Air industry buoyed by policy shift

|

| More open policies will improve the long-term outlook for airlines, Photo: Le Toan |

The Vietnamese arm of Japan’s Mitsubishi is now preparing to join the Long Thanh International Airport project, located in the southern province of Dong Nai. Mitsubishi and other foreign businesses who are interested in the project are now waiting for the country’s more open policies to emerge, in order to join future projects.

“The Long Thanh airport plans will be developed under the public-private partnership format. Accordingly, we have established an alliance with Taisei Corporation and Narita International Airport Corporation for this project,” said Tetsu Funayama, president and general director of Mitsubishi Corporation Vietnam.

Raising foreign ownership

A source from the Ministry of Transport (MoT) told VIR that the MoT is amending the Vietnamese government’s Decree No.92/2016/ND-CP governing conditional business lines in the civil aviation sector, with a view to cutting a number of business conditions and making positive changes to facilitate investment activities.

“Despite concerns and different ideas, the foreign ownership limit (FOL) in foreign-invested aviation businesses might be raised from the current 30 per cent limit. The increase will be considered carefully in parallel with the FOL in other transport segments,” the source said.

Under the latest discussions relating to the amendments, FOL is considered to be raised to a maximum of 49 per cent. Both foreign-invested aviation businesses and Vietnamese legal entities will be subject to this adjustment.

This is seen as a positive step in the aviation sector, compared to the current Article 8(3) of Decree 92, which stipulates that the maximum FOL in foreign-invested aviation businesses is just 30 per cent, while the threshold in Vietnamese firms with outside financing is capped at 40 per cent.

What is more, the charter capital distinction between international and domestic air carriage is now also considered to be removed, and the number of foreign representatives in a Vietnamese airline’s board of directors may increase.

Industry insiders said that the significant amendments are expected to add attraction to the sector, thus creating opportunities for overseas investors.

“Raising the FOL will make investment in Vietnamese airlines more attractive, as long as they also have the ability to manage operations to a degree in which they are satisfied,” said Thomas J. Treutler, managing director of Vietnam’s branch of Tilleke & Gibbins Consultants Ltd.

“The elite airlines that enter into joint ventures in Vietnam will want to maintain their standards and seek to protect their brand. To do that, they will likely want operational control over many aspects of the local airline,” he added.

|

Doors opening

Now, new opportunities are available for foreign businesses in the aviation sector. The additional divestment will be made by the local market giants Vietnam Airports Corporation (ACV) and the national flag carrier Vietnam Airlines (VNA).

Accordingly, ACV, the operator of 22 airports across the country, have sold off 20 per cent of its shares in 2018 and a further 10.4 per cent in 2019, while VNA, which has a market share of around 40 per cent, will sell 35.16 per cent of its shares this year.

The country is attracting private investment in certain parts of key national aviation projects, namely Long Thanh International Airport and the expansion of Tan Son Nhat International Airport. In particular, for Long Thanh, private investors might be allowed to join in terminals and hangars related to service areas.

“At present, only road projects face difficulties related to the government’s revenue guarantee due to risks from new ventures to be developed in the future, while investors in other specialised transport segments such as aviation, railway, and seaports do not, therefore private investors can develop projects without the revenue guarantee because of low risks,” Minister of Transport Nguyen Van The told VIR.

Thus far, the country has adjusted its aviation development planning for 2020, with a vision toward 2030, in which a network of modern airports will be developed. It also aims to call on private investment to develop logistics service centres at Noi Bai, Danang, and Tan Son Nhat international airports by 2020, and others like Chu Lai and Long Thanh by 2030.

The aviation sector has for years been struggling to attract sufficient foreign direct investment as aviation infrastructure funding has been mainly sourced from the state budget or official development assistance funds.

Although the wave of expected overseas investment in this sector might not break soon, the recent moves showed the MoT’s strong determination to facilitate business activities and bring more opportunities to investors from overseas, thus laying out hopes for a brighter and more profitable future.

