VIB approves 29.5 per cent dividend payout and 2024 profit plan of $481.6 million

|

According to a report presented at the bank's AGM held on April 2 in HCM City, after seven years of the 10-year strategic transformation journey (2017-2026), VIB has established a solid foundation for outstanding growth in scale, quality, and brand value. This positions VIB as the leading bank in terms of business efficiency, asset and revenue growth, cost-effective management, and stringent risk control.

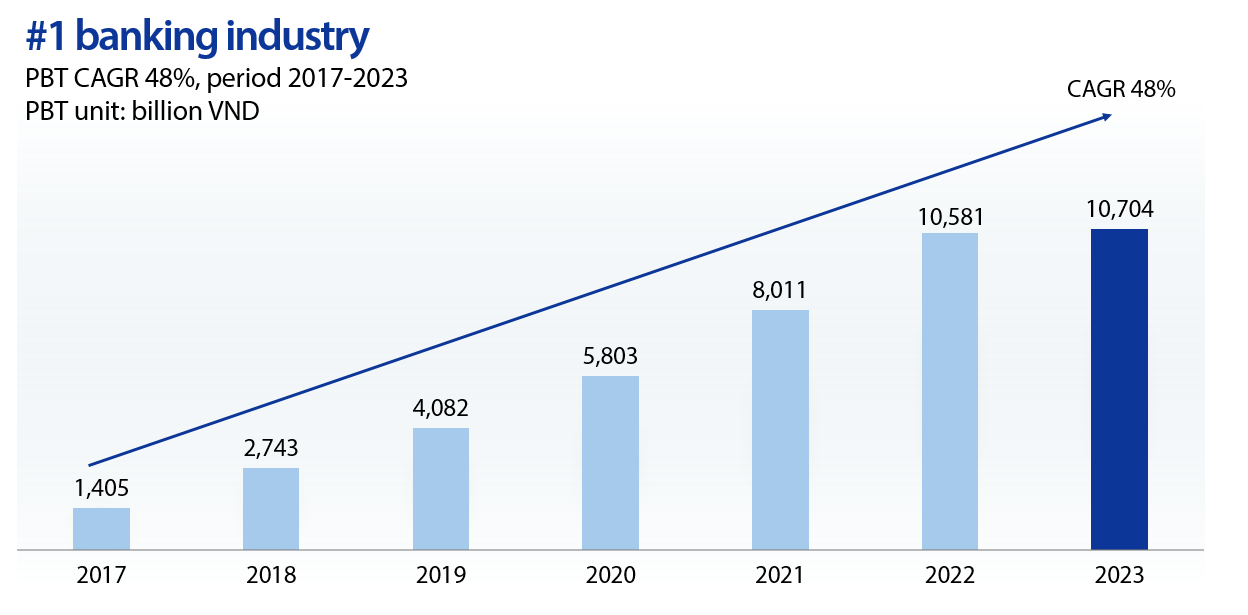

VIB's profits have achieved a remarkable CAGR of 48 per cent over the past 7 years, with return on equity (ROE) reaching 25 per cent, leading the industry for several consecutive years. Key indicators related to revenue growth, operational efficiency, and cost control all surpass the average of the top 10 listed banks.

|

Consistent with its strategy to become Vietnam's leading retail bank in terms of scale and quality, VIB currently maintains top position in retail proportion with over 85 per cent of its credit portfolio dedicated to retail lending. The bank consistently leads the market share in critical business segments such as home loans, auto loans, and credit cards.

