MoIT steadfast in aim to ensure coal switch

In a submission to the government from the Ministry of Industry and Trade (MoIT) dated October 12 on the nation’s electricity development plan for the decade and beyond, the MoIT suggested strong measures to delay build-operate-transfer (BOT) projects that do not ensure capital arrangements before the end of June 2024.

|

For instance, if the $3.23 billion Song Hau II scheme from Malaysian investor Toyo Ink Group Berhad cannot overcome its revenue and financial arrangement issues by July 1 next year, the MoIT will “send a notice of termination to the company,” it said, which would mean an immediate termination of the contract.

Song Hau II is one of five BOT thermal power projects that are behind set schedules. With total capacity of up to 7,220MW, the others are Vinh Tan III, Quang Tri, Cong Thanh, and Nam Dinh I.

At a conference on foreign-invested enterprises with Prime Minister Pham Minh Chinh last week, Chew Cheong Loong, executive director of Toyo Ink Group said, “With the global economic recession and force majeure situations arising continuously around the world, we face many challenges beyond control, causing delays in project progress.”

This group is still committed to making efforts with Eximbank Malaysia and financial funds to commit to implementing the project according to the schedule.

Similarly, the Nam Dinh I initiative is also facing a dark future. It is funded by Nam Dinh Electricity Co., Ltd., which was established in Singapore and is owned by Taekwang Power Holdings of Hong Kong and ACWA Power.

The investor is proposing to change the owner before signing the project contract. At the same time, the MoIT also requested the investor to promote implementation to meet the contract signing schedule by mid-2024.

In the context of credit sources for coal power being tightened, many localities have proactively proposed to switch to using liquefied natural gas (LNG). Therefore, experts said it is essential to quickly complete the necessary procedures to convert coal power projects that cannot be deployed to LNG.

This also opens up many opportunities for proposals to convert the Cong Thanh plant to LNG. Currently, the project has almost completed site clearance, levelling, and technical infrastructure investment.

The MoIT reported to the government earlier this month that Cong Thanh has completed some work in the investment preparation phase, such as having infrastructure ready.

Pham Van Hoa, member of the National Assembly Legislation Committee, said, “With the advantage of having available space and being able to take advantage of the Nghi Son LNG centre, investors should consider converting Cong Thanh coal power to LNG soon.”

Previously, the US-ASEAN Business Council also said that replacing some new coal projects with LNG should be supported. Cong Thanh Thermal Power JSC has actively worked with members of this council such as BP, General Electric, and Actis Investment Fund to study the feasibility of investing in the project using LNG.

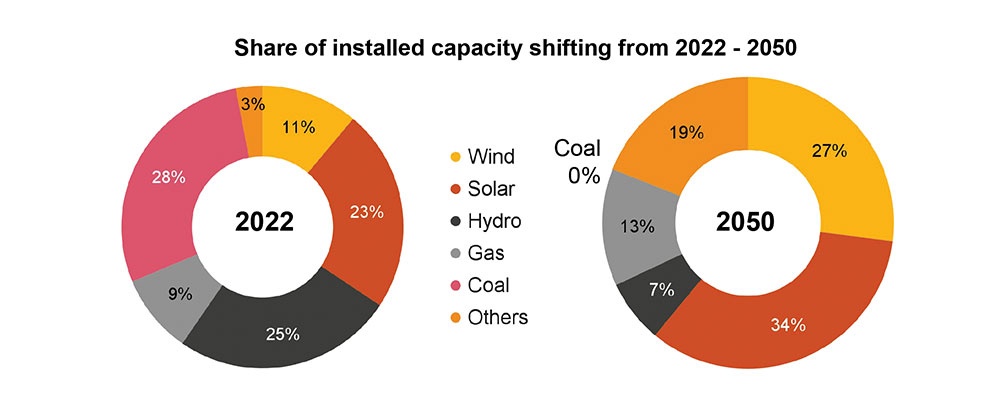

According to Vietnam’s new power plan approved in May, coal is expected to be phased out by 2050 through the introduction of alternative fuels.

| Coal continues to be vital for power generation As a result of government intervention and support, the amount of coal used for power generation exceeded 20 million tonnes during the first half of this year. |

| Coal supply moves shoring up generation of power As Vietnam faces the prospect of a coal shortage and the challenges of securing supply, more actions are needed to ensure a long-term coal supply for power generation. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- $100 million initiative launched to protect forests and boost rural incomes (January 30, 2026 | 15:18)

- Trung Nam-Sideros River consortium wins bid for LNG venture (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Envision Energy, REE Group partner on 128MW wind projects (January 30, 2026 | 10:58)

- Vingroup consults on carbon credits for electric vehicle charging network (January 28, 2026 | 11:04)

- Bac Ai Pumped Storage Hydropower Plant to enter peak construction phase (January 27, 2026 | 08:00)

- ASEAN could scale up sustainable aviation fuel by 2050 (January 24, 2026 | 10:19)

- 64,000 hectares of sea allocated for offshore wind surveys (January 22, 2026 | 20:23)

- EVN secures financing for Quang Trach II LNG power plant (January 17, 2026 | 15:55)

- PC1 teams up with DENZAI on regional wind projects (January 16, 2026 | 21:18)

Tag:

Tag:

Mobile Version

Mobile Version