ICT industry expects legal advances for growth burst

At a late December meeting to review 2022 performance and set tasks for 2023, Deputy Minister of Information and Communications Nguyen Huy Dung said that the ministry (MIC) will strongly focus on legal works to facilitate business activities, and to accelerate national digital transformation.

The MIC plans to complete the draft revised Law on E-Transactions, the revised Law on Telecommunications, and submit to the National Assembly (NA) for adoption this year.

|

“The amendment to the Law on Telecommunications is critical to meet development demands of the country, with the market recently witnessing significant changes with the emergence of new service and business models,” the deputy minister said. “Free trade agreements, especially new-generation ones, feature new commitments that we need to consider into local legislation.”

Both domestic and international companies are expecting the adoption of the amended Law on Telecommunications as it will help complete the legal framework of the industry, develop telecoms infrastructure for digital economy and digital society, and enlarge development space for businesses.

Moreover, a draft law for the digital tech industry will be sent to the NA for discussion in 2023 and adoption in 2024. An action programme will also be built to implement a related development strategy for 2025, with a vision towards 2030.

Also on the agenda is a draft strategy on development of the semiconductor industry for this decade, as well as development of a dynamic strategy for the IT industry to attract investment in Internet of Things (IoT) and AI-based production, particularly in the southern provinces of Dong Nai, Binh Duong, and Ba Ria-Vung Tau.

Other focuses will be the development of a national data-sharing integrated platform and development of a cloud computing platform for application in state agencies.

Continuing shift

Moves such as these are expected to increase the country’s attraction to international groups. There has already been growing interest and investment in research and development (R&D) from multinational corporations (MNCs) in the country, marking it a highlight in the local ICT industry, according to the MIC.

“Last year marked a shift of investment among many more foreign-invested enterprises from manufacturing outsourcing to investment in R&D by opening centres in Vietnam,” Deputy Minister Dung said, citing Samsung, Qualcomm, Panasonic, Intel, and Synopsys as the leaders in such activities.

Samsung remains the single-biggest foreign enterprise in Vietnam, and continued with its ambitious plan of developing Vietnam into its global R&D hub with the opening of a new R&D centre in Hanoi last month.

Vietnam is a key global base that produces nearly half of Samsung Electronics’ smartphones. In the past, it produced mainly low-end products, but increased investment means it now produces the latest foldable smartphones, TVs, batteries, and camera modules.

Other MNCs in the tech sector have been expanding in Vietnam. US chip giant Synopsys in August announced collaboration with Saigon High-Tech Park, with Synopsys supporting the park in establishing a chip design centre. The move aims to cultivate advanced design talent and facilitate semiconductor development in the country.

US conglomerate Qualcomm already established an R&D centre in Hanoi in 2020 for developing wireless technologies like 4G/5G and IoT. The facility develops new mobile technologies and provides testing services for Vietnamese manufacturing partners such as VinSmart, BKAV, and Viettel.

Ongoing progress

The growing interest from MNCs is deemed the result of the country’s sustained efforts in creating a more favourable business environment, with the MIC playing a key role in this path. In 2022, the NA adopted the amended Law on Radio Frequency and the amended Law on E-Transactions to facilitate business activities in the field.

The ministry also crafted legal documents to give priority to the development of cloud computing as an important platform for development of digital government, economy, and society.

Moreover, it worked with ministries and agencies on amending rules to create favourable conditions for businesses. For instance, it worked with the Ministry of Finance to issue circulars guiding the management and application management fees for use of radio frequencies and telecoms operation rights, among others.

