New order growth picks up speed in manufacturing

|

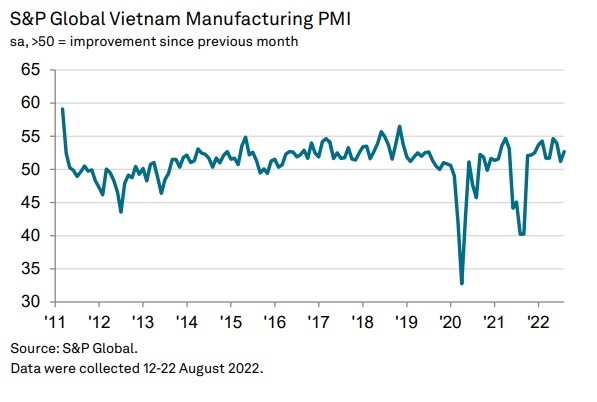

The latest survey by S&P Global revealed that the Vietnam Manufacturing Purchasing Managers' Index posted 52.7 points in August, up from 51.2 points in July and signalling a solid improvement in the health of the manufacturing sector midway through the third quarter of the year. Business conditions have now strengthened in 11 consecutive months.

Production growth regained momentum in August, after having slowed in July. The fifth successive rise in output was solid as firms reported a continued recovery and greater new orders.

Manufacturers reported higher new orders from both domestic and export customers. In line with the picture for output, the rise in total new orders was solid and sharper than seen in July. The increased customer numbers, improving demand and competitive pricing was all behind the latest expansion.

|

Firms were helped in their efforts to price competitively by waning cost pressures. The rate of input price inflation slowed sharply for the second month in a row and was the weakest in 27 months of rising costs.

In turn, firms also increased their own selling prices at a softer pace, and one that was only marginal. The survey's respondents mentioned lower costs for oil and other raw materials, although some firms continued to report rising transportation costs.

Rising new orders encouraged manufacturers to expand their staffing levels again in August. As was the case with output and new orders, the rate of job creation quickened midway through the third quarter.

| "Manufacturers benefitted from the first shortening of suppliers' delivery times since November 2019, a marked turnaround from the widespread delays seen this time last year," Harker said. |

Andrew Harker, Economics director at S&P Global Market Intelligence said, "The most eye-catching development in August was a further sharp slowdown in input cost inflation, with costs only rising marginally in the latest survey period. This gave firms some breathing room to limit their own price rises, thus boosting demand. Manufacturers also benefitted from the first shortening of suppliers' delivery times since November 2019, a marked turnaround from the widespread delays seen this time last year."

He added, "With these supply headwinds having dissipated, firms should be able to concentrate on securing greater new orders and expanding production over the remainder of 2022."

A further increase in employment was partly behind the second reduction in backlogs of work in the past three months. In fact, the decline in outstanding business was the most pronounced in just over a year.

Firms also responded to higher output requirements by expanding purchasing activity, the 11th consecutive month in which this has been the case.

Despite rising purchasing activity and quicker deliveries from suppliers, stocks of purchases continued to fall as inputs were used to support the growth of production. Stocks of finished goods were also down as products were dispatched to customers.

Expectations that market conditions will be relatively stable over the coming year and that customer demand will improve supported confidence in the year-ahead outlook for production. Around 57 per cent of respondents predicted that output will increase over the coming 12 months, against 9 per cent that expected a decrease.

| Vietnam’s economic growth accelerates on back of exports, manufacturing: Bloomberg Vietnam’s economic growth accelerated faster than expected in the second quarter of this year, as a recovery in exports and manufacturing helped offset risks from coronavirus outbreaks and rising oil prices, Bloomberg reported. |

| Manufacturing sector ends the first half of 2022 in good health The Vietnam Manufacturing Purchasing Managers' Index (PMI) posted 54.0 points in June, down slightly from 54.7 points in May but still signalling a solid monthly improvement in the health of the sector. Business conditions have now strengthened in each of the past nine months, according to the latest PMI survey by S&P Global. |

| Manufacturing output continues to rise amidst signs of slowing growth The Vietnamese manufacturing sector remained in growth territory at the start of the third quarter of the year, but there were some signs of demand softening. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Mobile Version

Mobile Version