With a contribution of $6 billion annually to the country’s GDP and double-digit growth, the aviation market is expected to see some mergers and acquisitions taking place in the near future, driven by state stake divestments among the most influential corporations in the sector, especially by ACV and VNA.

“Foreign investors often target large-scale businesses, or those in the same business field. VNA and ACV are good examples of past targets,” said another senior official at the MoT.

Back in 2016, stake sales by VNA and ACV were among the hottest in the aviation industry, as multinational corporations lined up to take part.

Aeroport de Paris, which manages 37 airports all over the world, outbid many powerful rivals, including Singapore’s Changi Airports International and Japanese investors Taisei and JATCO, to become ACV’s strategic foreign investor, while VNA too gained a valuable partner in ANA Holdings. It is possible that ANA, Japan’s largest airline, is very keen on the opportunity to increase its holding in VNA from its current 8.8 per cent share.

The International Air Transport Association forecast that Vietnam will be one of the world’s fastest growing aviation markets and the fastest in Southeast Asia with a projected average growth of nearly 14 per cent in the next five years, reaching 150 million passengers by 2035.

Impressive figures

According to statistics from the Civil Aviation Administration of Vietnam, Vietnamese airports handled an estimated 106 million passengers in 2018, up 12.9 per cent on-year, while cargo volume is estimated at 1.5 million tonnes, up 7.7 per cent on-year. Of which, Vietnamese airlines handled over 50 million passengers and nearly 400,000 tonnes of cargo, up 14 and 26 per cent on-year, respectively.

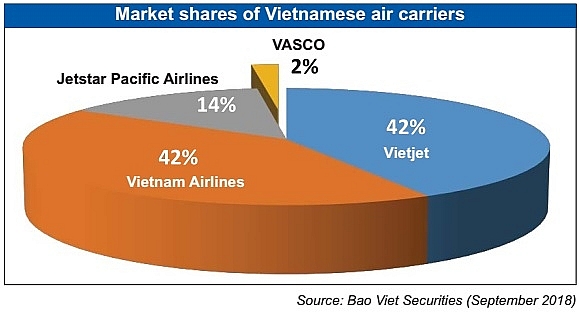

As of the end 2018, the Vietnamese aviation market had involvement of 68 foreign airlines and four Vietnamese ones, namely VNA, Vietjet, Jetstar Pacific Airlines, and VASCO, with VNA and Vietjet dominating the market.

VNA posted higher-than-expected business results last year, when its total consolidated revenues reached an estimated VND102 trillion ($4.43 billion). Its consolidated pre-tax profit was estimated at nearly VND2.8 trillion ($121.74 million), surpassing the whole-year target by 15 per cent. The carrier’s financial indexes have much improved, with the operating profit margin reaching 4.38 per cent and the debt-to-equity ratio falling below 3x. Its fleet continued to be increase and upgrade in 2018.

The year was also a rosy one for Vietjet, with total revenues hitting VND52.4 trillion ($2.28 billion), up 24 per cent on-year, and total pre-tax profit touching VND5.83 trillion ($253.5 million). Its debt-to-equity ratio is at 0.04x, while return on equity is 37.6 per cent and the price-to-earnings ratio is at an attractive rate of 11.5.

Competition in the Vietnamese aviation market is expected to stiffen this year with more newcomers. Bamboo Airways, a new budget airline, made its maiden flight on January 16, focusing on exploring niche markets, including direct flights from international and domestic airports to newly-emerged tourism destinations.

Also in January, Van Don International Airport officially went into operation in the northern province of Quang Ninh, bringing high hopes for domestically private-run and foreign investors like Mitsubishi Corporation to join future ventures.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Kurz Vietnam expands Gia Lai factory (February 27, 2026 | 16:37)

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

Tag:

Tag:

Mobile Version

Mobile Version