Competition within ASEAN for pharma investment

Vietnam’s pharmaceutical market grew from $2.7 billion in 2015 to $7.6 billion in 2023, making it one of the fastest-growing and most strategic markets for several multinational pharmaceutical corporations in the ASEAN region.

|

| Darrell Oh, chairman, Pharma Group |

Despite its potential, Vietnam has yet to fully capitalise on its strengths and competitive advantages to attract large-scale projects from across ASEAN. Southeast Asia remains an attractive destination for pharma investment, with robust double-digit growth expected to continue. Singapore is widely regarded as the region’s leading innovation hub due to its early and sustained strategy, while Malaysia has emerged as a promising destination for clinical trials, and Indonesia is gaining recognition as a key local manufacturing hub.

To engage new investors and retain existing ones, clear and progressive regulations are essential. These allow companies to operate efficiently while maintaining high standards for drug quality, safety, and efficacy. For instance, some ASEAN countries such as Malaysia, Indonesia, and the Philippines are adopting regulatory reliance mechanisms to streamline marketing authorisation, encouraging manufacturers to introduce advanced therapies sooner.

In light of the competitive race among neighbouring countries to increase their attractiveness to investors, Vietnam faces challenges in achieving its goals outlined in government resolutions. To overcome these obstacles and become a more appealing investment destination, it is essential for Vietnam to address current administrative bottlenecks while offering additional incentives.

Vietnam has set a clear goal to develop a high-value pharmaceutical industry and become a pharmaceutical hub in Asia. This ambition is outlined in key national policies and resolutions, as well as the national strategy for Vietnam’s pharma development towards 2030, with a vision to 2045.

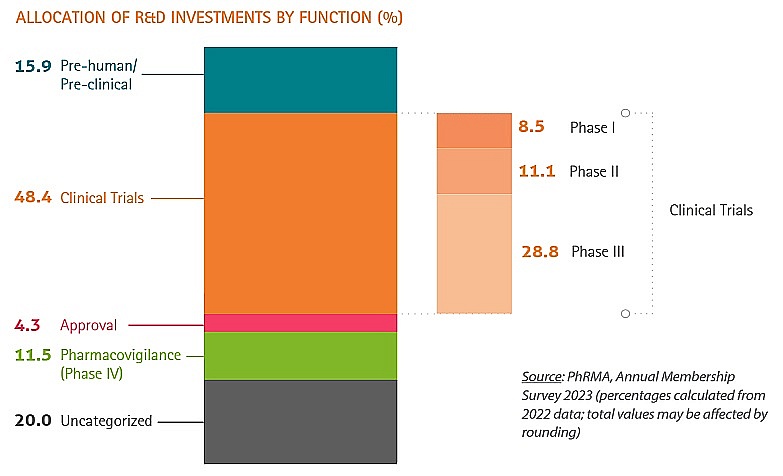

In an increasingly competitive global environment, where many countries – some with established experience and economies of scale – are striving to become integral parts of the global supply chain, Vietnam must define the specific stages of the product life cycle it seeks to target for investment, particularly in high-value areas. Clinical trials, especially Phase 2 and Phase 3 trials, which account for nearly half of research and development funding, represent a strategic focus for Vietnam.

To seize this opportunity, Vietnam needs more favourable regulations to allow foreign-invested enterprises to conduct clinical trials, from importing placebos and equipment such as lab kits to procuring drugs authorised for marketing in Vietnam.

In addition, technology transfer in innovative medicines and other areas could be potential areas of focus for Vietnam to consider. These efforts would not only enhance local capabilities but also help build Vietnam’s national brand, rooted in quality and innovation.

It is acknowledged that consistent public policies and incentives are key to attracting investors in the health and pharma sectors. While strategic planning is crucial, it is the successful implementation of these policies that ultimately drives success. Vietnam could adopt this approach as it shapes its sector development strategy to draw in more foreign investment.

This is a pivotal moment for Vietnam, with key legislative changes shaping the pharmaceutical industry, including the revision of the Pharma Law and its forthcoming guiding regulations. We support and eagerly anticipate its timely ratification in 2024, as well as its seamless implementation. These changes will help address current shortcomings and unlock opportunities to engage investors by linking incentives with market access and providing assurances on the predictability of the market.

I look forward to further discussions on fostering an enabling environment for the pharmaceutical industry, which I will participate in alongside policymakers and business leaders at a conference on innovation for health sustainability on September 25 in Hanoi.

|

| Pharma Group, a sector committee of the European Chamber of Commerce in Vietnam, has represented the voice of the innovative pharmaceutical industry in Vietnam for over 25 years. It currently comprises 21 leading innovative pharmaceutical companies from Europe, the US, and Japan, which allocate at least 10 per cent of their annual global sales to research and development. |

| Top pharma groups bet on high growth A decade of innovation is in sight for Vietnam’s largest pharmaceutical companies, as long as quick adaption and changes in business strategy are carried out. |

| Pharma groups step up competition More international pharma and medical device businesses are rushing to venture further in Vietnam, anticipating wide growth potential. |

| Legal landscape adjusted for global pharma groups Multinational corporations operating in Vietnam are expected to benefit from new legal changes in the months to come, after years of delay. |

| Global pharma expects bumper year Increasing footprints in Vietnam in 2023, multinational corporations continue to eye stronger local partnerships to bring more new innovative medicines and vaccines to the local market in 2024 and beyond. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version