Scope remains for new capital influx

|

According to a reliable source, a company which is one of China’s largest online retailers and a member of the Fortune Global 500, is set to invest into Vietnam in this year. The company also operates in logistics, with sophisticated data-driven delivery technologies.

“The capital investment cannot be revealed now, but it will likely be huge,” the source who declined to be named and works at the company told VIR. “When the company enters Vietnam, the country’s online retail and logistics landscapes will likely be changed, with bigger competition.”

Vietnam’s total retail revenue in the first half of 2021 hit VND1.99 quadrillion ($86.52 billion), up 6.2 per cent on-year. According to the General Statistics Office (GSO), this figure was relatively high, especially given the COVID-19 pandemic forcing the public to tighten their belt.

“Our company will invest in Vietnam thanks to the country’s good economic growth, good control of the pandemic, a growing middle class with big expenditure power, and a rise in foreign direct investment (FDI) in the market,” the source stressed, adding that the logistics industry in Vietnam is developing strongly.

“All logistics firms are expected to reap double-digit growth this year,” said the source, “We will strongly develop business-to-customers logistics services in Vietnam in the coming time.”

The GSO reported that despite difficulties, the local logistics industry is still increasing in the first six months of 2021 thanks to many reasons including the world’s recovering economy. Vietnam’s total goods transportation reached 903.5 million tonnes, up 11.5 per cent over that of -7.8 per cent in the same period last year. The figure in the second quarter hit 439.6 million tonnes, up 15.2 per cent on-year.

Over the past months, CEVA Logistics (Vietnam) under CEVA Logistics – a global logistics and supply chain company, is boosting recruitment of new employees and expanding its network to ship goods to the US, which is Vietnam’s largest export market – with total six-month export turnover of $44.9 billion, a 42.6 per cent rise over that of the same period last year.

CEVA Logistics (Vietnam) is expected to rake in a rise of 20-35 per cent in revenue for the entire year, after reportedly reaping double-digit growth in the first half of this year.

In June 2020, CEVA Logistics expanded its contract logistics footprint in Vietnam with the new multiuser facility in the southern province of Dong Nai. The facility is strategically located with easy access to Cat Lai Port and Tan Son Nhat International Airport.

According to the GSO, despite COVID-19, the Vietnamese economy in general has been bouncing back, with an on-year growth rate of 3.68, 0.39, 2.69, and 4.48 per cent during Q1-Q4 of 2020 respectively. In the first and second quarter of this year, the rate touched 4.48 and 6.61 per cent on-year.

Last November, the National Assembly set an economic growth target of 6 per cent for this year. In January, the government set a target of about 6.5 for the whole year.

The Ministry of Planning and Investment (MPI) has reported its two economic growth scenarios for the second half of 2021 to the government last week. In the first scenario, to hit the growth target of 6 per cent for 2021, the economy must grow 6.2 per cent in the third quarter, and 6.5 per cent in the fourth quarter.

In the second scenario, for the economy to increase 6.5 per cent for this year, the economy must climb 7 per cent in the third quarter, and 7.5 per cent in the fourth quarter.

“Based on these two scenarios, localities must formulate their own growth scenarios for implementation. We must be persistent and patient in carrying our dual target of economic development and pandemic fighting, though it is a very difficult choice in economic macromonitoring,” said Prime Minister Pham Minh Chinh at the government’s recent meeting with localities nationwide on six-month economic development.

Bullish projections

Though the government has been showing great caution in directing the economy, which is gradually recovering, a number of high-profile organisations are highly expecting Vietnam’s brighter prospects for this year and beyond, saying the economy is greatly supported by a series of factors, with a rising inflow of FDI continuing to serve as the key pillars for economic growth in the coming time.

The World Bank has just released it fresh forecast, saying that the Vietnamese economy will grow 6.6 per cent in 2021 and 6.5 per cent in 2022, thanks to a rise in investment and production, but still depending on how well the pandemic will continue being controlled.

