PwC report reflects CEO's latest sentiments

Accordingly, 69 per cent of Asia-Pacific CEOs believe global economic growth will decline over the next 12 months, compared to last year when 76 per cent felt growth would improve.

Despite gloomy economic prospects, Vietnam still shows high confidence in the country’s economy in 2023.

|

In light of the fresh report, Asia-Pacific CEOs are facing the dual imperative of pushing to manage short-term external risks and drive profitability, whilst simultaneously transforming to thrive in the longer term.

Mai Viet Hung Tran, Assurance Leader at PwC Vietnam noted, “Despite the tumultuous economic and political climate globally, the Asia-Pacific region remains a major player in trade and economic activity, with Vietnam shining as a bright spot for growth. As with their counterparts in the region, Vietnamese CEOs are facing growing societal pressures.

To lead effectively in this challenging environment, they need a comprehensive understanding of both the challenges and opportunities at hand. This presents a unique chance for these leaders to establish trusted, resilient, and profitable businesses for the future through visionary leadership.”

| Despite fading CEO confidence in the global economy, Asia-Pacific CEOs are far less pessimistic about the prospects of their own countries compared to their global counterparts. |

The report shows that while health and cyber risks were the top concerns a year ago, the impact of the economic downturn is paramount for Asia-Pacific CEOs this year, with inflation (41 per cent) and macroeconomic volatility (30 per cent) leading the risks in both the short and medium term.

Geopolitical conflict (30 per cent) also stands out as one of the top dangers. The war in Ukraine and growing concern about geopolitical flashpoints in other parts of the world have caused Asia-Pacific CEOs to rethink aspects of their business models.

Despite fading CEO confidence in the global economy, Asia-Pacific CEOs are far less pessimistic about the prospects of their own countries compared to their global counterparts.

The growing emphasis on national interests over global ones represents an acceleration of trends underway, however, the fundamentals of the region continue to be bolstered by trade liberalisation and markets welcoming foreign direct investment.

According to the new report, CEOs in Vietnam are facing a unique set of challenges, just like their counterparts in the Asia-Pacific region.

They must navigate the current economic landscape while also preparing their businesses for the future.

As such, there are several key insights they can draw from their regional peers and act to ensure their companies' longevity.

Firstly,while Asia-Pacific CEOs have reversed their prior optimistic sentiment on the global economy, Vietnam is expected to outperform its regional and global peers.

Despite the gloomy global outlook, the country continued to show great strength and resilience in 2022, resulting in GDP growth of 8.02 per cent – higher than the global figure at 3.2 per cent and Asia-Pacific at 4 per cent on average. Looking into 2023, Vietnam is projected to grow by up to 7.2 per cent.

Secondly, nearly half of CEOs in Asia-Pacific are cutting operational costs, diversifying products, raising prices, and adjusting supply chains.

CEOs in Vietnam should have a focus on efficiencies to ensure continuity and competitiveness, as the country is also exposed to changes and threats under the current economic environment.

Thirdly, fifty-three per cent believe their current business models will not survive within the next decade, indicating the urge to transform to remain viable.

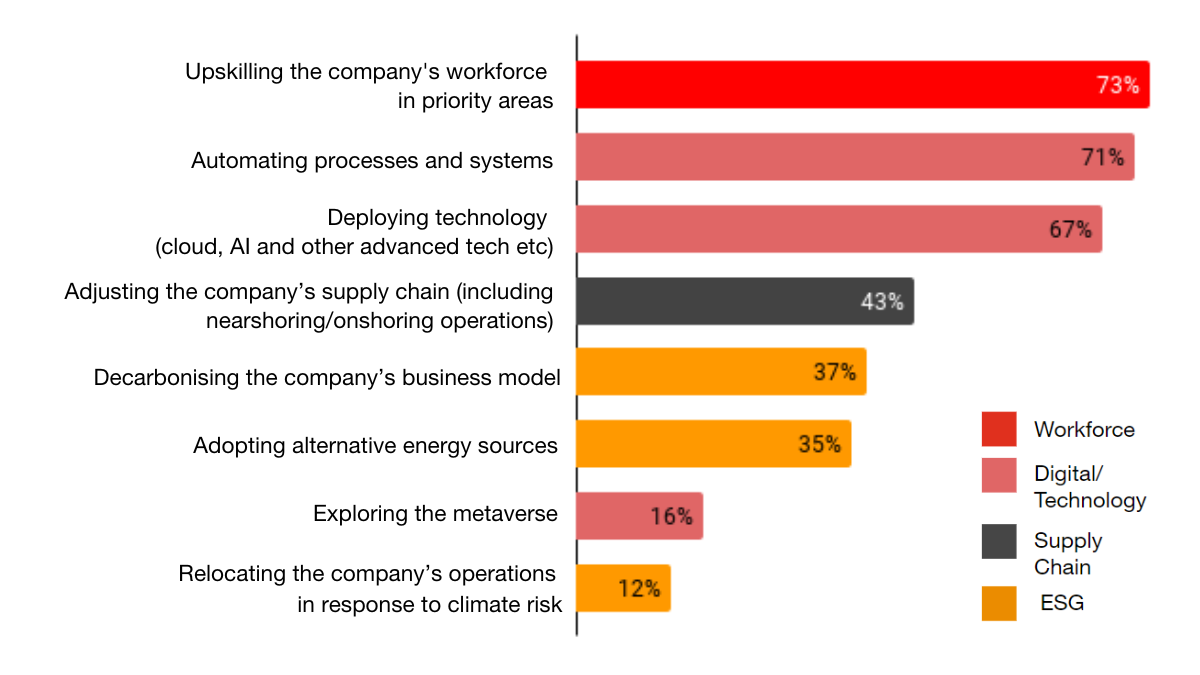

To make the transformation journey a success, Vietnamese CEOs need to overcome any resistance to change and leverage digital and technological advantages to fill the environmental, social, and governance (ESG) action gap.

In addition, to engage and inspire people, Vietnam's business leaders should pay more attention to empowerment within the workforce, while seeking to adopt more sustainable and ESG practices through greater communication and collaboration with the government and other partners to drive sustainable growth.

| Fresh report identifying potential Asia-Pacific unicorns On July 18, KPMG and HSBC released the Emerging Giants in Asia Pacific report, which examines new businesses across the region with strong potential to impact the global business landscape over the next decade. |

| Fresh CEO rush shakes up Vietnam’s banking arena With competition in the financial landscape mounting in recent years, a wave of new CEOs in some major foreign-invested banks operating in Vietnam is slated to boost corporate innovation and responsiveness to rapidly-changing business conditions. |

| PwC global revenues up 7 per cent to $42.4 billion For the 12 months ending on June 30, 2019, PwC firms around the world had gross revenues of $42.4 billion – up 7 per cent in local currency and 4 per cent in US dollars. Revenues grew across all lines of business and major markets, boosted by the power of the PwC brand and continued significant investments in quality, technology, and people. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- PM sets five key tasks to accelerate sci-tech development (February 26, 2026 | 08:00)

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Citi report finds global trade transformed by tariffs and AI (February 25, 2026 | 10:49)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

Tag:

Tag:

Mobile Version

Mobile Version