Manufacturing M&As continue to manifest

|

| Manufacturing M&As continue to manifest, illustration photo/ Source: Shutterstock |

In the automobile manufacturing industry, Jardine Cycle & Carriage Ltd., announced on November 14 that it has subscribed to a private placement by Vietnamese carmaker Truong Hai Group Corporation for a domestic convertible bond of VND8.68 trillion ($350 million).

A number of deals have been announced across other segments. In food manufacturing, a fortnight ago Sojitz Corporation along with Sojitz Asia and Sojitz Vietnam jointly acquired full ownership of New Viet Dairy.

New Viet Dairy is a wholesale importer and distributor that operates in commercial foods, food services, and dairy ingredients. “Vietnam has been one of Sojitz’s most important markets, and the firm has built value chains for manufacturing, logistics, and retail industries here to meet the rapid expansion of supermarkets, convenience stores, and other retail business formats,” Sojitz said.

“Through the acquisition, we will work alongside its consolidated subsidiary and major consumer goods wholesaler, Huong Thuy Manufacture Service Trading Corporation, to create a broad wholesale food distribution business that supplies independently owned retail stores, mass merchandisers, and top hotels and restaurants,” the firm added.

Many products are processed and manufactured at the company’s factory and distributed nationwide under the Bottega Lachize brand. These production activities will continue to be developed moving forward.

Likewise, Marubeni Corporation, through its wholly owned Singapore-based subsidiary Marubeni Growth Capital Asia Pte. Ltd. acquired a significant minority interest in Asia Ingredients Group earlier this month.

Back in August, Chinese battery firm Gotion Inc. announced that it had acquired 15 million ordinary shares of VinFast, with an investment totalling $150 million.

Julien Curtet, partner at Index-Asia, told VIR, “In 2023, given lower exports and overall slower economy, we can expect a smaller number of transactions overall in the manufacturing sector. However, this may not necessarily lead to a smaller amount of merger and acquisition (M&A) in value as the slowdown in volume can be compensated by some sizeable investments and transactions, namely Lego’s $1 billion investment at the end of 2022 into early 2023, or VinFast’s expansion of its manufacturing capabilities in the electric vehicle sector.”

Curtet further noted that manufacturing M&A has the same tailwinds as the industry overall, particularly due to the relatively qualified and plentiful workforce for a portion of the cost compared to China, and the strategy of global companies to diversify their supply chain and manufacturing away from China.

“Another key driver for the manufacturing sector and M&A is the large network of free trade agreements that Vietnam has been able to secure over the years, making it highly cost-efficient for global companies to export,” he added.

The Vietnamese government is also strongly supporting the manufacturing sector as evidenced by the recent proposition from the Ministry of Industry and Trade to offer an interest rate subsidy of 3 per cent alongside other support such as tax incentives and human resources training. This aims to stimulate part-supplying enterprises, enhance their competitiveness, and encourage participation in the supply chains of multinational corporations.

“Given the above tailwinds, there will be increasing M&A deals in the sector. Key segments that will attract are those where Vietnam has built expertise over the years and that accounted for the majority of exports, namely electronics, garments and textiles, and furniture,” Curtet said.

According to Seck Yee Chung, partner of Baker McKenzie Vietnam, the foreign investment and M&A market in Vietnam are showing signs of growth despite a challenging environment as the country is becoming an increasingly attractive destination for overseas investors, particularly due to its stable macroeconomic environment, growing middle class, and strategic location in Southeast Asia.

This, coupled with the supply chain recalibration to have Vietnam as a China+1 destination, will continue to drive the trend in 2024.

“In terms of manufacturing, this sector has shown considerable growth in Vietnam, with the country emerging as a reliable centre for producing high-tech products where international tech giants have kept up their expansion plans. It is actively promoting the growth of its chip manufacturing by courting international companies in assembling, testing, packaging, manufacturing with labs, and designing,” Chung said.

| Lego Group on track to complete billion-dollar manufacturing plant in Vietnam Lego Group is progressing towards completing a billion-dollar manufacturing plant in Vietnam, with more than one-quarter of phase one construction already completed. |

| Hoang Thinh Dat - a trusted partner for industrial manufacturing investors Nghe An province’s success in recent years in attracting foreign direct investment is associated with the strategic direction and contribution of industrial park infrastructure investors such as Hoang Thinh Dat Corporation. |

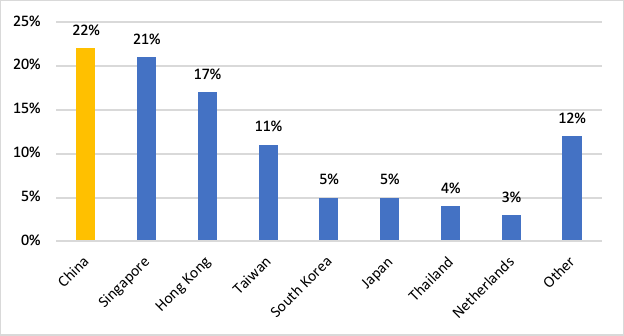

| China reigns as one of Vietnam's largest trading partners and investors Vietnam welcomes significant investment from China across diverse manufacturing segments, including textiles, optics, and telecommunications. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnam’s IFC creates bigger stage for M&As (February 01, 2026 | 08:16)

- Game startup Panthera raises $1.5 million in seed funding (January 29, 2026 | 15:13)

- Cool Japan Fund transfers shares of CLK Cold Storage (January 28, 2026 | 17:16)

- Nissha acquires majority stake in Vietnam medical device maker (January 26, 2026 | 15:40)

- BJC to spend $723 million acquiring MM Mega Market Vietnam (January 22, 2026 | 20:29)

- NamiTech raises $4 million in funding (January 20, 2026 | 16:33)

- Livzon subsidiary seeks control of Imexpharm (January 17, 2026 | 15:54)

- Consumer deals drive Vietnam’s M&A rebound in December (January 16, 2026 | 16:08)

- Southeast Asia tech funding rebounds on late-stage deals (January 08, 2026 | 10:35)

- DKSH to acquire Vietnamese healthcare distributor Biomedic (December 24, 2025 | 15:46)

Tag:

Tag:

Mobile Version

Mobile Version