Demand for domestic items continues to rise

Two weeks ago, Nguyen Hai Duong, vice director of Dung Hung Co. Ltd., in the northern province of Hai Duong, discussed export orders online with two new partners from South Korea, under which the Vietnamese company is expected to supply the latter with electronics items, with a total value of about $500,000 for the fourth quarter of 2022.

|

| Vietnam attained billions of dollars last year in exports of electronics, industrial equipment, and more / Le Toan |

“So far this year, it is estimated that our company raked in an export turnover of about $5 million, up from $4.8 million in the corresponding period, thanks to demand bouncing back in South Korea and several European markets,” Duong said.

This company has also earmarked money for importing electronic items from Indonesia, Thailand, and South Korea for its production. Its 8-month import turnover has risen 8 per cent on-year, and the rate is expected to climb about 10 per cent on-year for 2022.

Duong’s company has been an addition to an expansion in the Vietnamese economy’s electronics industry’s performance in the first eight months of this year, when the industry’s export-import turnover hit over $39.6 billion and $56.9 billion, up 13.3 and 21 per cent on-year respectively, according to the General Statistics Office (GSO).

South Korea’s Samsung is estimated to hold over 90 per cent of Vietnam’s total export values of electronics and mobile phones. In the first eight months, the nation’s total export of mobile phones and spare parts hit $39.6 billion, up 12.1 per cent on-year.

Samsung Vietnam fetched $34.3 billion from exports in the first half of 2022, up 18 per cent on-year. The group expects the figure will rise to $69 billion for the whole year, and plans to invest an additional $3.3 billion in Vietnam.

As Vietnam’s biggest foreign investor, Samsung first pumped in $1.3 billion in 2013 in producing mainboards and other electronic components. Last year, the figure climbed to $18 billion. The electronics giant also has six plants in the country and is building a research and development centre in Hanoi.

Wider expansion

The GSO reported that in the first eight months of this year, electronics were among many key export items with an on-year rise in export turnover, especially machinery and industrial equipment ($29.78 billion – up 28 per cent), textiles and garments ($26 billion – up 23.1 per cent), footwear ($16.47 billion – up30.5 per cent), and wooden products (over $11 billion - up 6.2 per cent).

Vietnam’s crude oil exports fetched $269.6 million in August and $2.22 billion in the first eight months – up 99 per cent on-year.

Vietnam Oil and Gas Group reported that its 8-month export turnover is estimated to be $1.96 billion, up 57 per cent as compared to the corresponding period last year, including crude oil exports of 5.78 million tonnes, down 2 per cent, liquefied petroleum gas 144,000 tonnes, down 19 per cent, and nitrate 389,000 tonnes, up 162 per cent.

The economy’s total export and export revenue stood at $65.78 billion in April, $63.53 billion in May, $65.07 billion in June, $61 billion in July, and $64.54 billion in August – with a trade surplus of $2.42 billion.

According to the GSO, in the first eight months of this year, the figure is estimated to be $497.64 billion – up 15.5 per cent on-year, including $250.8 billion for exports – up 17.3 per cent and $246.84 billion – up 13.6 per cent. All of these create a trade surplus of $3.96 billion.

The Ministry of Industry and Trade (MoIT) said that such a big trade surplus is impressive, and the domestic trade and production landscapes are visibly getting better, as the majority of Vietnam’s imported goods are used for production and exportation.

“When it comes to the 8-month import structure, the group of production materials accounts for 94 per cent, up 0.1 per cent on-year – in which the group of machinery and equipment holds 44.3 per cent – down 1.2 per cent, the group of materials is 49.7 per cent – up 1.3 per cent, and the group of consumer goods occupies 6 per cent, down 0.1 per cent,” said an MoIT report on Vietnam’s 2022 industry and trade landscape so far, released last week.

The MoIT ascribed the 8-month trade achievements to positive impacts from free trade agreements (FTAs) and the reopening of many foreign markets, such as the US with an export turnover of $77.7 billion – up 25.6 per cent on-year, China ($34.3 billion, up 2.9 per cent), the EU ($32 billion, up 24 per cent), ASEAN ($23.5 billion, up 27.6 per cent), South Korea ($16.5 billion, up 16.4 per cent), and Japan ($15.6 billion, up 17 per cent).

