CEOs at listed firms earn $100,000 average salary

|

According to a report released by financial data providers FiinGroup and FiinRatings on August 30, the top three industries with the highest average CEO remuneration, significantly outperforming the market average, were real estate, financial services (mainly securities), and insurance. Notably, a number of companies in the top 15 highest-paying enterprises had foreign CEOs, including Masan and Nam Long Real Estate.

CEOs in the real estate sector toped the list with an average salary of $198,000. It was followed by CEOs in financial services with an average salary $182,000, insurance $120,000, and healthcare $120,000.

The IT, banking, and retail sectors showed better-than-average operational performance, with a high return on equity (ROE) exceeding 15 per cent in 2023. However, the average CEO remuneration in these sectors remains relatively low.

The primary reason for this is that the remuneration data do not account for the value of bonus shares received under the employee stock ownership plan, which the leadership received during the year.

CEO remuneration in state-owned enterprises at $56,000 is less than half that of private enterprises, even though their operational efficiency, as reflected by the ROE, is quite similar. This discrepancy is largely because the chairman in state-owned enterprises also holds an executive role under the current governance structure.

Businesses with a market capitalisation of $1 billion or higher paid an average salary of $153,000 for CEOs, which is approximately 52 per cent higher than the market-wide average in 2023. This is reasonable, given that the operational performance in the large-cap group is more positive compared to the other two groups.

The report covers 200 out of 1,647 public companies listed or registered for stock trading on the stock exchanges; the Ho Chi Minh Stock Exchange, Hanoi Stock Exchange and Unlisted Public Company Market.

These 200 public companies represent over 85 per cent of the total market capitalisation across the three stock exchanges at the end of 2023.

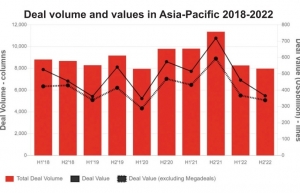

| Global CEOs resolute in M&As Global merger and acquisition (M&A) activities will likely rise later in 2023 as investors and executives look to balance short-term risks with their long-term business transformation strategies, according to PwC’s 2023 Global M&A Industry Trends Outlook. |

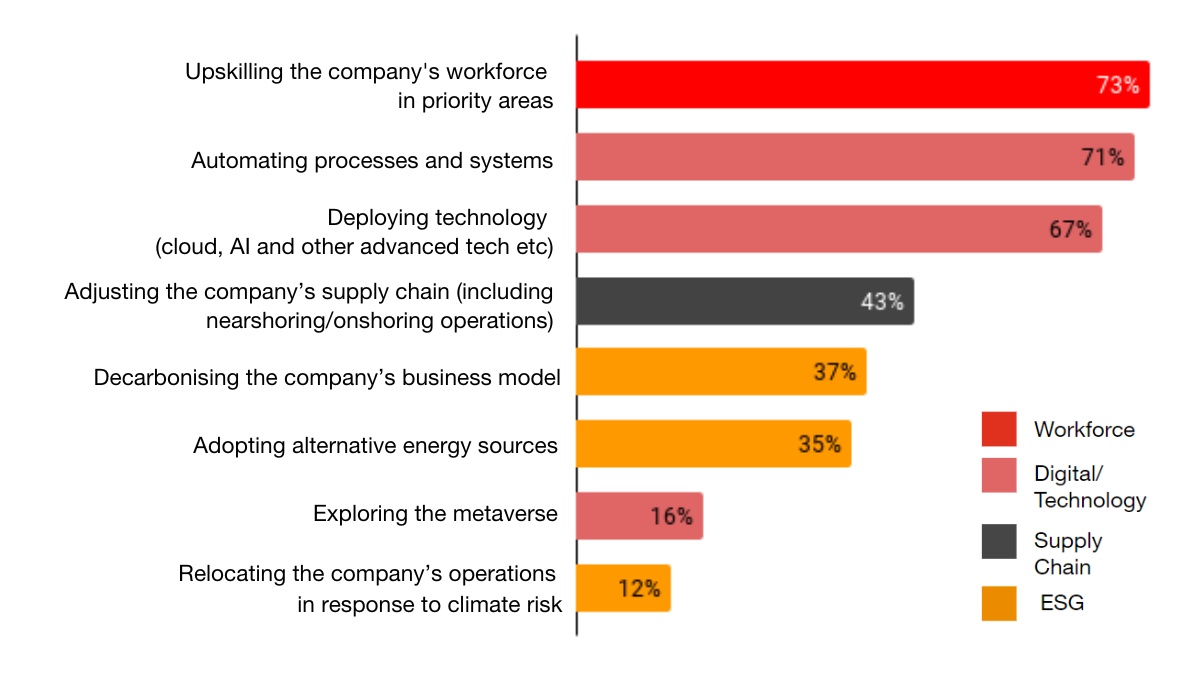

| PwC report reflects CEO's latest sentiments PwC Vietnam has just released its 26th Annual Global CEO Survey on What matters to CEOs in Vietnam based on PwC’s 26th Annual Global CEO Survey – Asia-Pacific: Leading in the New Reality, which reveals striking data points that bring to life the challenges facing 1,634 CEOs in the region and their implications in Vietnam. |

| Asia-Pacific CEO's uncertain about the future Almost two-thirds of Asia-Pacific CEOs are not confident about the long-term viability of their company, despite most of them having taken steps towards reinvention, according to a survey released by PwC on February 5. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Digital shift reshaping Vietnam’s real estate brokerages (December 31, 2025 | 18:54)

- Allen & Gledhill recognised as Outstanding M&A Advisory Firm (December 18, 2025 | 14:19)

- Inside Lego Manufacturing Vietnam (December 18, 2025 | 11:45)

- The next leap in Cloud AI (December 11, 2025 | 18:19)

- Vietnam’s telecom industry: the next stage of growth (December 11, 2025 | 18:18)

- Five tech predictions for 2026 and beyond: new era of AI (December 11, 2025 | 18:16)

- CONINCO announces new chairman and CEO (December 10, 2025 | 11:00)

- How AWS is powering the next-gen data era (December 09, 2025 | 13:14)

- Outlook in M&A solid for Singapore (December 08, 2025 | 10:31)

- Vietnamese firms are resetting their strategy for global markets (December 05, 2025 | 17:04)

Mobile Version

Mobile Version