Pharma to experience robust growth

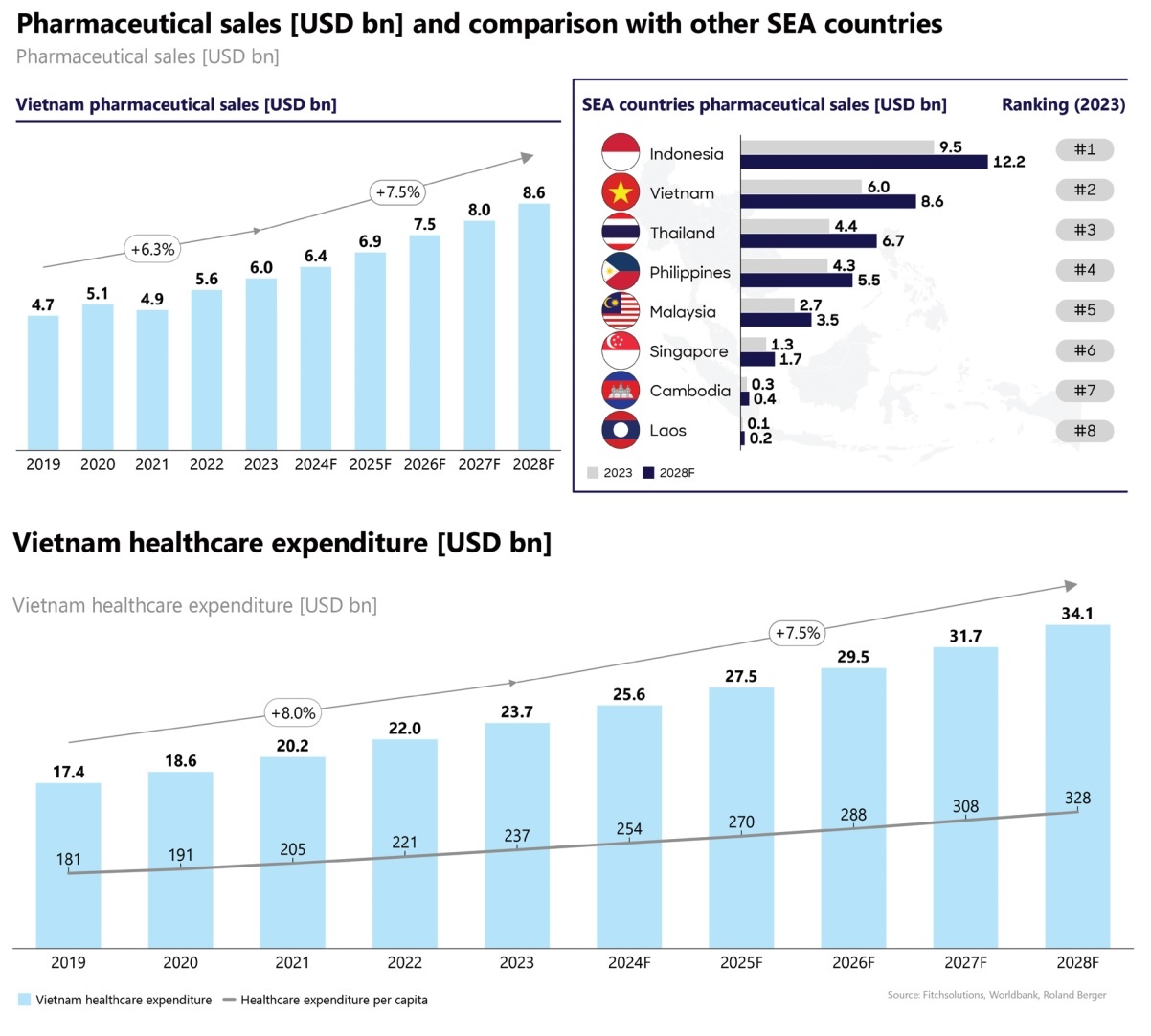

The pharmaceutical market here will experience robust growth, rising from $6 billion in 2023 to roughly $8.6 billion in 2028, with an annual growth rate ranging 7-8 per cent. Currently, Vietnam’s pharmaceutical market is the second largest in Southeast Asia, trailing only Indonesia.

|

| Aditya Agarwal, partner, Pharma & Healthcare for Southeast Asia, Roland Berger(left) and Truong Bui, partner and general manager Roland Berger Vietnam |

The growth of the pharmaceutical market in Vietnam is primarily driven by four key factors: the economic growth and increasing disposable income, the heightened awareness of healthcare, the ageing population trend, and government policies aimed at promoting and modernising the national healthcare system.

Vietnam has maintained an average annual real GDP growth rate of 6-7 per cent from 2010 to 2023, according to the World Bank. Per capita income rose from $2,000 in 2013 to roughly $4,300 in 2023, enhancing the capacity for healthcare spending. Specifically, total healthcare expenditure accounted for 10.2 per cent of total household spending in 2023, compared to 9.2 per cent in 2019.