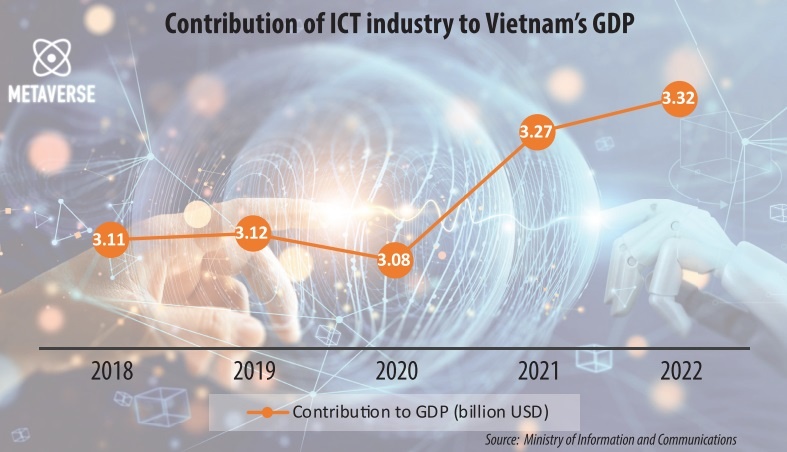

The ICT industry made strong advances in 2022 with estimated revenues of $148 billion, up 8.7 per cent on-year. The industry’s GDP contribution was estimated at $34.33 billion, up 8.7 per cent on-year.

Its export turnover of hardware and electronics was estimated at $136 billion, up 11.6 per cent from 2021. The year also saw registration of 70,000 digital technology businesses, up 9.6 per cent on-year.

In addition, total revenue overseas of ICT businesses reached over $2.2 billion during the year. And for the first time, with FPT, Vietnam has a digital technology business making revenues of over $1 billion in the international market.

Despite the results, the MIC admitted that some problems remain in the industry. For example, frequency auctions have not yet been carried out due to legal barriers. There are also overlapping laws, including the existing legislation on communications, information security, and investment.

To increase its attraction, the prime minister has asked the Ministry of Planning and Investment to study and work on policies to attract foreign investment inflows into chip technology, and submit them to the government in the first quarter of 2023.

| Apple Thy - Country manager Traveloka Vietnam | |

Opening borders and accelerating economic recovery have boosted public interest and confidence to return to travel and tourism activities. We also appreciate the Vietnamese government’s effort to help accelerate the recovery of the tourism sector. Traveloka’s internal data also captured a positive trend during the Black Friday campaign recently. The total transaction volume on the platform increased by 1.5 times compared to the previous month. The volume of hotel bookings and the number of Xperience tickets sold also increased by 1.5 times. The campaign has also attracted the participation of more than 1,000 partners, of which hotel partners recorded a 2.5-fold rise in total bookings compared to October 2022. At the same time, the outbound travel trend is returning more confidently through the number of bookings to foreign destinations increased by 1.5 times compared to the previous month. Traveloka will continue to collaborate with various provincial tourism boards to attract both domestic and international tourists to come to Vietnam and enjoy various travel attractions in local destinations. There are plenty of things to explore in Vietnam. According to our internal statistics, our customers’ favourite domestic destinations are Ho Chi Minh City, Hanoi, Danang, Nha Trang, and Phu Quoc. During your trip, you can book a memorable holiday at your favourite hotel in Danang or enjoy a breathtaking mountain view with your loved ones at Sun World Fansipan Legend in Sapa. With tourism experiencing a strong rebound in recent months, it is critical for Vietnam tourism to embrace digital transformation through the adoption of touchless and smart tourism in Vietnam. As a result, Traveloka will seize this opportunity to collaborate with relevant stakeholders to ensure the long-term growth of Vietnam’s tourism. This is because the digital transformation is more than just a temporary solution to the pandemic disruption, but also a long-term journey for the entire tourism sector to develop sustainably. Furthermore, we will keep making innovations that can create other initiatives and breakthrough programmes that will boost the digitalisation in the tourism sector. | |

| Nam Thieu - General director in Vietnam, Laos and Cambodia, Qualcomm Southeast Asia & Pacific | |

