Economic recovery momentum continues into second quarter

|

Data released by the General Statistics Office (GSO) at the end of May reaffirmed the encouraging outlook for Vietnam’s growth trajectory. The Purchasing Managers’ Index (PMI) for the manufacturing sector rose for the second straight month in May at 50.3, making it the fourth positive reading in the first five months of 2024. This came after industrial production gained 8.9 per cent on year in May, marking the third straight month of growth in 2024.

Exports of goods recorded their third month of a double-digit gain, rising 15.8 per cent on year in May from 10.6 per cent in April, while imports rose 29.9 per cent on year from 19.9 per cent in April. Year-to-date (YTD), exports had climbed 16 per cent on year, and imports increased by 18.6 per cent in May, compared to the negative readings in the same period in 2023. The trade surplus amounted to $7.8 billion YTD in May, narrower than the $9.5 billion in the same period last year.

Foreign direct investment (FDI) data was reassuring too, indicating investors’ continued confidence in Vietnam’s political environment and competitiveness. YTD FDI inflows rose 7.8 per cent on year to $8.3 billion in May, the fastest in the five-month period since 2018, following the record inflow of $23.2 billion in 2023. Domestic activities are on track, with total goods retail sales and consumer service revenues increasing by 8.7 per cent on year YTD in May, underpinned by restaurant and accommodation (15.1 per cent on year), and tourism (45.1 per cent on year).

While external headwinds continue to weigh on economic prospects (including conflicts in Eastern Europe and the Middle East), Vietnam’s prospects are bolstered by the recovery in the semiconductor cycle, stable growth in China and the region, as well as ongoing supply chain shifts.

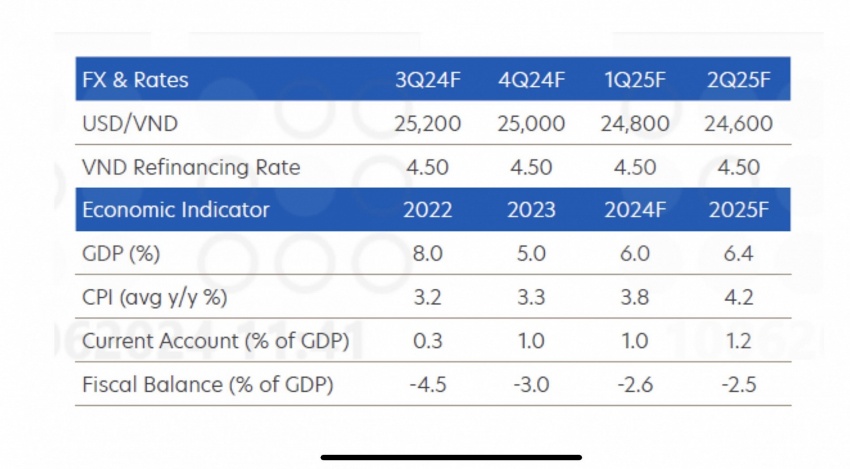

UOB expects the State Bank of Vietnam (SBV) to keep its key policy rates unchanged for the rest of 2024, driven by the steady domestic economic recovery, latent inflation pressures, and a weakened VND, which has fallen to a record low against the USD.

Instead of rate changes, the SBV is focusing on boosting credit growth to support economic activities, emerging sectors, green transition, circular economy, and social housing. Its latest guidance on May 31 aims for credit growth of 5-6 per cent by end-second quarter, and lowering of lending rates by 1-2 per cent, through simplified loan procedures, cost-saving measures, and the application of digital technology.

According to the SBV, credit growth until May 10 had increased by 1.95 per cent since the beginning of 2024, or an increase of VND264.4 trillion ($11 billion). The figure is well short of this year’s growth target of 14-15 per cent, or roughly VND2 quadrillion ($81 billion). In 2023, bank lending rose 13.5 per cent on year, compared to the 14-15 per cent goal for the year.

With activities on the mend, and with inflation rates hovering just below target, as well as concerns about the domestic currency, the possibility of lowering interest rates has diminished, UOB reported. Raising rates at this juncture may run the risk of hampering the credit and liquidity environment. UOB believed the SBV will keep its refinancing rate at the current level of 4.5 per cent, and focus its efforts on facilitating loans growth and other support measures.

Despite improving domestic fundamentals, VND was held hostage to broad-based USD strength in the second quarter and traded to a new record low of close to VND25,500 /USD. The SBV said it had intervened in the foreign exchange markets and this had helped to keep currency losses and volatility in check.

