Office segment resilient amid health emergency struggles

|

| Alex Crane - Managing director Cushman & Wakefield Vietnam |

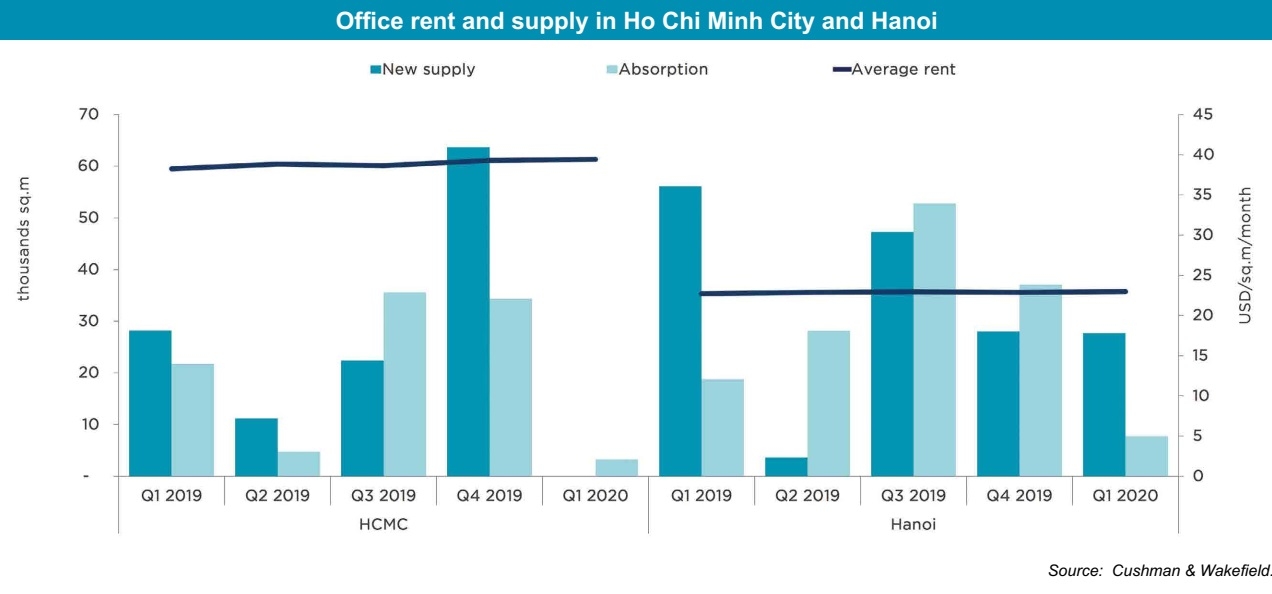

Figures from Cushman & Wakefield show that in the first quarter, net absorption in office space in Ho Chi Minh City was modest at 3,300 square metres, equivalent to 15 per cent that of the first quarter of 2019 and largely occurring in a recently completed building, Lim Tower 3.

However, overall occupancy remained at a healthy 95 per cent, unchanged on-quarter. No new supply was recorded in this period.

Rents meanwhile continued to trend upwards, increasing by 3 per cent on-year due to higher rentals at existing buildings such as mPlaza and President Place, as well as new completions in 2019 such as Sonatus Building and Lim Tower 3.

In general rents remained unchanged on a quarterly basis, remaining at $39.4 per sq.m per month. In May alone, Cushman & Wakefield leased more than the first quarter amount in office relocations, hopefully signalling signs of robustness in the southern hub.

Entering a new normal, we have successfully completed an above-average number of transactions, which in total was more than the entire market absorption in the first quarter of this year.

We would not announce the specific names of transactions; however, the deals closed were of an interesting range of sectors and were all multinational occupiers.

Manufacturing fast-moving consumer goods and new headquarters for one of the world’s largest retailers were all completed, as were multiple lease renewals.

Meanwhile in Hanoi, two new grade B offices were completed in the first quarter of this year, raising overall stock by 2 per cent on-quarter and 9 per cent on-year.

Effective pre-leasing strategies resulted in high occupancy levels for new completions, with both registering occupancies at over 90 per cent. Overall occupancy remained at a healthy 92 per cent. Absorption in the first quarter of 2020 was only a fifth of that of the previous quarter, and about 41 per cent of the same period last year.

Average rent remained unchanged on-quarter but rose moderately by 1 per cent on-year, mainly due to higher rentals at existing buildings such as IPH, TNR Tower, and PVI Tower.

Caution and restraint

Cushman & Wakefield, which works with some of the largest global companies in over 60 countries, however, heeds caution and restraint.