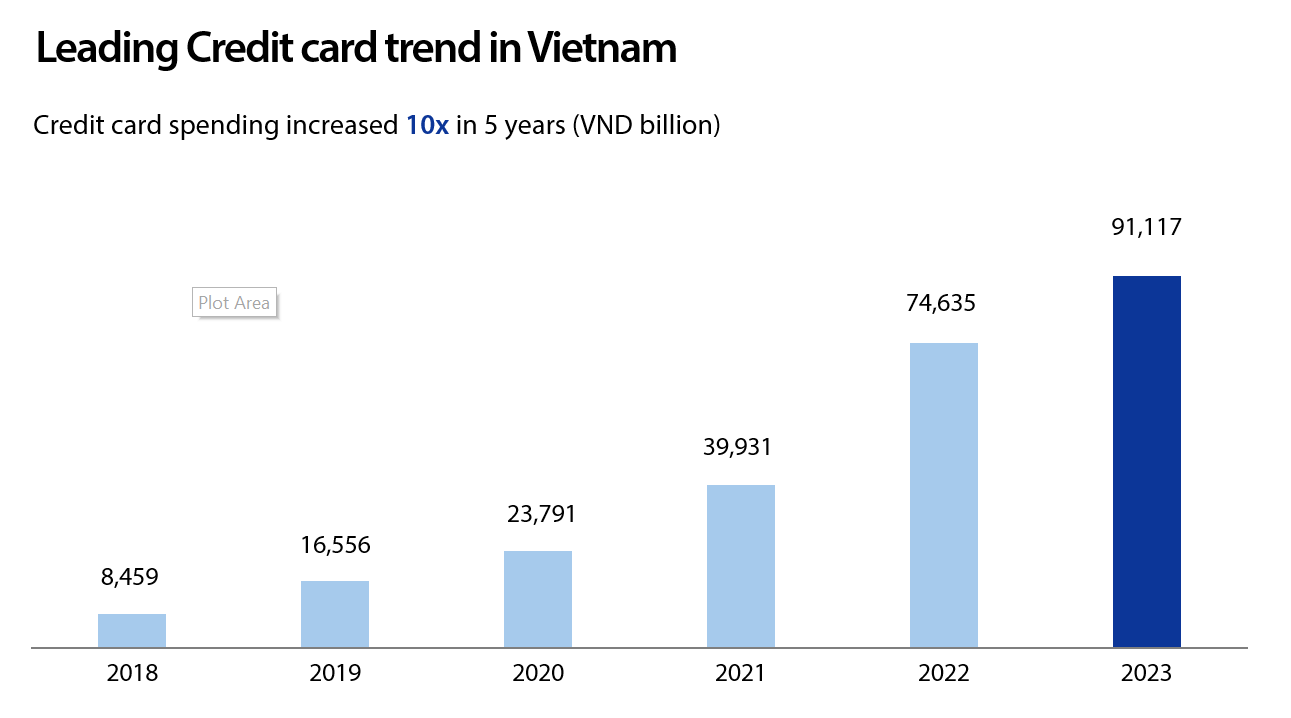

In 2023, with a trend-leading strategy in credit cards, VIB continued to introduce various new card lines to the market, featuring superior product features and first-time introductions in Vietnam. After six years, the total credit cards in use reached over 700,000, an eight-fold increase. Customer spending through VIB credit cards rose over 10 times, reaching a total expenditure of $4 billion in 2023, maintaining its top position in MasterCard's market share in Vietnam.

|

VIB's digital banking ecosystem continues to expand, offering a diverse range of products and services to cater for various customer needs. This expansion played a significant role in helping VIB acquire an additional 1 million new customers in 2023. The number of transactions on the digital platform exceeded 300 million, representing a growth of over 130 per cent compared to 2022 and a staggering 60 times increase over the past seven years. This has led to digital channels accounting for 94 per cent of the total retail transaction volume.

Robust risk management, strengthened brand reputation

According to the board of directors' report, VIB has the highest retail lending ratio in the market, with over 85 per cent of its lending allocated to retail. Alongside maintaining the best risk diversification level in the market, VIB also exhibits a cautious risk appetite by maintaining zero exposure in high-risk areas such as build-operate-transfer lending, corporate bond guarantees, and real estate business bond investments over the last four years.

In 2023, the State Bank of Vietnam (SBV) continued to rank VIB in the highest group within the industry based on assessments of capital safety, asset quality, management capacity, profitability, liquidity management, and sensitivity indicators. VIB consistently complies with SBV's indicators and regularly pioneers the adoption of international standards, including Basel II, Basel III, and IFRS.

Shareholder approval to raise charter capital and dividend distribution plan

At VIB's AGM, a plan to increase charter capital to VND29.791 trillion ($1.19 billion), representing a 17.44 per cent increase, was approved. The shareholders also consented to a plan to distribute a 29.5 per cent dividend to shareholders, comprising 12.5 per cent in cash and 17 per cent in stocks. VIB has consistently maintained a balanced and generous dividend distribution policy over the years, bolstering shareholders' trust and loyalty while also furnishing essential resources for the bank to pursue its growth plans.

Approval of 2024 business plan and implementation of new strategic directions

The shareholders also approved the proposed 2024 business plan presented by the board of directors, which includes targets for total assets, loan portfolio growth, capital mobilization, and profit. The lending growth target may be adjusted depending on the State Bank of Vietnam's room.

In the next phase, VIB has set out sustainable growth targets while leading in robust governance practices, pioneering in digitization, and consistently aiming to become the top retail bank in terms of quality and scale in Vietnam. This will drive dynamic and sustainable growth in shareholder value. To achieve the business goals for 2024 and the strategy for the remaining three years of the transformation journey, the directors have identified six strategic directions, including innovative and superior customer solutions and products; excellence in technology and digital banking; empowerment in human resources; leading brand; pioneering in the adoption of international standards; and robust risk management and compliance.

During the AGM, Dang Khac Vy, VIB's chairman, also conveyed the bank's commitment to aggressively expanding its retail operations, striving to realise the vision of becoming Vietnam's leading retail bank in both quality and scale. Furthermore, VIB aims to ascend as the premier banking partner for enterprises and uphold its reputation as a dependable and trustworthy ally for financial institutions across various areas, including currency, capital markets, and foreign exchange.

| VIB drives digital banking innovation with Temenos’ latest version of banking platform powered by AWS Vietnam International Bank (VIB) is delighted to announce the implementation of the Temenos Core Banking solution on cloud this week in collaboration with Amazon Web Services (AWS) and ITSS. |

| VIB introduces an easy, secure and private way to pay via Apple Pay Apple Pay is now available with the VIB Mastercards, bringing to card holders an easier, safer and more secure way to pay. Now, you can easily pay for everything you love, from everyday purchases like groceries and coffee, to online shopping and travel, using just your Apple devices. |

| VIB unveils Unlock privilege 4.0 The premium privilege package exclusively for VIB credit cardholders returns this year, bringing many expanded benefits to meet VIB's customers' needs. The package offers privileges ranging from restaurant deals to Vietnam Airlines membership, the lowest foreign exchange rates, birthday gifts, and a lot more besides. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Banks roll out God of Wealth Day promotions (February 26, 2026 | 17:10)

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- Banking sector targets double-digit growth (February 23, 2026 | 09:00)

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

Tag:

Tag:

Mobile Version

Mobile Version