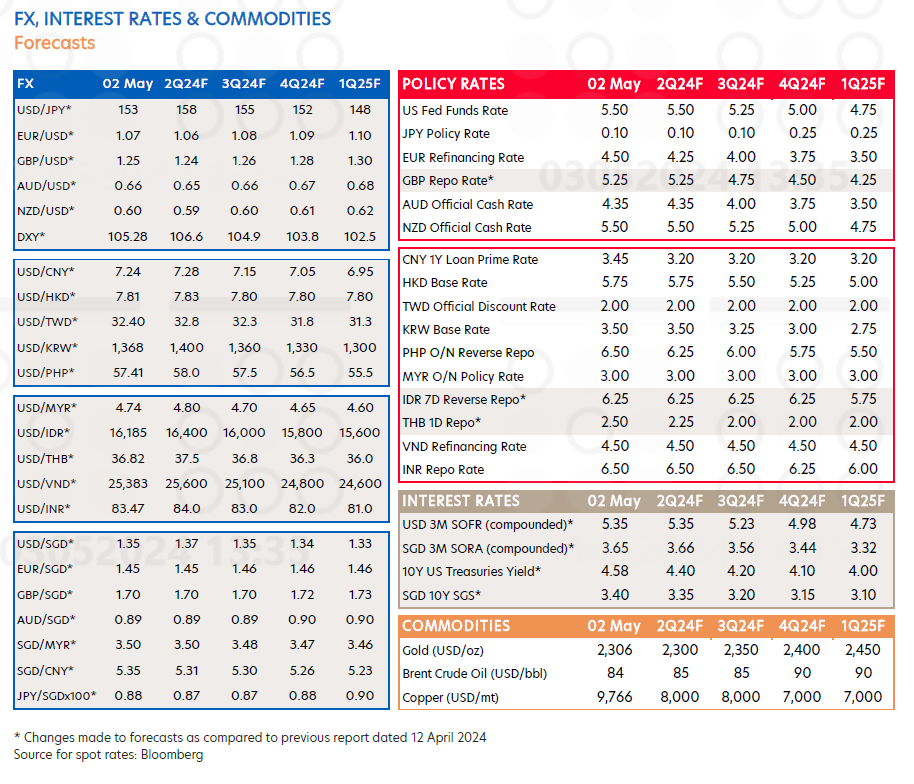

That said, UOB reiterated that the VND may recover in the second half of the year as external pressures from the USD ebb ahead of an expected Fed rate cut in September. In addition, the VND is likely to benefit from a subsequent recovery in the CNY in the second half as China’s economy shows clearer signs of stabilisation. Overall, its updated USD/VND forecasts were 25,200 in the third quarter, 25,000 in the fourth quarter, 24,800 in the first quarter of 2025, and 24,600 in the second quarter of 2025.

| PM outlines 10 socioeconomic achievements in first quarter Prime Minister Pham Minh Chinh highlighted 10 socioeconomic development achievements in the first quarter of the year, at the regular government meeting and online conference with cities and provinces yesterday on April 3. |

| Standard Chartered revises down Vietnam's 2024 GDP growth forecast to 6 per cent Standard Chartered Bank has lowered its 2024 GDP growth forecast for Vietnam to 6 per cent from the previous 6.7 per cent due to lower-than-expected Q1 growth and global trade headwinds. |

| GDP likely to meet NA growth target Hoang Van Cuong, member of the National Assembly’s (NA) Finance and Budget Committee, assessed Vietnam's economic landscape following the first full quarter of 2024, and the country's growth prospects for the rest of the year. |

| UOB: USD likely to weaken against the VND The latest Global FX and Rate Outlook from UOB Global Economics and Markets Research dated May 3 expects the USD to weaken from the third quarter of 2024. This comes after the latest Federal Open Market Committee, held April 30–May 1, and its statement conceding a lack of progress towards the 2 per cent inflation objective since the start of the year. |

| Vietnamese economy fared well in Q1 despite external risks The global economy is facing several headwinds, including the slowdown in China and the Eurozone as well as the US Fed's possible delay of interest rate cuts. In this context, ASEAN may be a global safe haven for economic growth. Abel Lim, head of Wealth Management Advisory and Strategy at UOB, discussed with VIR's Thanh Van the outlook of the global economic condition and its impact on Vietnam. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Iran war to modestly impact Vietnam (March 05, 2026 | 08:00)

- Middle East tensions drive cost pressures for seafood exporters (March 04, 2026 | 13:56)

- PV Gas reduces LPG deliveries amid Middle East conflict disruptions (March 04, 2026 | 09:23)

- JAPEX withdraws from LNG terminal project in Haiphong (March 03, 2026 | 11:57)

- Agency of Foreign Trade warns of trade disruption due to Middle East conflict (March 02, 2026 | 17:11)

- Vietnam manufacturing sees improved growth (March 02, 2026 | 16:27)

- Businesses bouncing back after turbulent year (February 27, 2026 | 16:42)

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Ho Chi Minh City launches plan for innovation and digital transformation (February 25, 2026 | 09:00)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

Tag:

Tag:

Mobile Version

Mobile Version