Tourism real estate groups seeking pastures new

Tourism developer CloudGate has been focused on 10 real estate projects in south-central province of Phu Yen, a location with high tourism potential. Le Hoang Vu, vice chairman of CloudGate Group, said it intends to grow the travel brand with international operators such as Sailing Club.

Vu stated that the sudden spike in tourist arrivals to Phu Yen is “an essential element” for investors in tourism real estate. In 2022, Phu Yen greeted 2.2 million visitors, deemed a modest figure but 20 per cent greater than in 2019.

|

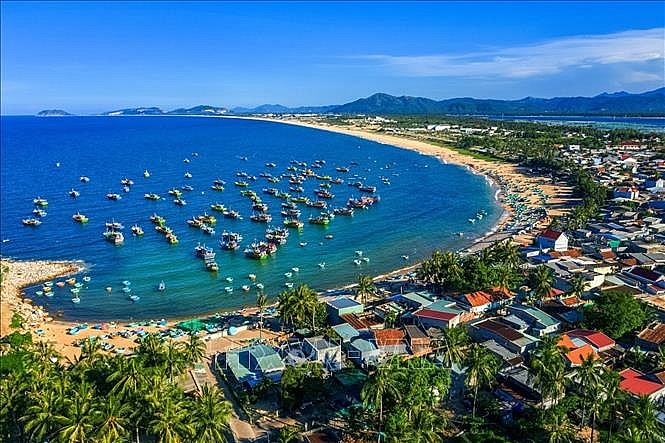

| Xuan Hai Fishing Wharf, Xuan Hai Commune, Song Cau Town, Phu Yen. Photo: Chau Dao Cuong/VNA |

During Q1 of this year, the number of visitors to Phu Yen increased by approximately 4.5 times compared to the same period last year. “Phu Yen’s potential is reflected by a limited supply of hotels, consisting of approximately 400 small-scale accommodations, 3-5-star hotels with approximately 700 rooms, and the absence of significant domestic and international investors,” Vu said.

An increasing number of other investors are considering investing in leisure real estate in the province, including Accor and Indochina Capital. The latter’s Wink Hotel brand is preparing to open a hotel in Tuy Hoa city by the end of this year.

Last month, Phu Yen hosted a tourism promotion week, demonstrating the local government’s commitment to tourism development. “The province has potential, but becoming a hot destination relies on many factors,” said senior vice president of JLL Hotels, Nguyen Quy Tuan. “It would take at least 10 years to reach the current size of Nha Trang in terms of tourism numbers.”

The development of tourism-related real estate is contingent on many factors. Many investors are interested in existing commodities with stable cash flow, whereas real estate developers are primarily concerned infrastructure, transport, and airports.

Meanwhile, industrial park (IP) development is flourishing many Vietnamese provinces. In a number of communities, there is a dearth of hotels to accommodate professionals who work in IPs.

Clients of Lodgis Hospitality claim that some professionals “can’t find a hotel to stay in,” while others are far from their workplace, sometimes more than an hour commute.

“Hotels near manufacturing areas can be a solid option for investors,” said Nguyen Gia Duc, senior vice president at Lodgis Hospitality. “After constructing two hotels in the southern province of Binh Duong, we are developing a model for 3- and 4-star hotels near IPs in the provinces of Bac Ninh, Thai Nguyen, Hai Duong, and Haiphong.”

Elsewhere, Mitsubishi Estate is currently seeking a new investment trajectory, with complex projects such as commercial houses, serviced apartments, offices for rent, and commercial centres as potential targets. “These segments create complementary value for the whole complex,” according to Nguyen Quang, investment director of Mitsubishi Estate Vietnam. The market is anticipating new hotel options for the tourism segment in the near future. Vu Viet Anh, development director of Accor Vietnam, agreed that most investors continue to concentrate on major cities and international tourists. Nonetheless, the central region remains “a priority” for many investors, despite visitor numbers currently being lower than anticipated.

“Currently, the provinces of Son La, Tuyen Quang, and Ha Giang are highly regarded for their picturesque landscapes and atmosphere. However many investors are still concerned about transport,” Anh said.

