Proposed LNG projects hasten clean and ample energy supply

|

The shift from coal to gas in energy planning is important for Vietnam’s energy security, the reliability of the electricity system, and the country’s greenhouse gas emissions, as well as towards a balance in trade relations between Vietnam and the United States.

|

| John Rockhold, chairman of the Vietnam Business Forum’s Power and Energy Working Group |

In 2019, liquefied natural gas (LNG) power plants were at the centre of discussions about Vietnam’s energy future as representatives of foreign investors and utilities and development finance institutions made appearances in Vietnam, holding meetings and workshops with authorities and energy executives with the aim of increasing the number and capacity of gas-fired power plants and LNG terminals in Vietnam.

Another objective is the import of LNG from the US, which is currently the largest producer worldwide. These sales could be used to work towards the trade balance between Vietnam and the US which grew even higher during 2019.

However, LNG should not be seen as a replacement for all planned and proposed coal power plants. Vietnam Business Forum’s Made in Vietnam Energy Plan 2.0 proposes a balanced strategy that integrates an adequate supply of LNG power generation within an electricity development strategy that is led by renewables which will also help to lower the trade deficit.

Vietnam’s gas reserves, which are primarily in offshore basins within the country’s exclusive economic zone, are estimated at around 202 billion cubic metres. Annual output, which reached 9.8 billion cu.m in 2017, is split between the power sector, which consumes about 80 per cent of output, and the fertiliser and industrial sectors, which consume about 10 per cent each.

While development of these domestic resources has been a priority for the government and its oil and gas industry, actual utilisation for power generation has been much slower than desired, partly due to increasing cost of drilling in deeper water, complex geology, and investor fatigue.

In the meantime, growth in demand for electricity has outstripped growth in supply, particularly in the Southeastern region. This could also increase the amounted of imported LNG from the US.

Driving demand for LNG

To help address Vietnam’s energy needs within the necessary timeframe, a rapid development of a wide spectrum of renewable energy sources and modalities is needed. In the future, battery storage and hydropower may also be able to resolve problems related to the intermittency of these sources.

However, dispatchable generation capacity capable of maintaining grid voltage and frequency under a variety of demand and climate conditions will need to be met with a lower carbon source of energy than coal, the energy source choice in the Power Development Plan VII (PDP VII).

This need can be met by importing LNG from the US and other markets.

Asia is already driving strong demand growth for LNG. By 2035, nearly 50 per cent of total global LNG demand growth, and 80 per cent of power and industry demand growth is expected to come from Asia. For this reason, the global power market is shifting towards better alignment and planning for increased use of LNG as fuel for gas-fired power projects. Additional commissioning of 132 billion cubic metres of liquefaction capacity is expected by 2022, with the US and Australia representing around 70 per cent of the new capacity. The US is expected to continue increasing its share in global liquefaction capacity by 70 billion cu.m alone.

New supply from the US and Australia is disrupting LNG flow patterns, while simultaneously introducing new pricing metrics for LNG based on US Henry Hub index pricing schemes rather than traditional oil-linked contracts. Since the 2014 global oil crash and subsequent recovery, the market begun to observe a delinking in the relationship between long-term contract price tied to crude oil and spot prices. Contract terms for LNG supply are evolving to include greater flexibility with the removal of restrictive destination clauses and shorter terms, resulting in a more competitive spot market in Asia.

Market liberalisation and deregulation in Japan have increased pressure associated with competitive procurement practices, and now many buyers in Japan are looking for alternatives to an oil-linked formula for their LNG contracts as Japanese utilities diversify their pricing exposure to include both hub-indexed and spot-indexed LNG. Some of the largest investors in US LNG are Japanese and South Korean firms that recognise the long-term value and potential of the competitive US LNG market.

Burning natural gas in power plants rather than coal could help provide public health and environmental benefits by reducing air pollution. Cleaner burning than other fossil fuels, the combustion of natural gas produces negligible amounts of sulphur, mercury, and particulates. Because combined-cycle natural gas generators can be ramped up and down 600MW within 10 minutes, they could support the integration of wind and solar. Natural gas can also play an important role in meeting peak electricity demand and fuelling cogeneration plants that generate both heat and power, which are up to twice as efficient as plants that only generate electricity.

However, natural gas is not a panacea. Poor management of drilling, extraction, and pipeline transportation can result in the leakage of methane, a greenhouse gas that is 86 times stronger than CO2 at trapping heat over a 20-year period. These fugitive methane emissions can equal 1-9 per cent of total life cycle emissions of an LNG power plant. Technologies are available to reduce leaking methane, but deploying such technology requires policy action and investment in both exporting and importing countries.

Taking centre stage

Given Vietnam’s offshore gas reserves, the ability to import LNG at favourable terms into the foreseeable future, the preferability of LNG over coal, the reduced impacts on public health and the environment, and the possibility of reducing climate change impacts, LNG is or ought to be considered a preferable competitor to coal.

Since gas is both used for baseload and quickly responds to changes in demand or renewable supply, it is a strong contender to be a larger part of Vietnam’s energy mix. The PDP VII planned for 10 gas-fired power plants, including six combined cycle power plants, with a total capacity of roughly 24.2GW, located in the central, south-eastern, and Mekong Delta regions. Investor interest suggests that there are likely to be more proposed as substitutes for planned coal thermal power.

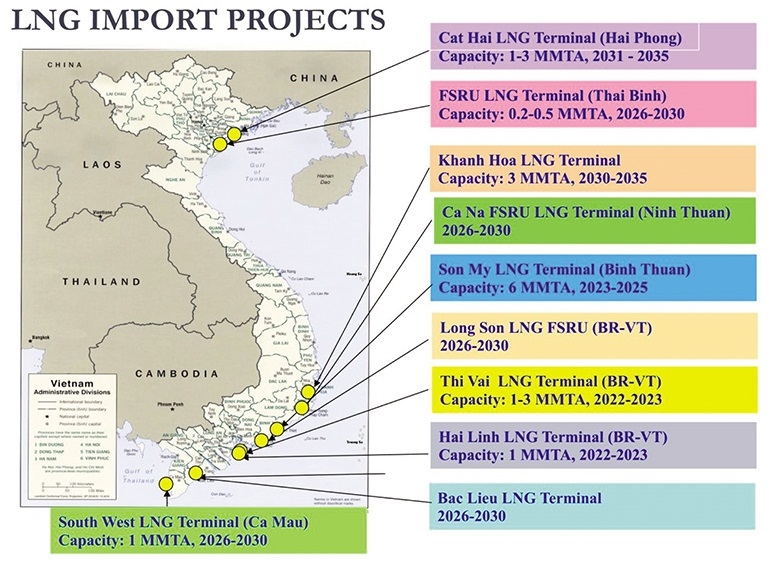

The expansion of LNG as a fuel source for power stations will be dependent on the creation of a network of regasification terminals. A recently completed report for the International Finance Corporation demonstrates that the Vietnamese coastline has many suitable locations for use of floating storage and regasification units (FSRU) and the installation of LNG import terminals, both on- and offshore.

Whether and how Vietnam uses FSRUs, should be determined based on financial feasibility studies matched to geography, expected size, and throughput capacity. None have so far been planned. Their value is in their capacity for rapid deployment, especially to existing gas power plants.

Vietnam’s most recent oil and gas sector plan proposed the construction of six LNG terminals. As of early 2019, 10 have been actually been proposed and one, Thi Vai, is now under construction.

The creation of storage facilities will allow for utilisation of LNG shipped via trucks to other industries outside the power sector. The ability for LNG to displace liquefied petroleum gas represents long-term cost savings to end-users by direct supply.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version