BNPL Fundiin raises $1.8 million in oversubscribed seed round

|

| Fundiin raised $1.8 million from some of the strongest international fintech investors |

Fundiin announced the closing of an oversubscribed seed round from leading Japanese funds Genesia Ventures, and JAFCO Asia, along with former Affirm executives (Xffirmers), Trihill Capital, Pham Le Nhat Quang, and existing investors 1982 Ventures and Zone Startups Ventures. The round was quickly oversubscribed and closed in three weeks.

Nguyen Anh Cuong, CEO and co-founder of Fundiin, stated, “Having the support of our new global investors will strengthen Fundiin’s market leading position, provide access to new capital pools and extensive BNPL expertise. Lending products have earned a bad reputation as money-draining traps that leave consumers stuck in a cycle of debt. Vietnamese consumers are in urgent need of products like Fundiin that work for them and protect their interest.”

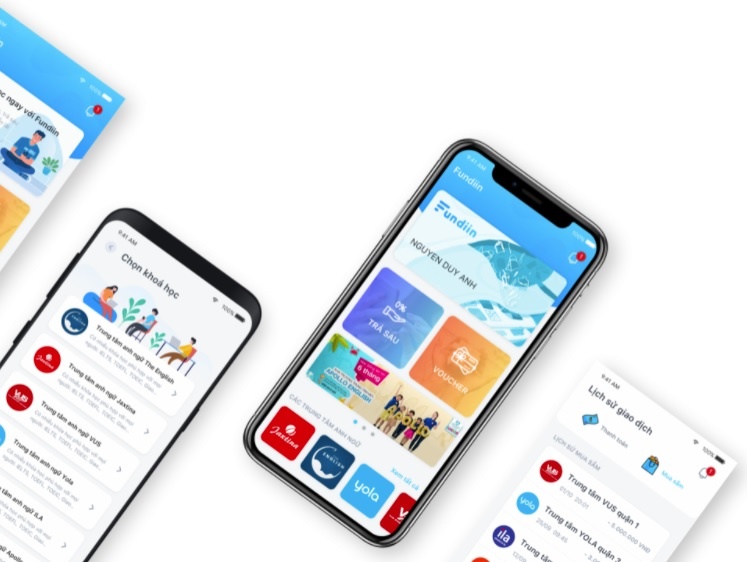

Fundiin was founded by fintech veterans Nguyen Anh Cuong (CEO) and Vo Hoang Nam (CTO), to provide consumer-friendly payment options to Vietnam’s population of 97 million and rising middle class consumers. Fundiin launched its BNPL product in mid-2020 and works with over 100 merchants including some of the country’s largest retailers such as Lug, Vua Nem, Mat Viet, and Giant International.

Takahiro Suzuki, general partner at Genesia Ventures, stated, “We are excited to be on the journey with Fundiin to increase Vietnam’s e-commerce adoption rate through BNPL service – which is a friendlier payment option for Vietnamese consumers. We believe that increasing the number of financial options for people will eventually lead to realise a prosperous society. Fundiin has convinced us that the company does not only provide a payment solution but also take on the challenge of making a significant contribution to the Vietnamese economy in the future.”

Amy Do, investment manager at JAFCO Asia, added, “BNPL solutions have long been popular in the world but this model has shown potentials in Southeast Asia only in recent years. Given the largely untapped market, Fundiin’s advanced technology and its partnership with SAPO, we believe Fundiin has great potential to expand their lead in Vietnam and become the leading BNPL player in the region. Cuong and Nam possess strong local knowledge and technical capability to lead the company to a greater height and we look forward to supporting them along the way.”

Eric Kobe, investor at Xffirmers and former vice president at Affirm, stated, “We only invest in the best new BNPL players around the world, and it was clear that Cuong and his team were the right partners for our first investment in Southeast Asia. As pioneers in the BNPL space, we provide earned insights to fintech founders on the right way to scale.”

Scott Krivokopich, managing partner at 1982 Ventures and Fundiin Board Member emphasised, “Fundiin is much faster, easier, and free for consumers, making it fundamentally better than credit cards, installment loans, and mobile wallets’ lending products. Instead of charging consumers high interest rates and hidden fees, Fundiin provides a zero-cost payment option that supports Vietnamese retailers’ increased conversion, average order value, and reach to new customers.”

1982 Ventures co-led Fundiin’s initial VC round with Zone Startups Vietnam announced in early 2021.

Fundiin’s latest funding round coincides with several key hires and surging demand from both consumers and merchants, including the recently announced partnership with Sapo’s 100,000 merchant.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- Vietnam’s IFC creates bigger stage for M&As (February 01, 2026 | 08:16)

- Game startup Panthera raises $1.5 million in seed funding (January 29, 2026 | 15:13)

- Cool Japan Fund transfers shares of CLK Cold Storage (January 28, 2026 | 17:16)

- Nissha acquires majority stake in Vietnam medical device maker (January 26, 2026 | 15:40)

- BJC to spend $723 million acquiring MM Mega Market Vietnam (January 22, 2026 | 20:29)

- NamiTech raises $4 million in funding (January 20, 2026 | 16:33)

- Livzon subsidiary seeks control of Imexpharm (January 17, 2026 | 15:54)

- Consumer deals drive Vietnam’s M&A rebound in December (January 16, 2026 | 16:08)

- Southeast Asia tech funding rebounds on late-stage deals (January 08, 2026 | 10:35)

Tag:

Tag:

Mobile Version

Mobile Version