VIB honoured at digital transformation conference

|

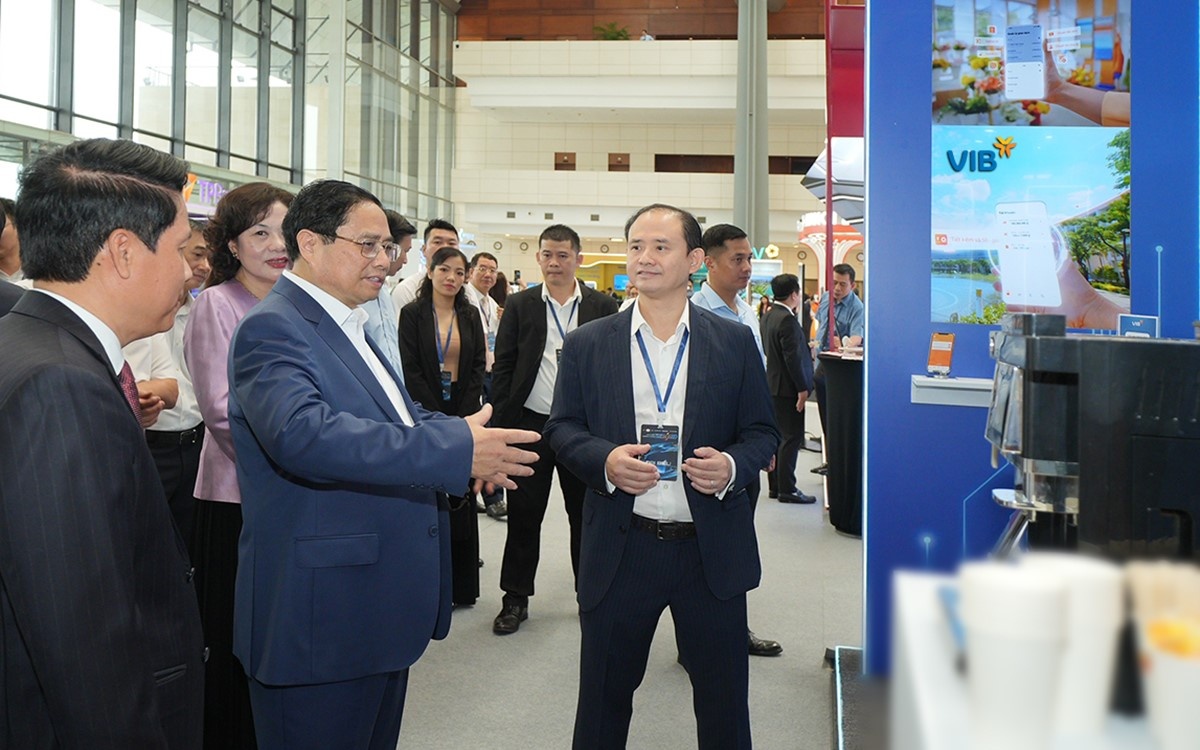

| Prime Minister Phan Minh Chinh and SBV Governor Nguyen Thi Hong visit the VIB booth at the event |

At the event, VIB showcased its prominent digital technology solutions, including the MyVIB digital bank with AI Voice technology and augmented reality; VIB Checkout, which turns smartphones into POS devices for payments; and VIB Verse, offering an exploration experience of VIB city bank products and services through Oculus VR glasses. The VIB booth attracted attention from government leaders, state agencies, and numerous delegates who participated in the experiments.

Tran Nhat Minh, deputy general manager and director of VIB's Digital Banking Division, presented a talk on developing smart financial services for small- and medium-sized enterprises, with such VIB solutions as the iBusiness account package for individual entrepreneurs, and the sBusiness account package for micro-enterprises and household businesses, alongside the digital VIB Checkout bank.

|

| Tran Nhat Minh, deputy general manager and director of VIB's Digital Banking Division |

With VIB Checkout, VIB is the first bank to integrate a Soft POS directly into the digital banking app, transforming smartphones into mobile POS devices without the need for traditional POS machine installations, thereby saving costs.

Also during the event, VIB was honoured to receive a commendation from Governor Nguyen Thi Hong for the bank's Technology Services Division and its success in implementing a digital transformation plan for the banking sector according to Decision No.810/QD-NHNN.

|

| Representatives from VIB and other banks receive commendations from Governor Nguyen Thi Hong (middle) |

VIB has pioneered digital transformation, invested in promoting technology initiatives and digitalisation, and built a robust, advanced technology platform. The bank is implementing a long-term digitalisation strategy while witnessing strong growth with high digital penetration and transformation rates.

From 2016 to 2023, the growth rate of transactions through digital channels increased by 50 times, with 340 million transactions in 2023. In the first quarter of 2024, 96 per cent of retail banking transactions were performed digitally, with millions of customers using digital banking services every month.

With a diverse product ecosystem integrated with advanced technology, convenience, and exceptional speed, VIB continues to assert its leadership in digital transformation, delivering innovative digital products focused on customer needs. The digitalisation strategy has also led to VIB being recognised by both domestic and international organisations for its technology-rich products and services.

| VIB introduces an easy, secure and private way to pay via Apple Pay Apple Pay is now available with the VIB Mastercards, bringing to card holders an easier, safer and more secure way to pay. Now, you can easily pay for everything you love, from everyday purchases like groceries and coffee, to online shopping and travel, using just your Apple devices. |

| VIB unveils Unlock privilege 4.0 The premium privilege package exclusively for VIB credit cardholders returns this year, bringing many expanded benefits to meet VIB's customers' needs. The package offers privileges ranging from restaurant deals to Vietnam Airlines membership, the lowest foreign exchange rates, birthday gifts, and a lot more besides. |

| VIB approves 29.5 per cent dividend payout and 2024 profit plan of $481.6 million Vietnam International Bank (VIB) has approved a 29.5 per cent dividend in cash and stocks, and a pre-tax profit plan of $481.6 million for fiscal year 2024. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Banks roll out God of Wealth Day promotions (February 26, 2026 | 17:10)

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- Banking sector targets double-digit growth (February 23, 2026 | 09:00)

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

Tag:

Tag:

Mobile Version

Mobile Version