Mixed fortunes for seafood sector in unpredictable year

|

| Vietnam’s shrimp segment is going from strength to strength thanks to increasing demand, Photo: Le Toan |

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), by the end of 2020, the total value of Vietnam’s seafood exports reached $8.41 billion, down 1.9 per cent on year.

Of these, exports of basa fish was $1.49 billion, down by 26 per cent, and shrimp accounted for $3.73 billion, up 11 per cent on year.

Basa fish farmers in Vietnam, China, and India all have been affected to different degrees by the COVID-19 pandemic. Prices for basa from the Mekong Delta region fell below VND20,000 ($0.90) per kilogramme and its export value to some major markets like China, Hong Kong, the US, ASEAN, and the EU decreased compared to the previous year.

However, thanks to the government’s pandemic prevention efforts, Vietnam’s shrimp production and export activities have stayed competitive against rival suppliers. Shrimp businesses tried to maintain production, flexibly adjust to the market, and take advantage of the given opportunities, and so export value to major markets grew positively, such as to the US (up 33 per cent), the EU (up 6 per cent), and South Korea (up 3 per cent), compared to 2019.

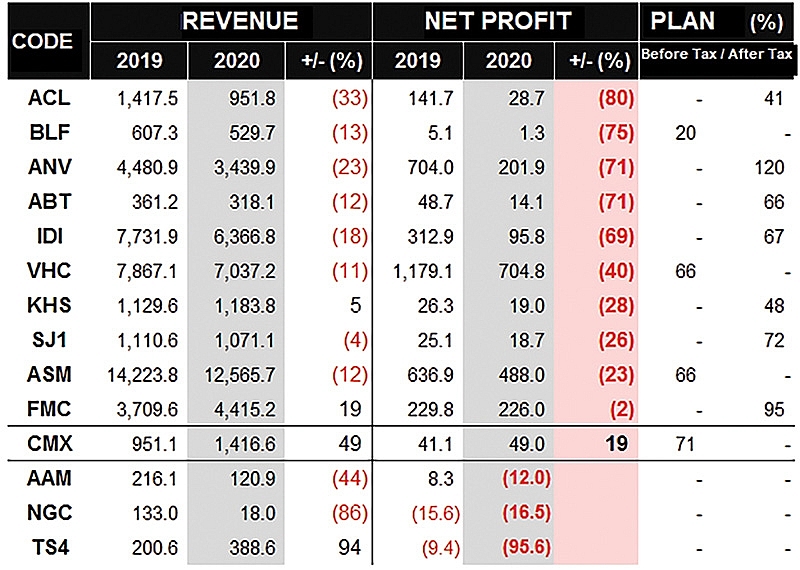

According to data from VietstockFinance, as of the beginning of February, there are 14 listed seafood enterprises that have generated nearly VND40 trillion ($1.7 billion) in revenue and more than VND1.7 trillion ($73 million) in net profit in 2020, down 10 and 48 per cent, respectively, compared to 2019.

Cuu Long An Giang Seafood JSC (ACL) saw the strongest net profit in 2020 yet also the strongest drop in the industry, down 80 per cent from the previous year. Compared to its business plan, the company only achieved 71 per cent of its revenue goal and 41 per cent of its targeted after-tax profit.

Similarly, due to the pandemic, the sales price and revenues of basa supplier Nam Viet (ANV)decreased simultaneously. The enterprise’s net profit in 2020 slid down to VND202 billion ($8.8 million). Last year, the company set targets relatively low compared to 2019, so the business exceeded its revenue and pre-tax profit plan by 15 and 20 per cent respectively, positioning Nam Viet as the only Vietnamese basa supplier exceeding initial targets.

For the same reason, leading basa processor Vinh Hoan Corporation (VHC) announced that 2020 net profits went down to 40 per cent, just reaching VND705 billion ($30.6 million). Compared to the plan, VHC only achieved 82 per cent of its revenue plan and 66 per cent of the after-tax profit target in 2020.

More dramatically, for the second year in a row, the accumulated loss of Ngo Quyen Processing Export JSC (NGC) amounted to VND31 billion ($1.3 million) as of December 31. According to the company, the reason is that its capital imbalance has not been overcome, causing a shortage in working capital for production.

