Super-rich grab half of all new wealth in past decade: Oxfam

|

| Super-rich grab half of all new wealth in past decade: Oxfam |

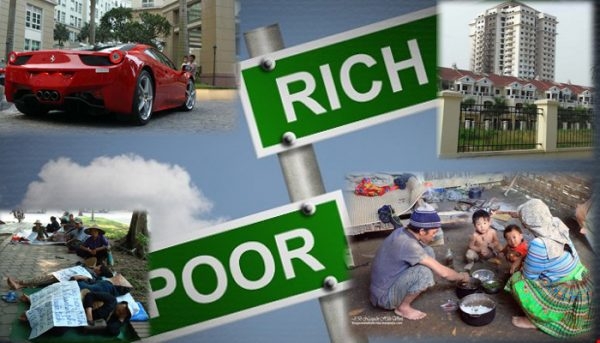

The richest 1 per cent grabbed nearly two-thirds of all new wealth, worth $42 trillion, created since 2020, almost twice as much money as the bottom 99 percent of the world’s population, reveals a new Oxfam report today. During the past decade, the richest 1 per cent had captured around half of all new wealth.

“Survival of the Richest” is published on the opening day of the World Economic Forum in Davos, Switzerland. Elites are gathering in the Swiss ski resort as extreme wealth and extreme poverty has increased simultaneously for the first time in 25 years.

“While ordinary people are making daily sacrifices on essentials like food, the super-rich have outdone even their wildest dreams. Just two years in, this decade is shaping up to be the best yet for billionaires —a roaring ‘20s boom for the world’s richest,” said Gabriela Bucher, executive director of Oxfam International. “Taxing the super-rich and big corporations is the door out of today’s overlapping crises. It’s time we demolish the convenient myth that tax cuts for the richest result in their wealth somehow ‘trickling down’ to everyone else. Forty years of tax cuts for the super-rich have shown that a rising tide doesn’t lift all ships —just the superyachts.”

Billionaires have seen extraordinary increases in their wealth. During the pandemic and cost-of-living crisis years since 2020, all new wealth was captured by the richest 1 per cent, while $16 trillion (37 per cent) went to the rest of the world put together. A billionaire gained roughly $1.7 million for every $1 of new global wealth earned by a person in the bottom 90 per cent. Billionaire fortunes have increased by $2.7 billion a day. This comes on top of a decade of historic gains —the number and wealth of billionaires having doubled over the last ten years.

Billionaire wealth surged in 2022 with rapidly rising food and energy profits. The report shows that 95 food and energy corporations have more than doubled their profits in 2022. They made $306 billion in windfall profits and paid out $257 billion (84 per cent) of that to rich shareholders. The Walton dynasty, which owns half of Walmart, received $8.5 billion over the last year. Indian billionaire Gautam Adani, owner of major energy corporations, has seen this wealth soar by $42 billion (46 per cent) in 2022 alone. Excess corporate profits have driven at least half of inflation in Australia, the US, and the UK.

At the same time, at least 1.7 billion workers now live in countries where inflation is outpacing wages, and over 820 million people —roughly one in ten people on Earth— are going hungry. Women and girls often eat least and last and makeup nearly 60 per cent of the world’s hungry population. The World Bank says we are likely seeing the biggest increase in global inequality and poverty since WW2. Entire countries are facing bankruptcy, with the poorest countries now spending four times more repaying debts to rich creditors than on healthcare. Three-quarters of the world’s governments are planning austerity-driven public sector spending cuts —including on healthcare and education— by $7.8 trillion over the next five years.

| Elon Musk, one of the world’s richest men, paid a “true tax rate” of about 3 per cent between 2014 and 2018. Aber Christine, a flour vendor in Uganda, makes $80 a month and pays a tax rate of 40 per cent. |

Oxfam is calling for a systemic and wide-ranging increase in taxation of the super-rich to claw back crisis gains driven by public money and profiteering. Decades of tax cuts for the richest and corporations have fueled inequality, with the poorest people in many countries paying higher tax rates than billionaires.

Elon Musk, one of the world’s richest men, paid a “true tax rate” of about 3 per cent between 2014 and 2018. Aber Christine, a flour vendor in Uganda, makes $80 a month and pays a tax rate of 40 per cent.

Worldwide, only four cents in every tax dollar now comes from taxes on wealth. Half of the world’s billionaires live in countries with no inheritance tax for direct descendants. They will pass on a $5 trillion tax-free treasure chest to their heirs, more than the GDP of Africa, which will drive a future generation of aristocratic elites. Rich people’s income is mostly unearned, derived from returns on their assets, yet it is taxed on average at 18 per cent, just over half as much as the average top tax rate on wages and salaries.

The report shows that taxes on the wealthiest used to be much higher. Over the last forty years, governments across Africa, Asia, Europe, and the Americas have slashed the income tax rates on the richest. At the same time, they have upped taxes on goods and services, which fall disproportionately on the poorest people and exacerbate gender inequality. In the years after WW2, the top US federal income tax rate remained above 90 per cent and averaged 81 per cent between 1944 and 1981. Similar levels of tax in other rich countries existed during some of the most successful years of their economic development and played a key role in expanding access to public services like education and healthcare.

“Taxing the super-rich is the strategic precondition to reducing inequality and resuscitating democracy. We need to do this for innovation, for stronger public services, for happier and healthier societies, and to tackle the climate crisis, by investing in the solutions that counter the insane emissions of the very richest,” said Bucher.

According to a new analysis by the Fight Inequality Alliance, Institute for Policy Studies, Oxfam, and the Patriotic Millionaires, an annual wealth tax of up to 5 per cent on the world’s multi-millionaires and billionaires could raise $1.7 trillion a year, enough to lift 2 billion people out of poverty, fully fund the shortfalls on existing humanitarian appeals, deliver a 10-year plan to end hunger, support poorer countries being ravaged by climate impacts, and deliver universal healthcare and social protection for everyone living in low- and lower-middle-income countries.

Oxfam is calling on governments to introduce one-off solidarity wealth taxes and windfall taxes to end crisis profiteering. Taxes on the richest 1 per cent should be permanently increased, for example to at least 60 per cent of their income from labour and capital, with higher rates for multi-millionaires and billionaires. Governments must especially raise taxes on capital gains, which are subject to lower tax rates than other forms of income.

The wealth of the richest 1 per cent should be taxed at rates high enough to significantly reduce the numbers and wealth of the richest people, and redistribute these resources. This includes implementing inheritance, property, and land taxes, as well as net wealth taxes.

| Towards human economy - The critical shift necessary in economic development model The global development landscape of the 21st century poses unprecedented challenges. Economies around the world have been emphasising GDP growth over other aspects of national development. In addition to climate change, wealth polarisation, rising inequality, and unsustainable production, COVID-19 has dealt another blow to the most vulnerable groups and exposed loopholes in current social protection systems and GDP-oriented growth. |

| Rich-poor gaps expanded worldwide during pandemic Rich and poor countries alike have exacerbated an explosion of economic inequality since the outbreak of the pandemic from 2020, reveals new research by Oxfam and Development Finance International. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- France supports Vietnam’s growing role in international arena: French Ambassador (January 25, 2026 | 10:11)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- Russian President congratulates Vietnamese Party leader during phone talks (January 25, 2026 | 09:58)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

- Int'l media provides large coverage of 14th National Party Congress's first working day (January 20, 2026 | 09:09)

- Vietnamese firms win top honours at ASEAN Digital Awards (January 16, 2026 | 16:45)

Tag:

Tag:

Mobile Version

Mobile Version