ThaiBev’s designs with Sabeco FOL

|

Last week the State Securities Commission approved the decision of Sabeco, Vietnam’s leading beer producer, to abolish its foreign ownership limit (FOL), which previously stood at 49 per cent. The green light came a month after Sabeco, whose board members come from Thai Beverage and the Vietnamese Ministry of Industry and Trade (MoIT), expressed their wish to remove restrictions on overseas investors.

According to experts, the decision is likely to pave the way for ThaiBev to buy 100 per cent of Vietnam’s number-one brewery. ThaiBev is already the largest shareholder, following a historic purchase last December that cost the Thai investor a whopping nearly $5 billion. It was reported that ThaiBev had to ask six banks to help it finance this investment.

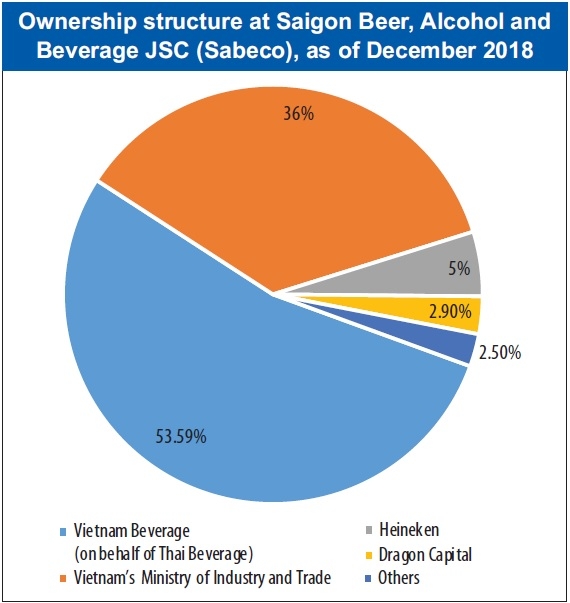

It is notable that ThaiBev’s holding at Sabeco is not a straightforward matter. Specifically, to dodge the FOL in the company, the company did not register as an overseas bidder last year. Instead, it set up a new subsidiary called Vietnam Beverage and kept its ownership there at 49 per cent so it could join the auction as a Vietnamese entity. This subsidiary then scooped up 53.59 per cent of Sabeco’s outstanding shares on behalf of ThaiBev.

This strategy clearly helped ThaiBev seize control at Sabeco, but it also means that essentially they hold just 26 per cent of Sabeco’s shares – something that a number of experts believe the Thai investor may want to change. Indeed, when asked by analysts about its ownership at Sabeco, representatives replied that the company hoped to announce updates of its holding structure soon.

Besides possibilities of greater control, counting Sabeco as a wholly-owned subsidiary may also boost the business results of ThaiBev. As the MoIT’s cash cow, Sabeco has been known as a lucrative business with consistently strong sales and generous dividends, which can reach 35 per cent in cash.

In fact, according to ThaiBev in last month’s analyst meeting in Singapore, its 2018 beer sales had already spiked by 64.9 per cent year-on-year to THB94.5 billion ($2.88 billion), thanks to contributions from Sabeco. At the same time, pre-tax profit at the Thai company doubled to THB9.3 billion ($282.6 million) also thanks to Sabeco.

Researchers believed that the removal of Sabeco’s FOL is indeed designed to speed up the synchronisation of the two parties. According to Lucas Teng and Andrew Chow from UOB Kay Hian, this is considered a “positive development that allows better management control, as well as tapping into the synergistic benefits of the acquisition.”

According to analysts, Sabeco faces competition from strong players like HEINEKEN, and its management is now looking to integrate synergies in areas such as raw materials to reduce costs. Improving Sabeco’s operating margin is a major goal for ThaiBev, as Vietnam’s biggest brewery lags behind its rivals in terms of business efficiency.

Other experts, however, are not convinced that boosting ownership is the biggest reason for Sabeco’s FOL. They pointed out that the Thai brewer already calling the shots at Sabeco and boosting its stake there for further control would not be a concern right now, especially considering the huge pile of debt taken out for last year’s share purchase.

Huynh Anh Tuan, deputy director at Everest Vietnam Securities, believed that for ThaiBev, transferring ownership between itself and Vietnam Beverage may not be a priority.

“I think ThaiBev may want to scrap the foreign ownership cap so that it might later buy more shares to increase its market price,” said Tuan.

The analyst concluded that this is more likely to be a technical move than a strategic one.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version