Strength to strength for the French connection

|

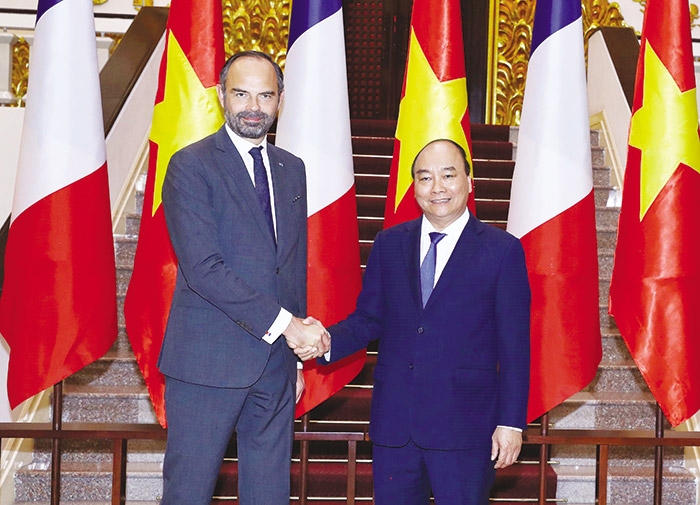

| Prime Minister Nguyen Xuan Phuc (right) and his French counterpart Édouard Philippe at the Government Office |

| France is Vietnam’s leading official development assistance (ODA) provider in Europe, and Vietnam ranks second among the recipients of France’s ODA in Asia, with a total $18.4 billion committed since 1993. In 2017, Vietnam disbursed $104 million worth of French ODA. The country is also among a few nations receiving assistance from all three financial aid channels of France: namely ODA, preferential loans of the French Development Agency (AFD) and those of the Priority Solidarity Fund (FSP). To date, France has provided Vietnam with €2.2 billion ($2.49 billion) in aid and preferential loans. |

For the first time in the history of Vietnamese-French ties, this year has seen enterprises from the two nations ink a raft of investment and business co-operation deals, worth nearly $23 billion.

During the November 2-4 official visit to Vietnam by French Prime Minister Édouard Philippe, he and his Vietnamese counterpart Nguyen Xuan Phuc witnessed the signing of 17 co-operation deals valued at over $10 billion, covering many sectors such as energy, education, health, e-commerce, urban management, space, technology, and environment.

Notably, two big business deals were clinched, including the purchase by Vietjet, Vietnam’s leading private airline, of 50 Airbus A321neo planes worth $6.5 billion and CFM Leap engines worth $5.3 billion.

“The deals signed today are valued at over $10 billion, showing that a growing number of French businesses are entering Vietnam in many sectors. This is a striking demonstration of the Vietnamese-French relations,” said PM Phuc.

Earlier, during an official visit to France in March 2018 by Vietnam’s Party General Secretary Nguyen Phu Trong, businesses from the two nations also inked deals worth €11 billion ($12.53 billion).

Last week, Vietnam and France also inaugurated the Alexandre Yersin School in Hanoi, and the French Medical Centre in Ho Chi Minh City, where construction of the French House project was also begun.

Upcoming investment plans

According to Vietnam’s Ministry of Foreign Affairs, Vietnam has become a magnet for French investors, especially in the sectors of energy, gas, electricity, infrastructure, smart city, and e-government. They are also interested in projects regarding agriculture, forestry, adaptation to climate change, science and technology, education and training, and health care.

Since late March 2018, when Party General Secretary Trong paid an official visit to France, doors have been opened for French businesses to invest in Vietnam’s infrastructure, transport, and space industries.

Vietjet agreed on a $6.5 billion deal with France’s Safran Aircraft Engines, under which the latter will support the former with fleet management services, training, and research and development programmes including efficient fuel usage and technical management. Vietjet also signed a finance agreement with GECAS France on buying and leasing six A321neo aircraft valued at $800 million.

Vietnam’s industry-real estate-finance T&T Group and France’s infrastructure developer Bouygues clinched a €250 million ($307.5 million) deal to upgrade Hanoi’s Hang Day stadium, and another deal worth €1.4 billion ($1.72 billion) on developing the city’s urban railway project No.3.

