Japanese see potential with startup initiatives

More than 100 Japanese and Vietnamese in-person and about 500 others online took part in the Inno Vietnam-Japan Meetup in Hanoi on April 23 to seek cooperation opportunities, following the launch of the latest phase of the Vietnam-Japan Joint Initiative in a New Era.

|

| The Inno Vietnam-Japan Meetup in Hanoi on April 23, photo: baodauthau.vn |

Tran Manh Hung, Vietnam country manager of Japan’s Mynavi Corporation, said that since 2017 the company had invested in mergers and acquisitions and local startups in IT, education and human resources. The related companies include Homedy, JobHopin, Itviec, TOPCV, NAL Solutions, MindX, and others.

“We are learning more about the startup ecosystem in Vietnam to look for investment opportunities for our parent company. Although the local startup market is not as big as that in Singapore and Indonesia, the potential is huge,” he told VIR. “We plan on 4-5 transactions this year.”

Hung said that the market in 2023 faced difficulties due to economic challenges and global uncertainties. Now, the market conditions have become more favourable in the first months of 2024, signalling recovery for the year. However, as economic headwinds continue, challenges in the capital market for startups still remain.

Similarly, Japanese-invested IT company Cresco enhanced its offshore business activities by establishing Cresco Vietnam in 2019. Last September, the company invested in a local startup called Capichi, a food delivery service provider. With the investment, Cresco becomes a sole distributor of Capi Order in Japan. The two companies are expecting to expand operation in sales channels, human resources, know-how and technology.

For Capichi, the startup journey began in 2019 with the Capi Order app. It is now available in Vietnam, Thailand, and Japan, and has as many as 2,000 affiliated stores and more than 160,000 users registered for the service.

“Food delivery is quite mature in Vietnam at this time. It is expected to have a change in delivery methods in the future towards electric vehicles or drones. This changes the landscape of the food delivery market,” said Mori Taiki, CEO of Capichi. “We will continue to invest in technology and others to increase customers’ experience.”

In anticipation of potential cooperation with Japanese funds, local startups like Med247 showed off their growth potential at the event.

Med247 operates under the online-to-offline model, combining traditional medical examination in a convenient clinic chain and remote medical examination technology. Med247 currently operates several clinics in Vietnam.

Thao Minh Nguyen, CEO and co-founder of Med247 JSC, said, “We have got funding from Singapore funds and others. Now we eye Japanese funding to serve our future expansion plan of opening more clinics in Hanoi and in the Northern region.”

According to Do Tien Thinh, deputy director of the National Innovation Centre, the startup cooperation between Vietnam and Japan now focuses on app services, and the app-model economy. More potential sectors are waiting for bilateral partnerships.

“Vietnam is calling for investment and international cooperation in high-tech and chip industries in which the country has advantages and market potential. Japan and Vietnam’s startups collaboration should enhance these fields in the future,” he said.

|

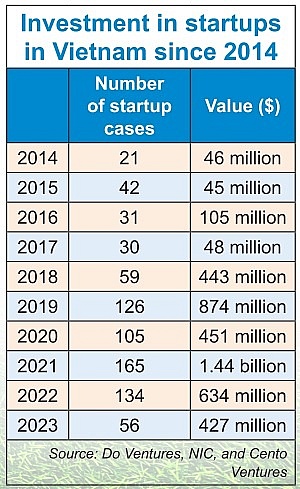

While the local startup market has potential, experts said that investment in such areas has yet to show a bright picture in 2024.

According to Next100 director Doan Van Tuan, capital sources for innovative startups in 2023 declined due to the gloomy picture of the global macroeconomy. In particular, rising inflation continuously broke previous records, forcing the US Federal Reserve to increase interest rates.

“This was the reason why cheap cash flow was gradually limited. Therefore, the cash flow from foreign startup investment funds into Vietnam also suffered the same situation,” Tuan said.

Meanwhile, Tran Anh Tung, managing director of VIC Partners, said that the flow of money is the biggest barrier.

“A company may have a talented and dedicated team and high-quality products, but when money in the capital market is not abundant, it is impossible to build a large company of hundreds of millions to billions of US dollars,” Tung said. “Once the US Federal Reserve maintains interest rates at the current high level of 5.5 per cent, money will flow very slowly to frontier financial markets.”

Japan is one of the biggest foreign investors in Vietnam. In 2023, Japanese investment in the Southeast Asian nation hit $6.56 billion, up 37.3 per cent on-year, with mergers and acquisitions value reaching $2.94 billion.

| Japanese retailer Takashimaya to advance project in Hanoi Japanese retailer Takashimaya is strengthening its foothold in Vietnam with a plan to launch a shopping centre in Hanoi by 2026. |

| Dong Nai woos Japanese investors More than 100 Japanese investors, with 200 more Vietnamese and Japanese attending online, participated in a conference to promote investment in the southern province of Dong Nai held in Tokyo on April 24. |

| Japanese leaders hold further talks to make North Hanoi Smart City a reality Japanese government agencies have held meetings with leaders of a consortium between Vietnam's BRG Group and Japan's Sumitomo Corporation to push progress on the North Hanoi Smart City project. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

Tag:

Tag:

Mobile Version

Mobile Version