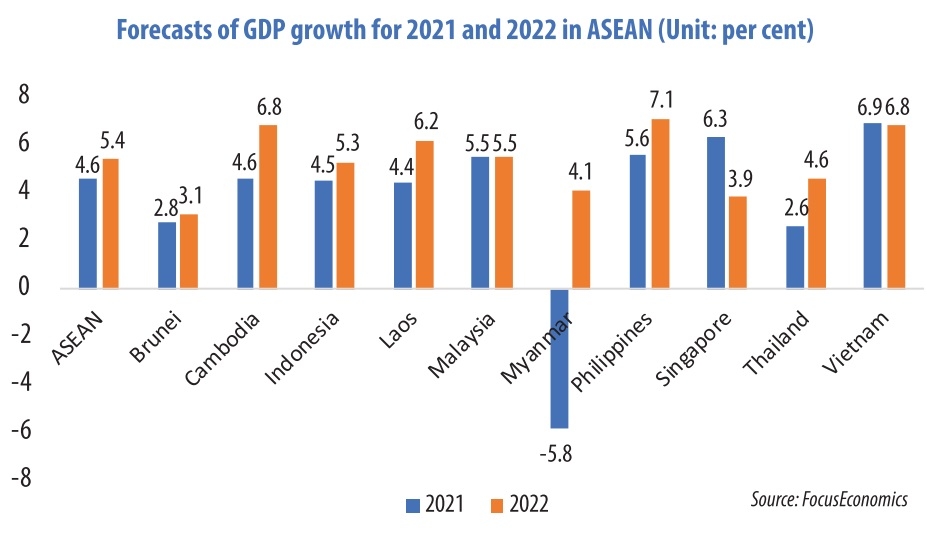

Global analysts FocusEconomics told VIR in a statement that Vietnam’s GDP is projected to grow at the fastest pace in the region this year (see chart), with a strong manufacturing sector driving domestic activity and improving foreign demand boosting exports.

“However, the impact of the recent surge in daily COVID-19 cases on the already-stifled tourism sector remains a key downside risk to the outlook. Our panelists expect GDP to expand 6.9 per cent in 2021, and 6.8 per cent in 2022,” said the statement.

Meanwhile, the Asian Development Bank (ADB) has also predicted that the Vietnamese economy is expected to grow by 6.7 per cent in 2021 and 7 per cent in 2022 – strong and steady growth made possible by Vietnam’s success in containing the COVID-19 pandemic.

The growth momentum is expected to continue, thanks to ongoing reforms to improve the business environment and Vietnam’s participation in multiple free trade agreements involving almost all advanced economies.

According to the ADB, looking ahead to 2021, investment will be boosted by improving disbursement of public investment, the continuing diversion of production from China to Vietnam, recovery in China’s economy, and the implementation of a trade agreement with the European Union to greatly liberalise trade.

“The Japan External Trade Organization has released a list of 15 Japanese firms to shift their manufacturing from China to Vietnam. The majority of those moving to Vietnam make medical equipment while the rest produce semiconductors, phone components, air conditioners, and power modules,” said an ADB report released recently.

During January-June 20, total newly registered FDI in Vietnam reached $9.55 billion, an on-year climb of 13.2 per cent. Operational firms increased their capital by another $4.12 billion, up 10.6 per cent on-year. Total disbursement hit $9.24 billion, up 6.8 per cent on-year.

Risks lingering

PM Chinh stressed that it would be a hard job to reach the set targets of economic growth, but the targets would not be changed now. “In the coming time, amid the increasingly complicated pandemic, we must be well aware that challenges will be much bigger than opportunities. We must make greater efforts to overcome all difficulties to hit the targets,” he said.

According to the World Bank, close attention should be paid to the evolution of industrial production and retail sales as both could be further affected by the latest outbreak. Exports may also suffer from the slowdown of activities in some industrial zones (IZs).

“If the current outbreak is not contained quickly, the government may wish to consider adopting a more accommodative fiscal stance to support affected people and businesses and to stimulate domestic demand,” said the World Bank bulletin for Vietnam in June.

The bank said that while the economy appears to have fared relatively well, several signs suggest slowdown in economic activity if the pandemic is not contained in the short term.

ADB country director for Vietnam Andrew Jeffries told VIR that the major downside risks are the re-emergence of the pandemic by new virus strains and delayed implementation of the vaccination plan. An ongoing resurgence is affecting not only major urban areas like Ho Chi Minh City and Hanoi, but also in the IZs in places like Bac Giang and Bac Ninh, where critical portions of the electronics supply chain are located.

“If the labour force in these zones is affected, it would impede manufacturing which is one of the key drivers of economic growth. Also, vaccination delays could have immediate impact on Vietnam’s economic recovery,” Jeffries said.

As for the Chinese retail company planning to set foot in Vietnam, despite numerous difficulties, it believed Vietnam’s big purchasing power and growing economy will continue being a major magnet for investors.

“Some big investors have come to Vietnam, such as Alibaba and Amazon. So there is no reason that our company will not enter Vietnam,” said the company’s source. “However, it is also expected that more administrative reform is needed because businesses are still facing complicated procedures in tax payment and customs clearance, hampering them from reducing production and business costs.”

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version