In addition, due to the heavy influence of the pandemic, the company’s trade with foreign customers was interrupted, with no export orders coming in. The production plans for both domestic and foreign customers have been cancelled, thus the company failed to meet its goal of gradually bringing production back on previous levels.

|

Blooming shrimp industry

Contrary to the gloomy atmosphere of the basa industry, shrimp businesses recorded an increase in revenue. Although its net profit reached a similar level of the previous year with nearly VND226 billion ($9.8 million), 2020 revenues of Sao Ta Food (FMC) reached VND4.4 trillion ($191 million) – a record high after 15 years of listing on the stock exchange.

According to Ho Quoc Luc, president of food processing group FMC, the pandemic has created good opportunities for Vietnamese shrimp farmers. Production of safely farmed shrimp increased compared to 2019, even if just by a mere one-digit figure. Meanwhile, other major shrimp farming countries were severely affected by COVID-19 and were seeing interrupted or broken supply chains in the likes of India, Ecuador, and Indonesia.

Along with shrimp, Camimex Group (CMX) is the only enterprise representing the seafood industry to report profit growth compared to the previous year. Net revenue and profit increased by 49 per cent and 19 per cent, respectively, over the same period. This is a positive result in the face of an uncontained pandemic which has changed the demand for imports in major markets and economic drivers.

The increased demand for shrimp at home is also a great opportunity for deeply processed shrimp products compared to fresh, raw, and frozen products.

As a result, while the total value of black tiger shrimp exports decreased by 14 per cent, processed tiger shrimp products alone rose by 34 per cent. The export value of processed vannamei shrimp also increased by 21 per cent.

According to Luc of FMC, consumer demand is increasingly high, and processing is becoming more intensive, geographically concentrated, vertically integrated, and linked with global supply chains.

“These changes pose new food safety challenges to all the parties in the seafood business. Thus we have determined our main direction to be processed products with high value content and food safety. Thanks to this direction, our products are now available in most high-level markets,” he said.

Minh Phu-Hau Giang Seafood JSC, a member of Minh Phu Seafood Corporation, also shipped over 22,000 tonnes of processed shrimp worth $240 million to the US, Europe, Australia, Canada, Japan, and South Korea, thereby contributing to its corporation’s overall revenue of $580 million from shrimp exports in 2020. This year, Minh Phu targets to export over 70,000 tons of shrimp, with an estimated revenue of $790 million.

The Ministry of Agriculture and Rural Development has asked if shrimp exporters could strengthen cooperation with local companies to diversify markets, continue to increase the share of value-added products, and control the quality of raw material sources, as well as ensure traceability of origin.

FTAs boost growth

According to VASEP, the fishery sector has a lot of opportunities from new-generation free trade agreements (FTA) such as the Regional Comprehensive Economic Partnership (RCEP) and the EU-Vietnam FTA. These FTAs have a good impact on Vietnam’s seafood exports and contribute to improving the competitiveness in regional and global markets.

It is forecasted that Vietnam’s seafood export in 2021 will increase by 10 per cent, reaching over $9.4 billion. In which, shrimp export may grow the strongest at up to 15 per cent, reaching $4.4 billion. Meanwhile, the growth of basa fish farming is expected to increase by 5 per cent, reaching about $1.6 billion.

Tran Minh Canh, CFO of Nam Viet Corp (ANV), also agreed that the EVFTA and the RCEP will contribute to boosting the growth of Vietnamese exports due to the tax exemptions for some industries.

The RCEP allows its members to pool originating materials across the bloc, which is an advantage over the current FTA with ASEAN members, and is helping Vietnam to take advantage of the diversified input supplies throughout the bloc. The EVFTA, on the other hand, allows the tax for frozen basa to be gradually reduced to zero according to a 4-year schedule.

According to Ho Quoc Luc, the EVFTA has a huge impact on shrimp products and presents a golden opportunity for businesses that have prepared well.

On the contrary, Luc also forecasts several challenges that businesses may experience in 2021. The internal challenge for shrimp farmers is that authorities remain rather slow numbering and coding farming areas, ponds, as well as provide more open mechanisms to create large-scale farms that meet the standards required by export markets.

However, Vietnamese shrimp has decent opportunities to penetrate high-end consumption systems with good prices. Meanwhile, information about supply and demand of basa is a prerequisite for its success or failure.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

Mobile Version

Mobile Version