He said that later-developed markets would inherit advantages from earlier-developed markets. “Phu Yen is lagging in tourism development but benefits from aviation infrastructure as well as government-built highways,” Anh added.

When contemplating a tourism undertaking, investors must perform numerous tasks. Le Viet Thu, CEO of Nova Hotels & Resorts, said the company must examine local planning and construction strategy; consider the project’s location and connectivity, and understand the engagement with local infrastructure development.

“When putting money into building hotels near IPs, investors must account for the area’s economic planning, the possibility for hotel growth in IPs, the extent of local government assistance, and the growth potential of this field,” Thu said.

| Jun Watabe - Manager Global Hospitality Solution, NEC Platforms, Ltd. Some 3-star and 4-star hotels in Vietnam are attempting to adapt to new hospitality technologies, but few are doing so, and there are few initiatives. Singapore, South Korea, Japan, the United States, Canada, and Europe are all becoming increasingly digital. If they make a greater effort to discover intelligent solutions, it will be more advantageous for foreign tourists. Therefore, the greater their possessions, the better. I believe there is a demand for hotels in Vietnam to adopt digitalisation, which will increase the hotel staff’s efficiency and provide benefits to their employees, such as smart check-in and smart access. Hospitality guests in Vietnam crave convenience more than ever. That means an unprecedented demand for innovative tools that allow customers to drive their travel, lodging, and dining experiences, including self-service, contactless transactions, messaging apps, food delivery, mobile ordering, and payments. Hotels are intended to do more with shrinking budgets for guest-facing technologies. In Vietnam, technology vendors, hotel operations, IT, and technology heads are interested in the technologies worthy of adoption to drive an optimal guest experience. Gloria Wong - Executive director Hospitality Asia It is evident that the tourism industry in Vietnam is experiencing exponential growth, and the hospitality sector is thriving. The Vietnam National Administration of Tourism reported that the number of international tourists has increased by almost 30 per cent, and domestic visitors reaching 27.7 million in the first quarter. The industry is constantly evolving and adapting to an ever-changing market. We are witnessing a wave of rebranding as hotel owners and operators aim to stay ahead of the curve. The trend of lifestyle accommodations is gaining traction among younger customers, who value innovative design and unique experiences. Emerging brands including Voco, Hyde, Hotel Indigo, Caption by Hyatt, and Garrya are set to expand their market presence by 2026. Furthermore, investors are tapping into a niche market of resorts built near industrial parks to cater to business travellers and capitalise on the flourishing industrial real estate market. Industry buzzwords like wellness are taking centre stage as hotel operators strive to meet the needs of health-conscious customers and digital nomads. |

| A pivotal time to capture tourism property potential Vietnam should complete a sturdy legal framework in order to allow non-nationals to buy tourist property in the country, according to international experts. |

| Prospects for green tourism real estate development Do Chi Cong, member of the European Chamber of Commerce in Vietnam (EuroCham) and general director of SB Invest shared with VIR the prospects of developing green tourism real estate in Vietnam. |

| Tourism real estate properties remain in legal limbo Experts have called for clarifying the legal status of tourism real estate properties such as condotels, tourism villas and shophouses to safeguard stakeholders’ benefits, helping revive the tourism sector. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- More than $40 billion investment recorded in Asia-Pacific commercial real estate (February 18, 2026 | 19:58)

- Keppel co-hosts Home Hanoi Xuan festival in Hanoi (February 14, 2026 | 09:00)

- Saigon Centre gains LEED platinum and gold certifications (February 12, 2026 | 16:37)

- Construction firms poised for growth on public investment and capital market support (February 11, 2026 | 11:38)

- Mitsubishi acquires Thuan An 1 residential development from PDR (February 09, 2026 | 08:00)

- Frasers Property and GELEX Infrastructure propose new joint venture (February 07, 2026 | 15:00)

- Sun Group led consortium selected as investor for new urban area (February 06, 2026 | 15:20)

- Vietnam breaks into Top 10 countries and regions for LEED outside the US (February 05, 2026 | 17:56)

- Fairmont opens first Vietnam property in Hanoi (February 04, 2026 | 16:09)

- Real estate investment trusts pivotal for long-term success (February 02, 2026 | 11:09)

Tag:

Tag:

Mobile Version

Mobile Version