Official denies power price rises to subsidise EVN losses

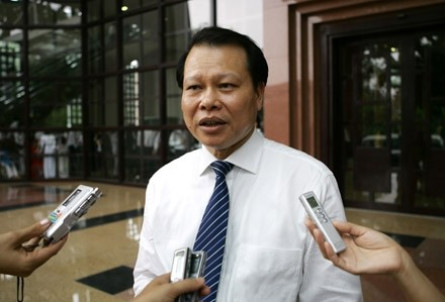

Deputy Prime Minister Vu Van Ninh said power prices would not be increased per every quarter

>> EVN reiterates power price hike proposal

>> EVN warned to carefully weigh up price hike

>> EVN given power to raise electricity prices on quarterly basis

Ninh, in an interview with a DTiNews reporter on the sidelines of the National Assembly’s year-end session, confirmed he had turned down the approach after EVN proposed a power price hike of 10 per cent-13 per cent from November.

There have been rising concerns over EVN and several other state-owned companies focusing on non-core investments despite their desperate need for capital to invest in their core businesses. EVN has incurred huge losses in its non-core investment in telecoms. Will EVN’s power price hike help offset such losses?

I think EVN needs to withdraw capital from its non-core investment. I’m sure that the government will not approve any increase in power prices in order to offset such losses.

In his report to the NA on October 20, Prime Minister Nguyen Tan Dung stood firm on the issue, advocating state owned industries should withdraw capital from non-core businesses in a bid to focus investment on their core businesses. The government will increase regulations to more strictly supervise investments made by these companies.

The government hasn’t agreed for companies to invest in non-core businesses since 2009.

Many people are worried that EVN may not recoup its initial investment even if it withdraws capital from its subsidiary EVN Telecom. What are your comments on this issue?

I will comment when they have a detailed plan for it. Careful consideration must be made before coming to a final decision.

Many people said that EVN’s proposal to raise power prices by up to 13 per cent may hinder the government’s policies to curb inflation. What do you think about this?

Power price rises are not contradictory to anti-inflationary efforts. However, it’s vital to consider the most suitable time for a price hike.

Do you think that it’s not suitable to increase power prices amid the current economic difficulties?

Each person has their own view point, however, the government will choose the best solution. The key issue is how to attract more investment in the electricity industry as current power shortages are mainly the results of a capital shortfall. Investors are not really interested in investing in this industry due to possible losses.

The same situation can be found replicated in other industries, such as transport infrastructure. If the government has no policies to help investors recoup their investment quickly, capital shortages will become more severe.

The public hopes that a decision to raise power prices will be delayed. What are your comments on this?

There has been no final decision made on the timing of a power price hike, so there’s no need to talk about a delay now. Like I said, it’s important to consider the most suitable time for a price hike in order to hamornise the interests of both the public and business community. The government is still considering the proposal.

After the recent 15.28 per cent increase in electricity prices, according to the government’s roadmap, you said, electricity prices should be increased by 62 per cent to ensure investors can become profitable from the business. If electricity prices are raised on quarterly basis, won’t this affect producers and people’s lives?

Power price hike is part of the government’s roadmap. It doesn’t mean that an increase will be applied per every two or three months, decisions depend on the reality. There has been no more power price rises since the latest increase on March 1, which fostered the government’s efforts to tame inflation, support production and the people in overcoming difficulties.

Personally, do you support EVN’s power price hike proposal this time?

EVN’s proposal is rational according to the aforementioned roadmap. However, it will take time to realise it. Practical decisions should be made based on the current context.

Will this time power price hike help EVN pay its debts of over VND10 trillion ($477.22 million) to the state-owned Vietnam Oil and Gas Group (PetroVietnam)?

EVN has yet to break even, let alone settle its debts. It would take some time for it to pay off the debts.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- South Korean company to build synthetic graphite anode material plant in Thai Nguyen (March 05, 2026 | 16:41)

- YADEA launches $100-million smart manufacturing plant in Bac Ninh (March 03, 2026 | 11:55)

- Law on Investment takes effect (March 02, 2026 | 16:21)

- VinFast invests nearly $500 million in its EV plant in Ha Tinh (March 02, 2026 | 16:19)

- Ho Chi Minh City attracts nearly $980 million in FDI in early 2026 (March 02, 2026 | 10:57)

- Japan’s Fujiya strengthens production base in Vietnam (February 28, 2026 | 09:00)

- Haiphong gains new growth impetus from strategic planning and integrated infrastructure (February 27, 2026 | 16:40)

- Kurz Vietnam expands Gia Lai factory (February 27, 2026 | 16:37)

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

Mobile Version

Mobile Version