Retail properties see vacancies increase

|

Vincom Mega Mall - Royal City has more available space following the departure of Robins Department Store. Vincom Nguyen Chi Thanh also has substantial leasable areas available, providing an attractive option for retail businesses.

The thriving food and beverages (F&B) sector has benefited from the nearby residential and office buildings, indicating opportunities for both new and expanding businesses, with Pizza 4P's expansion in Lotte Centre doubling its area.

Gyu Shige, a Japanese grill restaurant chain, opened its first location at Lancaster Luminaire in Hanoi after having a good reception in Ho Chi Minh City. In addition, Mak Mak Thai Kitchen and Manwah Taiwanese Hotpot are coming soon to Vincom Centre Nguyen Chi Thanh.

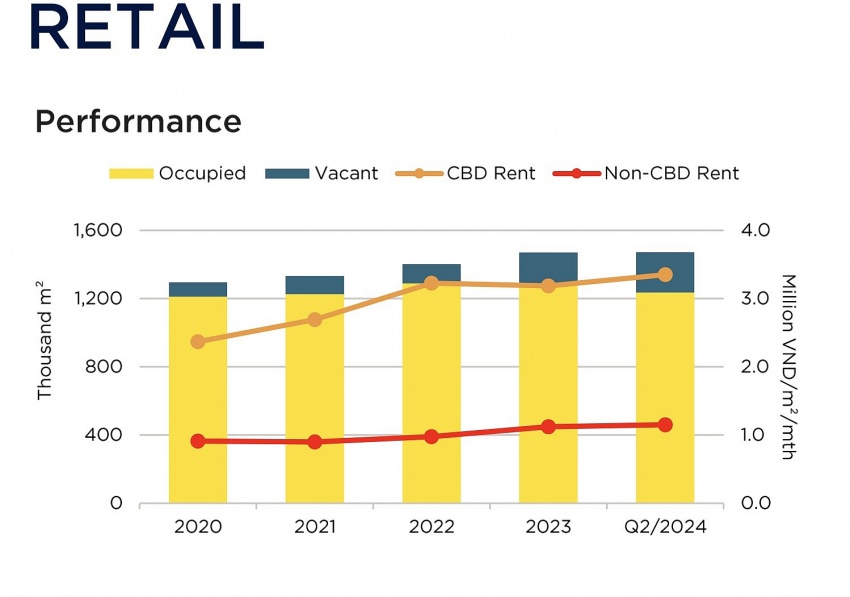

In general, the overall value of the retail segment decreased by 1 per cent on-quarter but increased by 4 per cent on-year, primarily due to the closure of net lettable areas (NLA) such as Robins Department Store. Over the past five years, retail stocks have grown 3 per cent a year on average.

Shopping centres dominated with 63 per cent of the share, with 1.1 million square metres of NLA, while retail podiums and department stores made up 17 per cent and 3 per cent, respectively.

"There was fluctuating demand for clinics and supermarkets, while new brands still face challenges in securing space in shopping centres," Trinh Huynh Mai, associate director of Savills Hanoi's Commercial Leasing.

Savills may have reported lower occupancy rates, but they also reported higher rents. Specifically, gross ground floor rents increased by 2 per cent on-quarter and 13 per cent on-year, mainly due to increased rents from department stores, reaching VND2 million ($80) per sq.m per month, and shopping centres, which paid VND1.3 million ($52) per sq.m. In the central business districts, rent was VND3.4 million ($136) per sq.m.

Occupancy lowered by 3 percentage points on-quarter and 2 percentage points on-year to 84 per cent. Retail podiums increased 7 percentage points on-year, while shopping centres declined by 4 percentage points. Department stores were stable over the same period.

Take-up fell by 49,800 sq.m with a significant decrease of 54,000 sq.m of NLA among shopping centres. Retail podiums had the largest take-up of 13,900sq.m of NLA.

Savills forecasts new supply between 2024 and 2026 will consist of 288,795 sq.m from six shopping centres and 11 retail podiums. Shopping centres will dominate with a 68 per cent supply and retail podiums will have a 32 per cent share.

| Vincom Retail retains brand name following Vingroup divestment Vincom Retail recorded its highest ever revenue in 2023, and signed a pivotal M&A deal in March 2024 that reshaped its ownership structure and set the stage for future growth. |

| Retail pricing conflicts set to persist Businesses in areas such as retail and food and beverages are looking at different strategies to retain budget-conscious customers amidst the shrinking demand caused by the challenging economic environment. |

| Apartment rental prices on the rise in country’s largest city Apartment rents in Ho Chi Minh City have surged by up to 28 per cent since last year, especially in the mid-priced and high-end segments. |

| Real estate sector enticing newcomers The newly released prospectus of Ton Dong A JSC ahead of its 2024 AGM on June 28 shows that the steelmaker is mulling over expanding into real estate and agriculture segments. |

| More overseas Vietnamese investment in real estate anticipated The real estate sector is expected to bag wider engagement of overseas Vietnamese thanks to more relaxed regulations on housing ownership. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Saigon Centre gains LEED platinum and gold certifications (February 12, 2026 | 16:37)

- Construction firms poised for growth on public investment and capital market support (February 11, 2026 | 11:38)

- Mitsubishi acquires Thuan An 1 residential development from PDR (February 09, 2026 | 08:00)

- Frasers Property and GELEX Infrastructure propose new joint venture (February 07, 2026 | 15:00)

- Sun Group led consortium selected as investor for new urban area (February 06, 2026 | 15:20)

- Vietnam breaks into Top 10 countries and regions for LEED outside the US (February 05, 2026 | 17:56)

- Fairmont opens first Vietnam property in Hanoi (February 04, 2026 | 16:09)

- Real estate investment trusts pivotal for long-term success (February 02, 2026 | 11:09)

- Dong Nai experiences shifting expectations and new industrial cycle (January 28, 2026 | 09:00)

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

Tag:

Tag:

Mobile Version

Mobile Version