Raging competition on e-commerce market promises to heat further up

|

A competitive market

After a long time of negotiations, JD.com, a large Chinese retailer, announced pouring VND1 trillion ($44 million) in Tiki.vn to become the domestic firm’s largest shareholder.

This amount may be turned to human resources training and optimising logistics to and from its warehouses as well as to conduct a study on promoting the Tikinow service, which is Tiki’s fastest click-to-delivery service. This is expected to bring Tiki.vn back to the e-commerce race in Vietnam.

Although Tiki and JD have not announced the coming strategies yet, Tiki has just opened up its marketplace, and working hard to attract sellers to their platform as well as promote delivery within two hours of placing an order.

Meanwhile, Shopee has been developing fast in Vietnam after the first year of operation. A report from iPrice Group, a market research company, announced that the shopping application of Shopee Vietnam has surpassed Lazada Vietnam in the third and fourth quarter of 2017.

Tran Tuan Anh, Shopee’s CEO, said that the company will maintain its delivery policy, and will still not charge commission for each successful order in the coming time. “We do not intend to cancel these support policies yet,” he said.

Lazada, on the other hand, has adjusted personal orders to stay in the competition against Shopee Vietnam. The latest move of Lazada Vietnam was to reduce commission by 50 per cent and offer free delivery during the two largest shopping occasions at the end of the year. Some domestic e-commerce brands, such as Sendo (FPT) and Zalo (VNG), show no signs of expanding this year.

Based on this competition, a trend of mergers and acquisitions (M&A) could appear in the next several years. Market leaders are likely to press smaller players until they drop out of the race.

New elements

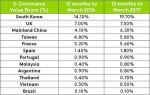

According to the latest report of Google and Temasek, Southeast Asia’s ecommerce market hit $11 billion in 2017, up 41 per cent in comparison to 2015. Vietnam is one of the fastest-growing markets with 33 per cent.

Thereby, the race in this sector is becoming increasingly heated. The appearance of Cho Tot shows ambition to push the race into an even higher gear. Johan Rostoft, managing director of 701Search and vice president of Online Classifieds at Telenor Group (owner of Cho Tot), said that the company is looking for opportunities in new fields, including online classifieds.

This is not a new model in Vietnam and over the world, as Sendo, Zalo, and Shopee already offer similar features. The advantages of not needing warehouses and shippers enable of these three to develop faster than other models like Lazada and Tiki.

Johan said that Telenor’s Cho Tot has allowed shoppers to do business and connect with delivery companies through the application. Telenor also acquired a bank in Pakistan to deploy a financial technical application. Thereby, Cho Tot is expected to become a comprehensive e-commerce system including shops, delivery service, and e-payment.

However, in Vietnam, Cho Tot remains focused on online classifieds, especially for vehicles, real estate, and electronics, in 2018, which are making up over 50 per cent of the total traffic on Cho Tot every day. In developed countries, the traffic of the online classified applications equals half of the total Internet users.

According to iPrice Group, unlike Thailand and Malaysia, Vietnam has not formed a B2C (business to client) model yet, thus Lazada, Tiki, and Shopee are still combining the two models of B2C and C2C to serve clients.

As a result, firms like Lazada and Tiki are creating barriers for new entrants and are promoting the C2C model through Cho Tot, Sendo, Zalo, and Shopee to innovate and change commodity, service structure, and ways of approaching customers.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version