There is no doubt that Vietnam has led the world in the fight against COVID-19, but some of our biggest trading partners in the United States and Europe are still struggling with containment. With many multinational companies headquartered in these areas, they are likely going to hesitate making big decisions when their home environments are still being hit hard.

While we hope the initial signals in the Ho Chi Minh office market are positive, there are some challenging times to come for landlords to incentivise global firms to make a move to their building. There will still be a competitive edge to the market and good deals on the table for tenants.

The outbreak moreover is expected to negatively impact market performance in the next few quarters, exerting downward pressure on asking rents in Hanoi.

Hanoi is about to receive significant supply in the second and third quarter of this year, so our belief is that rents will be harder hit by this than the pandemic. CapitalPlace, launching 90,000sq.m of office space, is going to take grade A vacancies from about 5 per cent to 20 per cent which will add significant pressure on rents.

Regarding the movement from companies to Vietnam, obviously before the pandemic, Vietnam had been an attractive destination for companies.

We believe this will accelerate in the post-coronavirus environment as enterprises will seek to diversify supply chains

With the highly effective containment of the pandemic, arguably the best in Southeast Asia, Vietnam is considered a leading destination for foreign investors to base their manufacturing operations.

Apple is shifting some of its AirPod production to Vietnam. At the same time, Samsung has also considered moving some of its high-end smartphone production lines to Vietnam. Japan also announced an initiative to set up a fund of $2.2 billion to encourage companies to move out of China, and Panasonic has shifted some production here from Thailand. Optimism, therefore, has prevailed with regard to office relocations to Vietnam.

|

New generation of space

Vietnam still has a limited number of offices which are up to international standards with modern and environmentally-friendly facilities; however, this number has been increasing almost daily.

The country still has some way to go until the market reaches the heights to match others in the region, but we are catching up at quite some speed as all eyes in the region are now firmly fixed on Vietnam.

As more investors look towards our market – and so long as supply reverts to trailing behind the demand as we saw pre-pandemic – we can look to expect to welcome more green buildings in the future.

However, for now, occupiers will just have to look to the next best options available that meet their business vision and requirements, but we are anticipating to see a brand new LEED-certified 15,000sq.m building, OfficeHaus, coming to the market very soon in the northern part of Ho Chi Minh City very near Tan Son Nhat International Airport.

We are excited to see how this very pragmatic, affordable, elegantly, and sensibly designed building will perform as it will be attractive to the IT, tech, logistics, and manufacturing industries, which we expect to be the most active in the office sector in the next 12 months.

The shortage of space for offices for lease in Hanoi and Ho Chi Minh City may look like a bit of a disadvantage on the surface, but it does not mean that there are no comparable options in the market. Occupiers should explore the market for alternative grade A options which are setting new benchmark standards for future grade A buildings and certified green buildings.

We have returned to the office market with a bang closing a number of transactions and with other occupier projects now given the go-ahead by regional and global levels to resume their business.

Decisions naturally showed during the brief semi-lockdown, but thanks to leadership taking clear and supportive decisions, we can now really see the benefits reaped as a result and this is reflected in the sentiment of investors and occupiers.

We see our market picking up speed as we go into the second half of the year and continue this momentum through to the end of the year. Our market was one of the first to reopen up in the world and we are seeing businesses given full attention to it while they are quickly re-evaluating their existing offices and operations.

Now is the perfect time to go out to the market and go shopping for a new building and office.

In the future taste of occupiers, we expect that grade A occupiers will want to remain headquartered in downtown business districts but will wish to have higher quality grade A options to be able to shortlist and select from. Companies will look towards overtime-friendly building options.

Most important will be the facilities, amenities, technology, and building management improvements to satisfy the world’s new normal which include new etiquette regarding social distancing, access control and cleanliness.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Construction firms poised for growth on public investment and capital market support (February 11, 2026 | 11:38)

- Mitsubishi acquires Thuan An 1 residential development from PDR (February 09, 2026 | 08:00)

- Frasers Property and GELEX Infrastructure propose new joint venture (February 07, 2026 | 15:00)

- Sun Group led consortium selected as investor for new urban area (February 06, 2026 | 15:20)

- Vietnam breaks into Top 10 countries and regions for LEED outside the US (February 05, 2026 | 17:56)

- Fairmont opens first Vietnam property in Hanoi (February 04, 2026 | 16:09)

- Real estate investment trusts pivotal for long-term success (February 02, 2026 | 11:09)

- Dong Nai experiences shifting expectations and new industrial cycle (January 28, 2026 | 09:00)

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

Tag:

Tag:

Mobile Version

Mobile Version