Paving the way for paramount infrastructure projects

|

Deputy Minister of Planning and Investment Tran Quoc Phuong told VIR that the ministry is expediting the collection of ideas and feedback from ministries, localities, and the business community to have “high-quality input” for the draft Law on Public Private Partnerships, before submitting it to the National Assembly for discussion this October.

“We expect that the draft law will be adopted soon, so that we can have a sound legal framework to attract infrastructure investment. Without such a law, it would be quite difficult to attract this type of investment,” Phuong said. “One of the key points of the law is the risk-sharing mechanism between the government and the investor, and such a mechanism is now under discussion.”

Infrastructure in Vietnam refers to many sectors, like telecommunications, power, transport, water and sanitation, rural and urban roads, railways, bridges, and seaports.

Under the draft law, the government proposed two options for risk sharing mechanisms in terms of revenue. Firstly, the government would bear a maximum of 50 per cent of losses between the actual revenue and the committed one in the contract. Secondly, financiers will commit to share with the government not less than 50 per cent of the difference in proceeds between the actual and the committed figures.

Nobufumi Miura, chairman of the Japanese Chamber of Commerce and Industry, said that many Japanese investors are interested in implementing infrastructure projects in Vietnam. However, they need a clear public-private partnership (PPP) framework for them to carry out these projects.

“To encourage overseas participation in PPP projects, it is vital that the government clarifies the risk allocation between the government and the private party, and provides comprehensive support for the private party to ensure a reasonable return from their investment,” said Miura.

Vietnam released Decree No.63/2018/ND-CP in 2018 on PPP investment. However, Phuong asserted that a law on PPP would help protect investors’ rights and benefits more effectively.

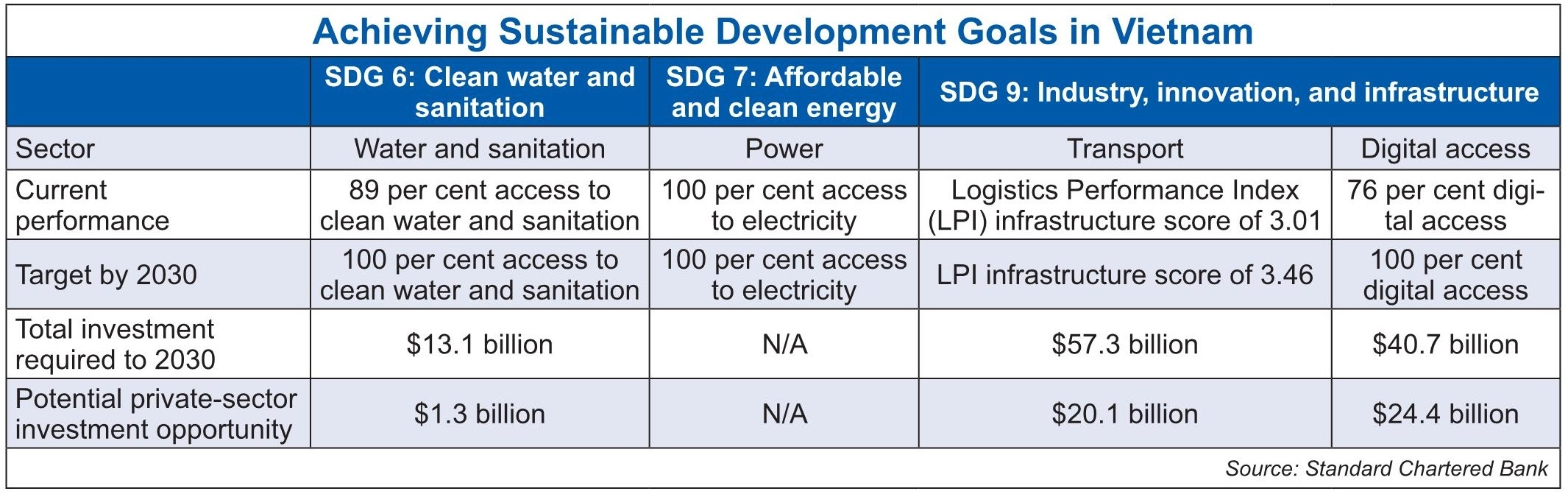

Last week, Standard Chartered Bank released its report “Opportunity2030: The Standard Chartered SDG Investment Map”, stating that in Vietnam, the greatest SDG investment opportunities are found in transport infrastructure and improving digital access, both key indicators of SDG 9, which encourages improvement in industry, innovation, and infrastructure.

Opportunity2030 states that achieving universal digital adoption – a combination of mobile phone subscriptions rates and internet connectivity – will require private-sector investment of around $24.4 billion between now and 2030, while significantly improving Vietnam’s transport infrastructure will require an estimated private-sector investment of $20.1 billion.

The potential private-sector investment opportunity in the water sector is smaller, but as 11 per cent of Vietnam’s population still do not have access to clean water and sanitation (a key SDG 6 indicator), investment will make a real impact.

To help achieve universal access by 2030 will require an estimated private-sector investment of $1.3 billion.

At last month’s meeting between the government and localities, Prime Minister Nguyen Xuan Phuc stated that in 2020, the government will boost the construction of many major infrastructure projects and facilities in the power, water, traffic, and urban development sectors.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Mobile Version

Mobile Version