The awareness of healthcare in Vietnam has increased significantly following the 2020 pandemic. According to a 2023 survey by Roland Berger, 78 per cent of Vietnamese are willing to spend more on healthcare products and services, reflecting an increasing consumption trend in this sector.

Besides that, Vietnam is undergoing a rapid ageing process, with the proportion of people aged 65 and over expected to reach 14 per cent by 2036, as per the United Nations. This trend leads to higher demand for pharmaceuticals and medical services, particularly for chronic diseases such as diabetes, cardiovascular diseases, and hypertension.

Lastly, the Vietnamese government is implementing various policies to modernise the healthcare system and develop the pharmaceutical market. The national strategy to 2030 aims to strengthen domestic pharmaceutical manufacturing, reduce reliance on imports, and promote investment in research and development (R&D).

Measures such as tax exemptions and the simplification of administrative procedures have also been implemented to support businesses and facilitate market growth.

|

However, Vietnam’s pharmaceutical industry faces numerous challenges in its efforts to localise manufacturing. As of 2023, Vietnam had about 50 foreign-invested companies and around 230 domestic companies operating in the pharmaceutical manufacturing sector.

However, foreign-invested companies like DHG Pharma, Imexpharm, Sanofi, and Traphaco still dominate the market due to advanced technology and manufacturing plants with international good manufacturing practice (GMP) standards. This reflects a significant disparity in capabilities between domestic and international players.

The domestic pharmaceutical manufacturing industry heavily relies on imported raw materials, with around 85 per cent of active pharmaceutical ingredients (API) being imported from China and India, and Vietnam also import 58 per cent value of the pharmaceutical end product. This dependency increases costs and risks from global price and supply fluctuations, hindering the competitiveness of domestic products.

The challenges facing Vietnam pharmaceutical industry mainly stem from the lack of necessary infrastructure, human resources, and finances for R&D, and production activities.

Vietnam lacks robust infrastructure to produce critical inputs, particularly APIs, and lacks concentrated regions for pharmaceutical raw material cultivation and extraction.

Additionally, most domestic pharmaceutical players are small- and medium-sized enterprises with limited expertise and financial resources, leading to low investment in API and brand name drug research and development.

Current manufacturing infrastructure is primarily focused on simple formulations for common and chronic diseases, while there is a lack of capacity to produce speciality drugs. This causes domestic companies to compete on the price rather than on the quality or product innovation.

To enhance competitiveness and ensure sustainable development, pharmaceutical companies in Vietnam should consider several recommendations. First, it should invest in the construction of API manufacturing facilities can reduce costs and risks from international market fluctuations while increasing self-sufficiency in raw materials. Collaborating with foreign partners for technology transfer or joint ventures in API manufacturing could be an effective approach to rapidly enhance capabilities.

It can also fund R&D to develop new pharmaceutical products and improve existing product portfolios. Establishing research centres and seeking opportunities to collaborate with international organisations can provide access to advanced technology, enhancing innovation and market differentiation.

Improving and upgrading manufacturing infrastructure and equipment is a must to meet high-quality standards such as EU-GMP and Japan-GMP. It will not only help enhance product quality and gain consumer trust but also expand export opportunities and attract interest and collaboration from multinational pharmaceutical players.

Vietnam should also diversify product portfolios, developing high-value and difficult-to-compete speciality drugs instead of focusing solely on low-value generic drugs. Particularly, companies should seek to develop speciality products for chronic or rare diseases that align with the increasing market demand.

This strategy not only helps increase the added value of products but also creates a sustainable competitive advantage.

Last but not least, contract development and manufacturing organisations is also an effective strategy to promote localisation and reduce reliance on imported raw materials. They can help domestic players access modern manufacturing technology, optimise processes, and save costs through larger-scale production.

| Vietnam welcomes major Indian pharmaceutical investments Leading Indian pharmaceutical corporations proposed significant investments in Vietnam, including a $5 billion eco-industrial park, underscoring Vietnam's attractiveness as a prime destination for foreign pharmaceutical investments. |

| Big Pharma push back on first Medicare drug price cuts Major pharmaceutical companies lashed out following a landmark deal unveiled Thursday to cut the costs of 10 key medicines, with some saying the price-setting process was not transparent. |

| Imexpharm part of emerging trend of innovation in pharmaceuticals Imexpharm Pharmaceutical JSC (IMP) is investing heavily in high-quality pharmaceutical production technology to meet international standards. |

| AstraZeneca Vietnam deepens collaboration to enhance education and research AstraZeneca Vietnam is continuing its collaboration with the University of Medicine and Pharmacy of Ho Chi Minh City in medical education and science research capacity enhancement. |

| Imexpharm’s ambitions to enter global pharma supply chain Imexpharm is driving significant growth by boosting research and development (R&D) into high-tech pharmaceuticals. |

| Pharma businesses lean towards to open innovation The pharmaceutical business community expects that the draft amendments to the Law on Pharmacy 2016 will be adopted by the National Assembly at the October 2024 session. The revised draft law has groundbreaking contents that create new advantages for businesses in the industry, including those of Vietnam Pharmaceutical Companies Association. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Mobile Version

Mobile Version