Production woes not yet out of the woods

|

| Production woes not yet out of the woods, photo freepik.com |

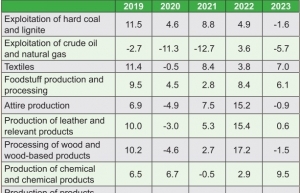

The General Statistics Office (GSO) last week reported that the index for industrial production (IIP) in January was estimated to expand 18.3 per cent on-year, in which the manufacturing and processing industry, which creates more than 80 per cent of industrial growth, increased 19.3 per cent on-year.

The key reason is that many businesses have increased their business and production activities to market more products in service of growing demand in the market to welcome the Lunar New Year taking place in early February.

However, such an increase in January was in fact recorded based on a negative IIP growth of -11.3 per cent on-year in the same period of 2023. Thus, the climb in January this year does not reflect the fact that domestic industrial production has bounced back strongly.

But according to the GSO in January, except for electronics products increasing 5.6 per cent on-year, production of all other key products in the economy recorded double-digit growth, such as leather, paper, garments and textiles, metal, and furniture.

For example, production of garments and textiles increased 20.9 and 46.2 per cent on-year, respectively.

Since Q3 of 2023, Hanoi Textile and Garment Materials JSC has been recovering its performance, with a rise in export orders landed from China, Singapore, Taiwan, and South Korea, which also traditionally welcome the lunar New Year.

“Our revenue in the second half of 2023 increased by 10 per cent on-year versus a 3 per cent on-year rise in the first half,” said Nguyen Viet Thang, a company representative. “Since last October, we have pushing up production at full speed. In January, the revenue is estimated to climb 12 per cent on-year.”

Just one year ago, the company faced with a 30 per cent reduction on-year in output, while operational costs ascended 15 per cent.

“At that time, we were using about 500 workers, instead of 700 before. But now, the situation has remarkably improved. We hope the situation will get better,” Thang said. “Our revenue also reduced by 20 per cent Q4 of 2022 and the rate was down by 10 per cent in the first two months of this year.”

This company has been unable to import materials from China, which is the biggest material provider, while the domestic partners are also shrinking production. In addition, the company is now burdened by paying high lending rates of 15 per cent a year for bank loans.

However, reality shows that not all companies like Thang’s are bouncing back.

In January, 44,000 businesses halted operations – up 25.5 per cent as compared to the previous year; 7,800 enterprises stopped operations and waited for dissolution procedures – up 14 per cent; and nearly 2,200 enterprises completed such procedures.

Last year, 89,100 businesses halted operations – up 20.7 per cent on-year; 65,500 enterprises stopped operations and waited for dissolution procedures – up 28.9 per cent; and 14,400 enterprises completed such procedures.

According to the GSO, although difficulties remain, business confidence has been gradually on the rise, largely thanks to the government efforts to improve the domestic business and investment environment.

A recent survey conducted by the GSO showed that the last quarter of 2023 saw a marked increase in satisfaction among businesses: confidence in the country’s economic situation climbed from 24 per cent in Q3 to 32 per cent in Q4. The outlook for Q1 of 2024 was also positive, with 29 per cent of businesses viewing their prospects as “excellent” or “good” as extreme worries fell from 9 to 5 per cent.

What is more, 31.7 per cent of respondents said their performance got better than Q3. For Q1 of 2024, 31.6 per cent believed they will get better than in Q4 of 2023, while 40 per cent held that their performance would be stable – in which the rate of non-state enterprises is 72.3 per cent, and the rate of foreign-invested enterprises is 71 per cent.

Prime Minister Pham Minh Chinh said that the government in 2024 would continue creating more better conditions for individuals and enterprises.

“We will create an open investment environment and complete the legal system for effective investment, in the spirit of harmonising interests and sharing risks between the state, individuals and businesses,” PM Chinh said.

According to Andrea Coppola, lead economist for the World Bank in Vietnam, it is likely that the demand for Vietnamese exports from the rest of the world to recover in 2024, though it will not be as strong as in the past.

“My message for Vietnam is to leverage its internal strength and boost the productivity growth of its domestic economy to transform the challenges provided by the global economic slowdown into an opportunity to further strengthen its economic growth model,” Coppola said.

| Activities in industrial production heat up Vietnam’s industrial performance is looking up, with the economy forecasted to see a stronger outlook moving into next year. |

| Pro-business landscape heads industrial production wishlist Despite a slowdown in industrial production, confidence among the business community is expected to continue climbing, which is backed by government efforts to provide a more friendly business environment. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Tag:

Tag:

Mobile Version

Mobile Version