Steeper downturn in Vietnamese manufacturing sector in August

|

| Workers are receiving vaccines shots at Intel factory. Photo: Le Toan |

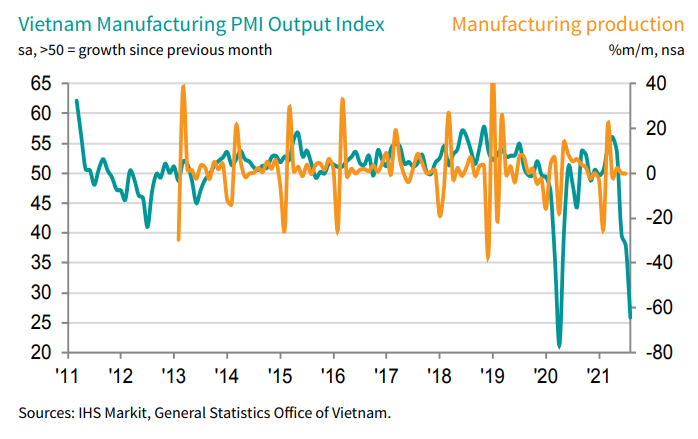

The downturn in the Vietnamese manufacturing sector intensified during August amid the worst outbreak of the COVID-19 virus in the country since the pandemic began. Restrictions leading to the temporary closure of some businesses, social distancing measures, and limits on travel to try and contain the spread of the pandemic resulted in accelerated declines in output, new orders, purchasing, and employment.

The unprecedented spell of supply-chain disruption continued amid transportation difficulties and pressure on capacity at the country's ports. This, allied with raw material shortages, placed upward pressure on input costs which continued to rise sharply.

COVID-19 restrictions meant that a number of manufacturers were closed temporarily, while others reported staff shortages and limits on their ability to produce. As a result, output declined at a substantial pace. The rate of contraction was the second fastest on record, behind only that seen in April 2020.

A similar picture was recorded with regards to new orders which decreased for the third month running and at the fastest pace in 16 months. The rate of decline in new export orders also accelerated as COVID-19 restrictions made exporting difficult. The sector's labour market also suffered amid social distancing restrictions.

A number of businesses indicated that they were operating the "three on the spot" policy to maintain some staff presence on site, but that not all workers were able to participate in this. Overall, employment decreased for the third month running, and at a sharp pace that was the steepest since April 2020.

|

Severe supply-chain disruption continued, with vendor delivery times lengthening at the sharpest pace on record for the second month running. Transportation issues were widely reported, with congestion at ports a result of them being unable to operate at full capacity. Raw material shortages was a secondary factor contributing to longer lead times.

Raw material shortages and transportation issues led to a further steep increase in input costs, with the rate of inflation remaining among the fastest in a decade. In turn, output prices were also raised, albeit to a much lesser extent than input costs as some firms offered discounts in order to try to secure sales.

August saw a near-record reduction in purchasing activity amid temporary company closures and lower output requirements. Despite the drop in purchasing, stocks of inputs increased for the first time in three months. The accumulation largely reflected the difficulties firms were having in maintaining production volumes.

Business sentiment hit a 15-month low in August as the severity of the current COVID-19 outbreak in Vietnam led a number of businesses to predict a sustained period of restrictions on their operations. That said, others were confident of a rebound in production.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

Mobile Version

Mobile Version