As 5G is critical in digital transformation, everywhere and everything will soon need connectivity. We have helped Vietnam to develop related strategies and also carriers such as MobiFone and Viettel to develop networks. To be more specific, we have been providing training for Vietnamese carriers’ engineers and giving consultancy to network services to help develop and design the 5G network. To help Vietnam become independent and self-sustaining in technology, for example, Qualcomm has helped Viettel to build a station for 5G deployment next year. Based on our observations, Vietnam has three big goals: successfully deploy a 5G network; design and build products for the domestic and international market; and develop digital skills and capacity. However, currently Vietnam has yet to possess adequate human resources to achieve this goal. The Qualcomm Vietnam Innovation Challenge is one of our initiatives, which is in its third year of giving the green light to potential entrepreneur teams to not only shine in Vietnam but also worldwide. Another way that we have helped to develop digital personnel for Vietnam is through collaboration with Vietnamese universities such as PTIT, sponsoring research programmes for 5G, AI, and machine learning research projects as well as providing training programmes to PTIT lecturers and professors in Hanoi. In addition, we have helped Vietnamese manufacturers with the Internet of Things, camera products, and even Wi-Fi mesh to help bring Vietnamese products into the world. Last but not least, we have established a research facility to help Vietnam build world-class products because more companies are moving to Vietnam for manufacturing. | |

| Cao Hoang Nam - Director of Foreign Affairs TOMRA Vietnam | |

TOMRA has spent over 50 years advancing its reverse vending and sensor-based sorting technology to enable the recovery of valuable materials from almost any waste stream and accelerate the transition towards a circular economy. Today, we have over 100,000 installations in over 80 markets worldwide. The reverse vending technology is a key enabler of this system. We have developed a wide range of state-of-the-art machines and systems suitable for various customers and applications – from small convenience stores to large bottle depots, and everything in between. In fact, we facilitate the collection of more than 40 billion empty cans and bottles every year. In addition to this, our Internet of Things platform can turn data from reverse vending machines into actionable intelligence that helps customers work more effectively and efficiently. With the advent of extended producer responsibility (EPR) in Vietnam, it has become increasingly important to implement closed-loop solutions like this to reduce the burden on Vietnam’s landfills. Our technology can assist Vietnam in achieving its national and international commitments towards waste reduction, marine litter prevention, and carbon emission savings. TOMRA believes that interventions at policy level are critical for waste collection systems to thrive in Vietnam. We actively engage with governments and industries to collaborate on building circular solutions across the value chain, including the integration and upskilling of the informal sector. TOMRA’s advanced, fit-for-purpose sensor-based technology can help the entire value chain optimise resource productivity. Our evaluation of the world’s highest-performing DRS found that these systems share four common principles of performance, convenience, producer responsibility, and system integrity. These are applicable both in the design of new deposit systems and the modernisation of existing ones. However, as with all policies, it is recognised that local culture, infrastructure, and politics need to be factored in to shape a system that works best for each market. Therefore, a national policy framework that can support DRS requires ambitious targets for collection, recycling, and the use of recycled content. The framework must enable EPR in Vietnam in a way that is not disruptive and not biased towards large producers or brands. The system of implementation must have high accountability and transparency. | |

| Ngo Trung Linh - CEO, Payoo | |

Like most businesses, Payoo faced many challenges in 2022. Cashless payments become more popular, requiring the development of infrastructure at stores. We quickly seized the opportunity to accompany partners and provide payment and operation solutions provided by Payoo itself. Businesses whose infrastructure is still not ready will be supported by us with technology solutions to process transactions and meet the needs of customers. The comprehensive payment solution deployed by Payoo has been widely applied. We also provide customers with a variety of payment methods including domestic and international cards, QR code scanning of more than 40 banks and popular e-wallets, interest-free instalment payments, and also emerging payment methods such as contactless payment or buy now, pay later. In addition, we also conducted extensive market research and observation to promptly adapt to new trends. The QR payment method has emerged in the past year and is especially popular with young people. Thanks to the preparation in advance, Payoo has supported many partners to quickly change according to consumer tastes and the system records the transfer of transactions from other methods to QR code payment. | |

