Shopee pulling ahead in e-commerce blitz

|

| Shopee pulling ahead in e-commerce blitz |

The fierce e-commerce market in Vietnam and the wider region Southeast Asia has swayed towards Tencent’s Shopee in recent times after it overtook Alibaba-backed Lazada outside of China.

More deals are being carried out now on Shopee compared to Lazada, with its gross merchandise volume in 2020 hitting $35.4 billion, greatly helped by the exploding adoption of online shopping after the pandemic persuaded more people to remain home for longer periods of time.

|

Shopee, established only five years ago, claims in its latest financial report that about 57 per cent of ASEAN goods sold online and related transactions last year were through its platform and courier networks.

The remarkable growth of Shopee has helped Tencent chip away at Alibaba’s base in the pair’s largest overseas market, where the 600 million combined ASEAN market means huge opportunities are still ahead. Asia Times reported last month that Shopee’s ability to pull ahead of the competition was partly helped by boardroom tussles at Lazada and the lengthy Alibaba takeover.

Its traffic in Vietnam is also overwhelming rivals Lazada, Tiki, and Sendo. According to e-commerce aggregator iPrice Group from Kuala Lumpur, traffic of Shopee Vietnam improved significantly during 2019-2020, remaining top of the rankings and attracting a huge number of visits.

While the gap of traffic between Shopee and remaining players was around 5-10 million per month in 2019 (between 34.6 million visits for Shopee and 24.4 million for Lazada in the last quarter of 2019), the gap increased significantly to between 46-57 million in the last quarter of 2020. Specifically, Shopee Vietnam reported 68.6 million visits monthly, with Tiki on 22.3 million, Lazada 20.8 million, and Sendo 11.2 million.

Chinese investment and massive media campaigns are playing a massive part in the success of the e-commerce giants. For example, with Tencent’s backing, Shopee had the financial wherewithal to burn through funding to offer free or cheap courier services to buyers, not just in Vietnam but elsewhere. Besides this, Shopee is frequently seen on eye-catching adverts across various media featuring the presence of Asian celebrities such as K-pop group Blackpink.

Behind the scenes there is also plenty of jockeying for power. Shopee carries out the practice of requesting that vendors sign an exclusive agreement.

Shopee in the past has sent vouchers valued at hundreds of dollars to some sellers, allegedly attached by the only condition that they must close their shop on Lazada during the biggest e-commerce sales events in Asia such as Super Shopping Day in September. This platform is said to provide this exclusive agreement in all three regional leading markets of Indonesia, Malaysia, and Vietnam.

Lazada meanwhile proposes a similar exclusive priority seller package including pick-up service, free shipping cashback programme, free assortment uploading service, and traffic and campaign exposure among others.

Shopee previously sent messages to sellers regarding penalties if they violated any exclusive agreement, including seizing sellers’ benefits, removing shipping discounts or free shipping codes, and prohibited from participating in marketing campaigns. The company has since clarified that this practice is no longer used.

The pressure is on for these companies to keep costs low in order to survive and thrive in the bustling e-commerce sphere.

In the case of Shopee in the fourth quarter of 2020, its revenue from e-commerce and other services and sales of goods was $873.2 million, while all costs for e-commerce, other services, goods sold, sales, and marketing expenses were $1.69 billion, making $817 million of losses in the quarter, much bigger than the on-year loss of $561 million.

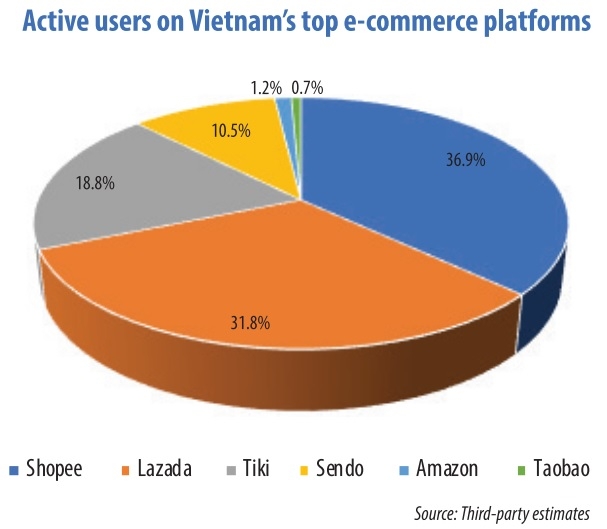

In the Southeast Asian region, Shopee leads the e-commerce scene by active users, while Lazada remains firmly entrenched as the number-two player.

In Vietnam, the shares of active users in the first quarter of 2021 are 36.9 and 31.8 per cent respectively, followed by Tiki and Sendo with a proportion of 18.8 and 10.5 per cent, respectively.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

- Innovation breakthroughs that can elevate the nation (February 19, 2026 | 08:08)

- ABB Robotics hosts SOMA Value Provider Conference in Vietnam (February 19, 2026 | 08:00)

- Entire financial sector steps firmly into a new spring (February 17, 2026 | 13:40)

- Digital security fundamental for better and faster decision-making (February 13, 2026 | 10:50)

- Aircraft makers urge out-the-box thinking (February 13, 2026 | 10:39)

Mobile Version

Mobile Version