Vietnamese businesses express interest in venturing overseas

Despite ongoing uncertainties such as geopolitical tensions and moderated global demand, economies in ASEAN have remained resilient. The region continues to evolve within the world economy with strong foundations driven by a fast-growing middle class, a young and dynamic workforce, increased interconnectivity, and strong foreign direct investments.

|

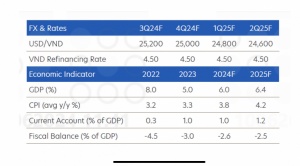

Within ASEAN, Vietnam stands as a rising star with a positive outlook in 2024. UOB’s growth forecast for Vietnam this year is 6.0 per cent, aligning with the government's official target of 6-6.5 per cent.

Against this backdrop, the UOB Business Outlook Study 2024 (SMEs & Large Enterprises), which surveyed more than 4,000 businesses in seven key markets across ASEAN and Greater China, including 525 businesses in Vietnam, found that most businesses in Vietnam remain optimistic about the current business environment. Nearly 90 per cent of businesses expressed interest in venturing overseas, with ASEAN being the top market for expansion over the next three years (by 2026).

While the overall business sentiment is positive, the study shows that fewer businesses in Vietnam saw an increase in revenue in 2023 compared to the previous year. High inflation, uncertainty over commodity prices, and the recovery from economic slowdown were the top three macro factors impacting businesses in 2023.

High inflation also led to rising supply costs for nearly 50 per cent of businesses in Vietnam in 2023, making it the top challenge in supply chain management, alongside challenges in procuring supplies or raw materials.

To cope with these challenges, businesses plan a prudent mix of short-term measures like reducing costs, and long-term measures like diversifying supply chains and finding new business partnerships in the next one to three years.

Although geopolitical tensions impacted the supply chain of nearly one in two Vietnamese businesses in 2023, the study indicates a positive trend as fewer businesses are being affected than a year ago.

Looking forward, nearly 90 per cent of businesses in Vietnam expect a positive outlook in 2024, with improved business performance. To achieve this, businesses are looking to adopt digital solutions, upgrade equipment or facilities to improve productivity, and diversify sales channels to drive growth.

Venturing overseas to grow revenue and improve profitability

About 60 per cent of businesses surveyed in Vietnam said that their top motivator to expand overseas is to grow revenue. Cross-border digital trade platforms are a popular means of overseas expansion, with more than nine in 10 businesses showing interest in using them.

When looking at the regions where businesses in Vietnam are eyeing for their overseas ventures in the next three years, ASEAN is the top choice, with nearly seven in 10 businesses wanting to expand in this region. Mainland China is the second key market, with 37 per cent of businesses preferring to venture into this country. Within ASEAN, Thailand is the most important country for businesses in Vietnam, followed by Singapore, Malaysia, and Indonesia.

However, overseas expansion is challenging for Vietnamese businesses due to several main barriers, including a lack of customers in new markets (41 per cent); lack of legal, regulatory, compliance and tax support (39 per cent); and difficulty in finding the right partners to work with (38 per cent).

To successfully expand into overseas markets, businesses in Vietnam are expecting financial support such as tax incentives or rebates (42 per cent), and funding or grants available for new markets (40 per cent). More than 40 per cent of Vietnamese businesses are also looking for non-financial support, like connections to large corporate businesses that could become anchor clients their companies can supply to in overseas markets.

Lim Dyi Chang, country head of Commercial Banking, UOB Vietnam, said, “As the leading bank in ASEAN with 30 years of doing business in Vietnam, we are well-positioned to connect local businesses to opportunities in the region, and vice versa. With our broad industry insights and strong sector expertise, coupled with our extensive regional footprint and wide partner ecosystem, we enable businesses to navigate market complexities and seize growth opportunities in ASEAN and beyond.”

|

Increasing budget for digitalisation

The study finds that nearly nine in 10 businesses in Vietnam have adopted digitalisation in at least one department. About 41 per cent of businesses have digitalised their entire operations, the highest rate in the region. More than 80 per cent of Vietnamese businesses are planning to spend more on their digitalisation efforts in 2024, with most budgeting an increase of 10-25 per cent.

However, businesses expect to face several challenges, including cybersecurity concerns, lack of digital skill sets among employees, and increased risks of data breaches.

Businesses said they want more tax incentives/rebates, connections to the right technology and solution providers, and training programmes to reskill/upskill employees to adopt digitalisation.

High awareness of sustainability, but more support needed to fuel implementation

Sustainability is considered important by 94 per cent of the businesses surveyed in Vietnam. However, only 45 per cent implemented sustainable practices in 2023.

More than half of the businesses see value in sustainability adoption for improving reputation, better branding, and attracting investors. However, top barriers holding back higher adoption of sustainability include a lack of proper infrastructure for renewable energy (38 per cent), lack of good options for sustainable financing (34 per cent), and concerns about negative impacts on profits (34 per cent).

“Insights from the Business Outlook Study help us understand what businesses need to accelerate their transition to sustainability. By offering green finance options for businesses in Vietnam, connecting them with the right partners in our regional ecosystem, and enabling them to benchmark against best practices with industry peers, UOB is helping to drive businesses in Vietnam towards faster and wider adoption of sustainability practices. Our effort is totally aligned with the country’s sustainability agenda to achieve net zero by 2050,” Chang shared.

The UOB Business Outlook Study 2024 (SMEs & Large Enterprises) aims to understand the business outlook and key expectations among SMEs and large enterprises across seven markets in ASEAN and Greater China – Singapore, Indonesia, Malaysia, Thailand, Vietnam, Mainland China, and Hong Kong SAR.

| Vietnamese economy fared well in Q1 despite external risks The global economy is facing several headwinds, including the slowdown in China and the Eurozone as well as the US Fed's possible delay of interest rate cuts. In this context, ASEAN may be a global safe haven for economic growth. Abel Lim, head of Wealth Management Advisory and Strategy at UOB, discussed with VIR's Thanh Van the outlook of the global economic condition and its impact on Vietnam. |

| Economic recovery momentum continues into second quarter UOB (United Overseas Bank) expects GDP growth to pick up to 6 per cent in the second quarter of 2024, extending the 5.66 per cent gain seen in the first quarter, and has maintained its growth forecast for Vietnam at 6 per cent for 2024. |

| Steady ship anticipated for monetary policy to 2025 Despite an uncertain global economic environment, Vietnam’s overall macroeconomic situation is forecast to remain stable in the second half of 2024. Suan Teck Kin, head of research at UOB, shared with VIR’s Thuy Van the outlook of Vietnam’s economy and how the country positions itself to capitalise on opportunities for economic growth and investment. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnam and Laos commit to joint industrial development and research (December 03, 2025 | 19:08)

- Viettel opens representative office in UAE (November 20, 2025 | 17:16)

- VinFast signs MoUs with Indonesian banks to boost EV adoption (November 17, 2025 | 18:05)

- Vietnamese businesses pour $1.1 billion into overseas ventures (November 10, 2025 | 19:25)

- Viettel Global sets new profit record with sustained overseas growth (October 30, 2025 | 08:00)

- Coteccons charts course for regional expansion (October 22, 2025 | 17:06)

- Green GSM drives VinFast EV expansion into the Philippines with Xentro (October 10, 2025 | 18:11)

- Vietnamese investors pour nearly $847 million into overseas markets in nine months (October 08, 2025 | 18:42)

- VinFast India joins forces with State Bank of India for EV financing (October 02, 2025 | 10:05)

- MoF backs reforms to cut red tape for overseas investment (September 29, 2025 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version