Buy now, pay later model ripe for explosion across Vietnam

|

| Buy now, pay later model ripe for explosion across Vietnam, platform Kredivo |

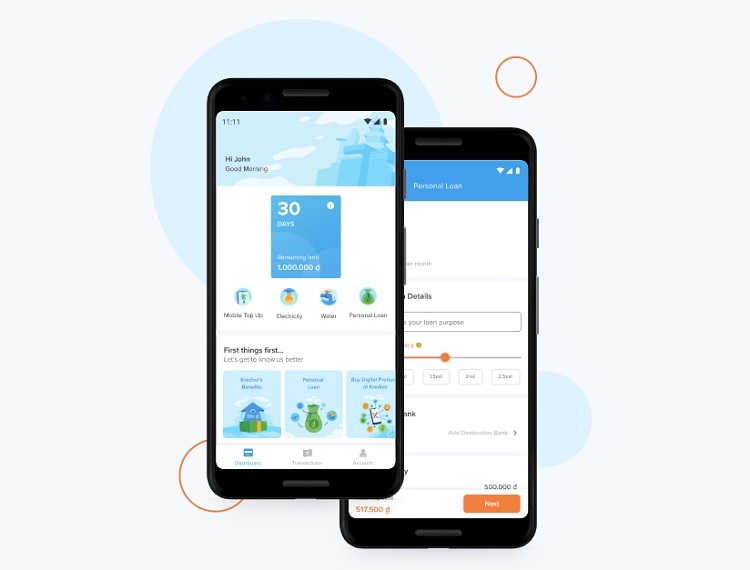

Singapore-based FinAccel, the parent company of buy now, pay later (BNPL) platform Kredivo, last week signalled its intention to foray into Vietnam by forging a joint venture with local investment firm Phoenix Holdings.

True to its name, BNPL allows shoppers to make purchases without forking over the cash at the time.

With nearly four million approved customers in its pocket, Kredivo is the largest and fastest-growing BNPL player in Indonesia, and wants to expand into Vietnam and Thailand.

Elsewhere, Bankograph, a provider of digital payment solutions from Singapore, has recently launched its BNPL solution designed to provide banks in Vietnam with a comprehensive set of new features.

BNPL has gained ground in the international market with banks, card payment providers, and fintech firms capturing the value created from engaging consumers through the entire purchase journey.

In July, Apple and Goldman Sachs were reported to be collaborating on providing iPhone users with a BNPL option within Apple Pay.

In Vietnam, several startups and digital payment providers have also jumped on the BNPL bandwagon, such as Ree-Pay, Fundiin, LitNow, Movi, and Atome.

A survey by Research and Markets last year revealed that BNPL payments in Vietnam are expected to grow by 137.3 per cent annually, reaching $491.3 million in 2021. The BNPL payment industry in Vietnam has recorded strong growth over the past year, supported by increased e-commerce penetration along with the impact of economic slowdown.

The survey points to medium- to long-term growth of the BNPL industry in Vietnam. Payment adoptions are expected to grow steadily over the forecast period, recording a compound annual growth rate of 36.5 per cent during by 2028. The BNPL gross merchandise value in the country will increase from $207 million in 2020 to $4.33 billion by 2028.

Dragan Bozic, founder and CEO of Ree-Pay, believed that the country is one of the best markets in the world for BNPL adoption since only few people carry a credit card.

“BNPL in Vietnam could replace a significant portion of cash-on-delivery transactions and improve the overall financial ecosystem, and we are excited to contribute in this transition,” he told VIR.

Alexander Gold, CEO of Bankograph said, “We believe that BNPL is the next generation credit card which is instantly issued for smart and savvy people who want to control their spending. Vietnam has a young population and a generation of digital consumers, and we see a tremendous potential in the market segment.”

In March, the Vietnamese BNPL startup Fundiin wrapped up an undisclosed investment in its latest funding round led by foreign funds like Zone Startups Ventures.

Founded in 2019 by Nguyen Anh Cuong and Vo Hoang Nam, Fundiin provides solutions to retailers so that their customers can BNPL in three interest-free instalments without involving credit cards.

Cuong stated that, unlike credit cards, BNPL customers will not be subject to hidden fees and exorbitant interest rates for late payments. “Fundiin’s current growth rate is even higher amid the pandemic, as we hit the right spot of BNPL trends without no late pay penalty fees,” he said.

Bankograph meanwhile is offering an alternative BNPL-in-a-box solution, as opposed to other payment providers where banks still have to build their solution using either Visa or Mastercard tools.

“We are a partner and enabler of banks, but the major difference is that we launch products for banks under their names, therefore remaining purely a technology provider and platform manager, and the bank owns the consumer and the merchant,” Gold of Bankograph told VIR.

Bozic of Ree-Pay said the driving force for BNPL in Vietnam was inspired by market leaders such as Klarna and Afterpay. Klarna, with its BNPL platform, is currently Europe’s highest-valued private fintech company and the second-highest worldwide. Meanwhile, Afterpay went from zero to $39 billion within just six years. “Financing a purchase of a product at checkout has been around for a while, but the answer to their sucess lies in a very profound analysis of the two companies with combined valuation of $80 billion,” Bozic said.

While credit cards are designed for customers with high credit scores, BNPL reaches a broader audience, including those who lack credit history. The penalty interest rate (if any) of BNPL offerings is also much lower than that of credit cards, with late interest charges of up to 48 per cent per year.

“We keep an eye on competition with our market intelligence team, but this takes less time compared to the amount of time we dedicate to building value to all our counterparts and compared to scouting the best talents in Vietnam,” Bozic added. “We can acquire a customer and their transaction in 90 seconds, and our core technology has been built to scale into digital banking services and open banking protocols.”

Ultimately, he emphasised, the domestic market is large and will decide who brings more value with BNPL in Vietnam.

Experts however warned that fintech companies customising their BNPL must have a sufficient data-based credit rating system for managing risk and avoiding bad debt. In Vietnam, as a new concept, consumers might fall into bad debts with cut-throat high interest rates.

As it stands, black credit firms or loan sharks are still able to disguise their zero-interest payment plan under the auspices of fintech or legitimate-sounding purposes, and force borrowers to repay loans such as the concealment of online loan applications.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version