Asia-Pacific CEO's uncertain about the future

|

PwC’s 27th Annual Global CEO Survey has confirmed the sentiment of uncertainty among today's top bosses. Business leaders in the Asia-Pacific region diverge significantly on their views of the global economy for the year ahead, with 45 per cent expecting it to decline while 40 per cent believe it will improve.

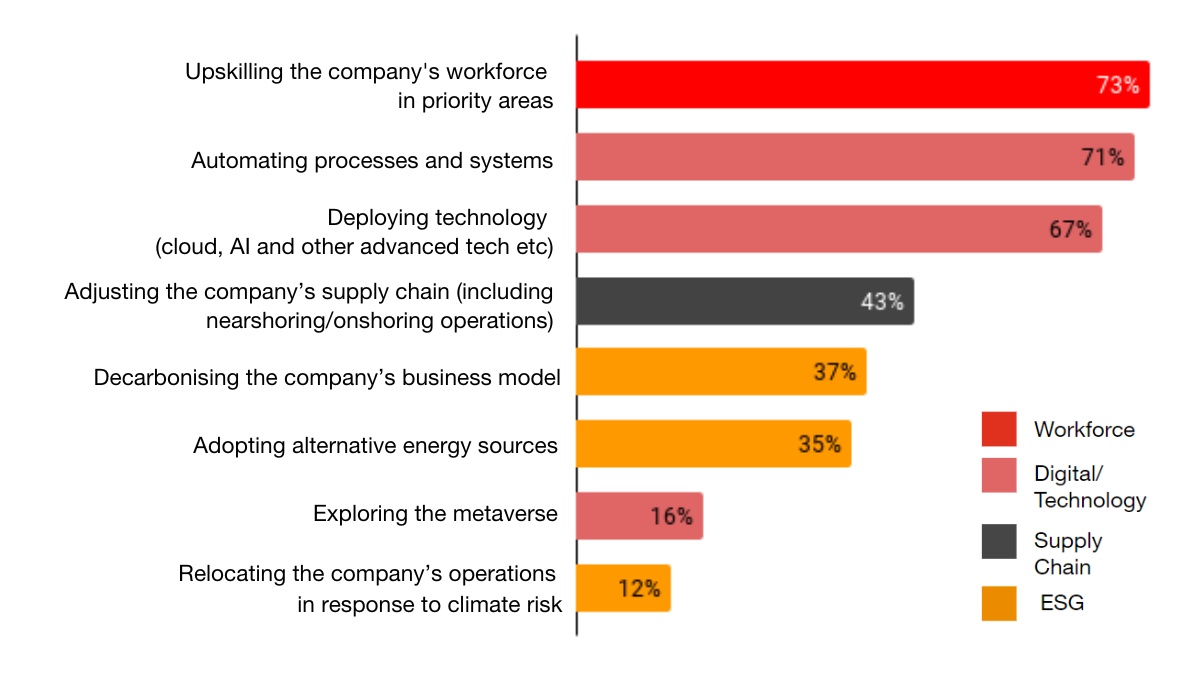

97 per cent of Asia-Pacific CEOs report that they are taking some steps towards reinvention, with a certain degree of success. The survey shows that managers in the region feel less exposed to short-term risks including macroeconomic volatility (down 9 per cent), inflation (down 21 per cent) and geopolitical tensions (down 12 per cent). However, confidence is fragile. 63 per cent remain uncertain about their company's viability – 10 per cent higher than the previous year and 18 per cent above the global average.

Raymund Chao, chairman of PwC Asia Pacific and China, said, “Our survey serves as an urgent and powerful call for intensified action towards business reinvention. Persistent geopolitical conflicts and inflationary worries, among other challenges, have really dug in, amplifying risk and constraining growth in Asia Pacific. Simultaneously, global megatrends including technological shifts - exemplified by the rise of Generative AI (GenAI) - and climate-related issues are increasingly demanding the attention of CEOs. In a constantly evolving market, businesses must embrace a culture of continuous innovation to sustain their competitive edge and ensure long-term viability.”