Adam Sitkoff, executive director of the American Chamber of Commerce in Hanoi, told VIR that great changes have taken place in the development of the American business community here.

“Vietnam has continued to focus on economic integration, with membership in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, the Regional Comprehensive Economic Partnership, and the new Indo-Pacific Economic Framework in addition to other regional and bilateral FTAs,” Sitkoff said. “This increases its economic independence and attractiveness as a destination for American investment as many companies seek to diversify their global supply chains. The US business community is optimistic about Vietnam’s prospects for continued strong economic growth in 2022 and beyond, despite global headwinds.”

Fresh forecasts

In last week’s document sent to its units on solutions for trade monitoring until the year’s end, the MoIT said that global demands for goods from Vietnam are expected to continue rising in the last four months of this year supported by consumers’ high spending and tax reduction and removal under FTAs’ commitments.

The MoIT projected that Vietnam’s total export and import turnover for the whole of 2022 is estimated to be about $368 billion and $367 billion – both up 9.46 per cent over 2021. This is expected to create a $1 billion trade surplus.

By late last year, predicting that the global market will see negative fluctuations in goods demand, the National Assembly set a target that Vietnam’s export and import turnover for 2022 will be $660.8 billion, including $329.9 billion for exports and $330.9 billion for imports. This means a $1 billion trade deficit.

This target is lower than what was reaped last year, in which the export-import turnover hit $668.5 billion, with a trade surplus of $4.08 billion.

The MoIT has also set a 2023 target of an on-year export turnover increase of 8 per cent, or $397.44 billion, with a trade surplus reached, and a total retail and consumption service revenue of about $268.6 billion – up 9 per cent on-year.

However, the MoIT also underlined major headwinds against Vietnam’s trade landscape.

“In the remaining months of this year, very high inflation in many nations has shrunk demands for consuming indispensable imported goods, then affecting Vietnam’s exports and economic recovery. Besides this, supply chain disruptions are expected to continue,” said the MoIT report. “Prices of indispensable goods and transport costs remain at a high level, affecting the global economic recovery and also denting Vietnam’s export and import activities.”

According to Duong of Dung Hung Co. Ltd., though his company is performing quite well, it remains concerned about possible risks in several of its foreign export markets.

“For example, in Europe, the biggest concern now is how to ensure sufficient energy from now until the year’s end. Though we can land some new export orders, we are also worried that the partners can break the contracts at any time if they face difficulties,” Duong said.

Le Tuan Anh, general director of the Ministry of Planning and Investment’s Department of Industrial Economy, also said that Vietnam’s trade situation until the year’s end may face some difficulties.

“For example, the garment and textile industry is facing big risks from many export markets. Global uncertainties and the strict anti-pandemic measures in many markets including China, Japan, and Taiwan are having negative impacts on the industry’s supply chains and product consumption,” Anh said.

Economic difficulties and high inflation in Vietnam’s big export markets such as the US and Europe are decreasing consumption of garments and textiles, Anh said, affecting Vietnam-based garment and textile businesses’ exports. “Moreover, enterprises are suffering from a rise of an additional 20-25 per cent in operational costs due to big expansions in prices of materials since early this year,” he added.

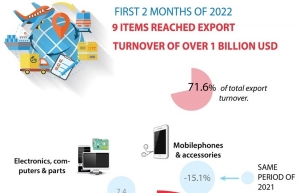

| Nine items reached export turnover of over 1 billion USD in first 2 months In Jan-February, there were nine export commodities recording turnover of at least 1 billion USD, accounting for 71.6 percent of the total export value. |

| 27 export items listed in “one-billion-USD” club in five months Twenty-seven export items joined the “one-billion-USD” club in the first five months of this year, as compared with only 23 seen in the same period last year, Deputy Minister of Industry and Trade Do Thang Hai told a press conference on June 16. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

- Innovation breakthroughs that can elevate the nation (February 19, 2026 | 08:08)

- ABB Robotics hosts SOMA Value Provider Conference in Vietnam (February 19, 2026 | 08:00)

- Entire financial sector steps firmly into a new spring (February 17, 2026 | 13:40)

- Digital security fundamental for better and faster decision-making (February 13, 2026 | 10:50)

- Aircraft makers urge out-the-box thinking (February 13, 2026 | 10:39)

Tag:

Tag:

Mobile Version

Mobile Version