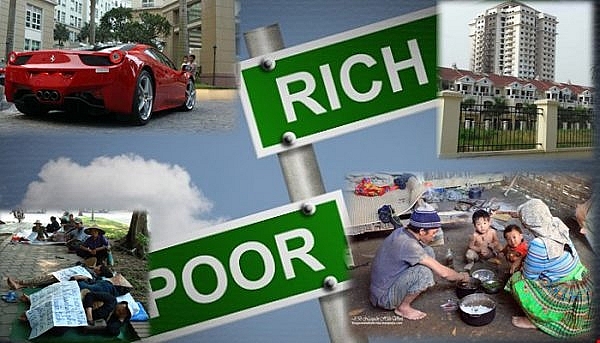

Rich-poor gaps expanded worldwide during pandemic

|

| New index shows stoked the rich-poor gaps worldwide during COVID-19 pandemic |

Half of the poorest countries saw health spending drop despite the pandemic, while 95 per cent of all countries froze or even lowered taxes on the rich and corporations, according to the report.

The overwhelming majority of governments cut their shares of health, education and social protection spending. At the same time, they refused to raise taxes on excessive profits and soaring wealth.

The 2022 Commitment to Reducing Inequality Index (CRI Index)is the first detailed analysis of the type of inequality-busting policies and actions the majority of 161 countries seem to have pursued during the first two years of the pandemic.

The index shows that despite the worst health crisis in a century, half of the low and lower-middle-income countries cut their share of health spending in their budgets. Almost half of all countries cut their share going to social protection, while 70 per cent cut their share going to education.

| “For every dollar spent on health, developing countries pay 4 dollars in debt repayments to rich creditors. Comprehensive debt relief and higher taxes on the rich are essential to allow them to reduce inequality dramatically,” said Matthew Martin, director of Development Finance International. |

As poverty levels increased to record levels and workers struggled with decades-high prices, two-thirds of countries failed to raise their minimum wages in line with economic growth. Despite huge pressure on government finances, 143 of 161 countries froze the tax rates on their richest citizens, and 11 countries even lowered them.

France fell 10 places in the index after cutting corporate tax rates and eliminating its wealth tax altogether in 2019.

Jordan dropped its budget share for health spending by a fifth, despite the pandemic. Nigeria did not update its minimum wage since before the pandemic, and the United States has not raised the federal minimum wage since 2009.

“Our index shows that most governments have completely failed to take the steps needed to counter the inequality explosion created by COVID-19. They ripped away public services when people needed them most and instead left billionaires and big corporations off the hook to reap record profits. There is some good news of valiant governments from the Caribbean to Asia bucking this trend, taking strong steps to keep inequality in check,” said Gabriela Bucher, Oxfam international executive director.

Strong actions to reduce inequality were taken by both low and middle-income countries. Costa Rica put up its top income tax by 10 percentage points, and New Zealand by 8 percentage points. The Occupied Palestinian Territory increased its social spending from 37 to 47 per cent of its entire budget. Barbados introduced a comprehensive set of laws to improve women’s labour rights, and the Maldives introduced its first national minimum wage.

As Finance Ministers gather in Washington for the International Monetary Fund (IMF) and World Bank Annual Meetings, developing nations are facing a global economy that is making it ever more difficult to meet the needs of their population. While injecting trillions into their own economies, rich countries failed to increase aid during the pandemic. Economic inequality and poverty in poor countries are further exacerbated by the IMF’s insistence on new austerity measures to reduce debts and budget deficits.

“The debate has catastrophically shifted from how we deal with the economic fallout of COVID to how we reduce debt through brutal public spending cuts and pay freezes. With the help of the IMF, the world is sleepwalking into measures that will increase inequality further. We need to wake up and learn the lessons; preventing huge increases in inequality is completely practical and common sense. Inequality is a policy choice, governments must stop putting the richest first, and ordinary people last,” said Matthew Martin, director of Development Finance International (DFI).

Oxfam and DFI analysis shows that based on IMF data, three-quarters of all countries globally are planning further cuts to expenditures over the next five years, totalling $7.8 trillion dollars.

In 2021, lower-income countries spent 27.5 per cent of their budgets on repaying their debts - twice the amount they have spent on their education, four times that on health and nearly 12 times that on social protection.

“For every dollar spent on health, developing countries pay 4 dollars in debt repayments to rich creditors. Comprehensive debt relief and higher taxes on the rich are essential to allow them to reduce inequality dramatically,” said Martin.

Despite historical precedent, nearly all countries failed to increase taxation on the richest or pursue windfall profits during the pandemic. After the 1918 flu epidemic, the 1930s depression, and World War Two, many rich countries increased taxes on the richest and introduced taxes on corporate windfall profits. They used this revenue to build education, health and social protection systems. Taxation of the wealthiest and windfall profits can generate trillions of dollars in tax revenue.

“Government leaders in Washington face a choice: build equal economies where everyone pays their fair share or continue to drive up the gap between the rich and the rest, causing huge, unnecessary suffering,” said Bucher.

| Permanent progressive policies to tackle Asia's coronavirus and inequality crisis The pandemic has aggravated already existing inequality for 148 million Asians, pushing them further into poverty while billionaires grew their wealth by $1.46 trillion. |

| Rising inequality threatens to deny access to basic healthcare for some With Vietnam's rising wealth, lingering inequality threatens to leave those behind that suffer under the heavy burden that COVID-19 and the high costs of medical treatment are causing, motivating several experts to call for more equal policies that secure the most basic healthcare needs of all. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- France supports Vietnam’s growing role in international arena: French Ambassador (January 25, 2026 | 10:11)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- Russian President congratulates Vietnamese Party leader during phone talks (January 25, 2026 | 09:58)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

- Int'l media provides large coverage of 14th National Party Congress's first working day (January 20, 2026 | 09:09)

- Vietnamese firms win top honours at ASEAN Digital Awards (January 16, 2026 | 16:45)

Mobile Version

Mobile Version