| Bui Hoai Nam - Founder, UrBox | |

As an e-commerce startup in the field of digital gifts, UrBox was primed to support corporates with their gifting experiences, especially during the pandemic lockdown. With restrictions in place across the country, UrBox e-gift solutions provided an easy to execute solution for corporates to recognise, reward and appreciate their customers and employees digitally, contributing to our growth. Businesses have focused on digitalising customer care activities and bringing digital benefits to employees to save time, optimise operations, and diversify services and goods for users. This was an opportunity for UrBox and some other e-gift groups to expand activities. We have since seen the e-gift market bouncing back and we anticipate a stronger growth rate in the future. Urbox forecasts that the market will grow in proportion to the retail market, especially the modern trade channels in Vietnam which account for around 35-45 per cent, much lower than other developed countries such as Singapore at 90 per cent. Currently, UrBox’s growth rate is still doubling on-year through solutions and platforms we provide to businesses, thus expanding the scope of growth for the company. For example, UrStaff, a relatively newer product in UrBox’s ecosystem, helps businesses to reduce staff churn by rewarding employees and recognising their contributions to a company, thus diversifying our loyalty programmes solutions. UrBox also worked with an electronics manufacturing company to develop a reward solution for its customers. By using a proprietary AI tool and other tech, we were able to verify the customer’s information from their bill and direct them to redeem their rewards on the UrBox application quickly and easily. | |

| Christanto Suryadarma - Sales vice president for Southeast Asia, Zebra Technologies | |

During 2022, we saw the retail industry recovery strongly and rapidly, with many companies reporting strong growth. Retailers do not need to move to omnichannel just to survive – it is basically what people are expecting. They expect that blend of online and offline. Companies in Vietnam must cope with big demand from customers to modernise and automate their business process and also understand customer pinpoints, not just selling hardware or software and then design solutions. They should continue learning about new technologies that are available in the industry and also learn use cases, in particular in retail and also in manufacturing and logistics. Enterprises also need to make sure that their inventories are ready to respond to both physical and digital purchases. They must quickly provide information about availability and then carry out the delivery. To achieve that, retailers in Vietnam need to invest in digital solutions. This brings good opportunities for certain retailers in Vietnam. Vietnam is a key market for us, and we have a strong team with an extensive certified partner network. We hope to work closely with our partners to deliver industry-tailored, comprehensive solutions to our shared customers. Zebra has been empowering the frontline of businesses, including retailers, for more than 50 years. We invest up to 10 per cent of our annual revenue in R&D and have also expanded our product portfolio through several acquisitions to bolster our product offerings throughout the years. Besides offering them with the right solutions, we also take extra effort to ensure our customers have adequate aftersales support. In fact, we have expanded our Zebra service centre in Vietnam to complement business growth. It is equipped with skilful technicians who are well-trained in the repair of our extensive range of laptops, wearables, and printers. For end-users, we recently held a healthcare solutions event in partnership with Elitein Hanoi, which was attended by dozens of hospital IT professionals, to share our leadership and outcome-based solution. We also held a manufacturing forum in Ho Chi Minh City and will do so again in 2023. |

| The key to promoting digital economic growth in Vietnam The wide applicability and huge connected data store created from blockchain have made this technology increasingly important in the progress of realising the goal of bringing the digital economy to 20 per cent of GDP, as set by the government. |

| Digital bonanza in sights for ASEAN To promote trade and investment ties, ASEAN member states will continue strengthening the bloc’s efforts to go digital on the back of its great potential, with Vietnam boosting the application of digital technologies and administrative reforms to facilitate businesses and investors. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Ho Chi Minh City launches plan for innovation and digital transformation (February 25, 2026 | 09:00)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

Tag:

Tag:

Mobile Version

Mobile Version