Bouygues said it considers Vietnam a very important market, and wants to engage more in Vietnam’s infrastructure projects. The group has constructed many key infrastructure projects in Vietnam, such as Phu Luong Bridge and Hai Van Tunnel.

Besides, Vietnam’s property developer FLC Group signed a memorandum of understanding with Airbus to purchase 24 A321neo aircraft for its newly-established Bamboo Airways scheduled to start operations in 2019. FLC has completed the deposit and initial payment of the contract, fulfilling the pre-condition for handing over the 24 aircraft to Bamboo Airways.

Furthermore, Vietnam Airlines and Air France Industries KLM Engineering and Maintenance (AFI KLM E&M) also clinched a contract, worth over $500 million, for maintenance of Boeing 787-9 aircraft. Under the contract, AFI KLM E&M will oversee the maintenance of 20 GEnx engines, including 16 engines fitted to eight operating aircraft and four others in reserve, for 12 years. The French company will also provide access to spare engines for Vietnam Airlines to guarantee seamless continuity in its operations.

French investors also want to deploy space-related projects in Vietnam. Vietnam’s Ministry of Science and Technology and Airbus Defence and Space SAS inked a deal on space technology co-operation. France’s Collecte Localisation Satellites (CLS) and Spatial Reference Information Systems (SIRS) are also working with the Vietnamese government about its upcoming projects in Vietnam.

“We provide services for agriculture, forestry, land and water related risk management,” said Jean-Paul Gachelin, CEO of SIRS, which produces geographic data derived from satellite and aerial images.

SIRS’ land services include remote control sensing, monitoring, and risk or damage assessment in case of natural, environmental or technological disaster. Each of these applications requires different image processing technologies.

“The use of high resolution/very high resolution time series allows a precise delineation of each parcel. Administration can include farmer identification as well as the crops cultivated as attributes in a national land parcel identification system,” Gachelin said.

In another case, CLS’ executive vice president Antoine Monsaingeon said that France has been supporting Vietnam in the space industry for a few years, and CLS will continue its co-operation with the country to master satellite technology.

CLS also worked with Vietnam’s Ministry of Agriculture and Rural Development for its upcoming projects in Vietnam.

French employers’ association MEDEF president Pierre Gattaz said that Vietnam is becoming “a big tiger in Asia”. The country has an attractive investment and business climate developed by the government’s great reform drives.

“Vietnam is strongly attracting French enterprises,” Gattaz said. “Currently over 200 French businesses are operating in Vietnam. With its rapid economic growth, and a fast-growing middle class, many opportunities are awaiting investors, including French ones.”

According to Vietnam’s Ministry of Planning and Investment, in the first 10 months of this year, France was Vietnam’s ninth-largest foreign investor, with 32 new projects registered at $470.7 million. If stake acquisitions and raised capital from operational projects are included, total newly-registered French investments mounted to $517.7 million.

Overall, France has 533 valid projects registered at over $3.6 billion in Vietnam, making it the 15th largest foreign investor in the Southeast Asian nation. Notably, France is Vietnam’s seventh-largest foreign investor in the tourism sector, with 14 projects registered at $188 million.

In general, French investments in Vietnam are largely in the forms of joint venture (35 per cent), wholly-foreign investment (33 per cent), and the remaining forms include partnership, joint stock company, build-transfer-operate, build-transfer, and build-operate-transfer. The average capital of each project is $11.6 million.

In terms of trade, France is the fifth largest European trade partner of Vietnam, after Germany, the UK, the Netherlands, and Italy. The bilateral trade turnover hit $2.3 billion in the first half of this year, and $4.6 billion last year – up 11.6 per cent on-year.

New commitment

Last week, the two prime ministers agreed to boost co-operation between both nations in e-government development and modernisation of state administrative governance, which is a new, promising co-operation sector. They also agreed to facilitate businesses of both nations to further cement co-operation in the sectors of infrastructure, energy, aviation-space, health care, science and technology, communications, response to climate change, and smart city.

PM Phuc affirmed that with its improved business and investment climate, Vietnam always welcomes and creates favourable conditions for all foreign investors, including French ones.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VIFC in Ho Chi Minh City officially launches (February 12, 2026 | 09:00)

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version