Asia-Pacific bosses also reported their top three barriers to reinvention, with regulatory environment being a challenge for 66 per cent, a shortage of workforce skills for 60 per cent, and supply chain instability causing problems for 57 per cent.

Executives are aware that they need to address global megatrends such as climate change and technological disruption, which are poised to compel further reinvention. Many have already taken steps with notable advancements in decarbonisation – 68 per cent and 51 per cent are actively enhancing energy efficiency and introducing climate-friendly innovations, respectively. However, one in five are currently not pursuing other types of action related to climate adaptation.

Several participants cited regulatory complexity (63 per cent) and lower economic returns for climate friendly investments (61 per cent) as the biggest barriers to overcome, although 51 per cent of business leaders in the region have accepted lower returns for climate-friendly investments in the past year, 10 per cent higher than the global average.

GenAI is overwhelmingly being seen as a catalyst for reinvention that will power efficiency, innovation, and transformational change. Over two-thirds of Asia-Pacific CEOs foresee substantial impacts from GenAI on their companies, workforces, and markets within the next three years. However, 41 per cent admit to not having adopted GenAI across their companies in the past 12 months.

Tackling complex societal challenges presents a golden opportunity for leaders in the region to create value and future-proof their businesses. To achieve a socially inclusive and environmentally sustainable growth trajectory, leaders should refine their transformation roadmap by embedding flexibility around key strategic imperatives and ensuring comprehensive, leader-led engagement throughout the entire organisation.

Mai Viet Hung Tran, general director of PwC Vietnam, said, “The economic outlook for Vietnam in 2024 and beyond is promising despite the slowdown in global trade and other uncertainties. While we may see some short-term positivity grounded in economic indicators and recovery trends, policymakers and businesses have to make long-term strategic decisions. Megatrends such as GenAI, energy transition, and climate change will be increasingly important when reinventing these strategies.”

“With 30 years of operations in Vietnam, PwC has witnessed the country's remarkable journey towards recovery and growth, highlighting its adaptability, resilience, and commitment to a sustainable future. We’re thrilled to work with the government and the business sector throughout this transformative era,” added Tran.

| PwC report reflects CEO's latest sentiments PwC Vietnam has just released its 26th Annual Global CEO Survey on What matters to CEOs in Vietnam based on PwC’s 26th Annual Global CEO Survey – Asia-Pacific: Leading in the New Reality, which reveals striking data points that bring to life the challenges facing 1,634 CEOs in the region and their implications in Vietnam. |

| Vietnam's new tax regulations reflect global tax trends There have been various economic ups and downs in the post-pandemic era that have necessitated decisive measures to sustain growth. Despite an improvement in the third quarter of the year, Vietnam's economy still faces a number of obstacles to achieve its targets. |

| Top strategies to employ for integration of ESG aspects Environmental, social, and governance (ESG) criteria are becoming increasingly important to Vietnamese businesses, with around 80 per cent having already made commitments to these criteria or planning to do so shortly. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Vietnamese consumers express concern about climate change (October 11, 2025 | 14:06)

- ESG seen as key to Vietnam’s business credibility and capital attraction (September 29, 2025 | 18:38)

- From compliance to strategy: ESG criteria gaining ground (September 29, 2025 | 15:47)

- Vietnamese firms step up ESG game (September 23, 2025 | 15:26)

- Vietnam tax and legal changes set to shape foreign investment landscape (September 16, 2025 | 13:46)

- Vietnamese businesses navigate US tariffs (June 25, 2025 | 12:14)

- The impact of cloud, AI, and data on financial services (April 14, 2025 | 11:20)

- Vietnam 2025 M&A outlook: trends, deals, and opportunities (March 21, 2025 | 08:54)

- Vietnam's M&A landscape mirrors global trends (February 18, 2025 | 17:13)

- Asia-Pacific CEOs enter 2025 with optimism and caution (February 06, 2025 | 17:16)

Mobile Version

Mobile Version