expanding the supply chain.

"For the second half of 2022, we have moderate expectations for the Vietnamese smartphone market. Manufacturing activities may feel the impact of raw material price increases due to global inflationary pressures, with consumer preference shifting to other essentials. We expect the local demand to revive during the last quarter, driven by the Lunar New Year consumer spending and Apple’s new iPhone launch," Jatwala said.

| Samsung Vietnam reports $74.2 billion in revenues in 2021 Samsung achieved $74.2 billion in revenues and $65.5 billion in export turnover in 2021, up 14 and 16 per cent on-year, respectively, reinforcing the position as the largest exporter in Vietnam. |

| Smartphone market of Vietnam expected to pick up speed in 2022 Based on an on-year comparison with 2021, Vietnam’s smartphone market is expected to continue to grow in 2022 and become one of the most competitive ones in Southeast Asia. |

| POCO’s flagship smartphones launched globally and are ready to reach Vietnamese consumers POCO, a popular technology brand among the world’s young techies, today announced the global launch of the POCO X4 Pro 5G and POCO M4 Pro during Mobile World Congress (MWC) Barcelona 2022, the world’s most influential exhibition for the mobile industry. |

| Xiaomi becomes second-largest smartphone manufacturer in Vietnam Xiaomi has officially surpassed a series of long-standing names in the Vietnamese market to rise to the second position among the biggest smartphone manufacturers in the first quarter of 2022. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

Mobile Version

Mobile Version