LNG driving FDI picture so far in 2021

|

As per a newly-issued investment certificate, VinaCapital GS Energy Pte., Ltd., a joint venture between South Korea’s GS Energy and VinaCapital, is to build a $3-billion liquefied natural gas (LNG)-to-power complex with a total capacity of 3,000MW in the Mekong Delta province of Long An.

The $3 billion LNG venture accounted for almost 30 per cent of the value of FDI attraction in the first three months of 2021.

This follows another mega-investment project from last year, when in January Delta Offshore Energy Pte., Ltd. registered $4 billion into an LNG-to-power complex in Bac Lieu province last year.

The list of registered LNG projects has been growing longer in recent years, including Japan’s Tokyo Gas, Sojitz, Kyushu, JERA, and J-Power, the United States, with familiar names such as ExxonMobil and AES Corporation, and South Korea with Kogas and GS Energy.

The demand for natural gas presents significant LNG opportunities in Vietnam not only due to the growing demand for energy. In anticipation of the declining supply of natural gas from domestic sources, Vietnam is expected to become an LNG importer as early as 2021. This will require significant upfront investments to build infrastructure across the LNG-to-power chain and Vietnam will be looking to strategic investors and sponsors for foreign capital and expertise according to the international law firm White and Case.

“As Vietnam transitions into an LNG importer, policies on LNG import prices (for instance to allow the ability to pass on increases in gas prices to consumers), technical standards for LNG infrastructure, and the liberalisation of the electricity and gas markets, among others, will be important considerations in the creation of a transparent and competitive market,” said Saul Daniel from White and Case.

He added that foreign investors looking to invest in large-scale infrastructure projects globally are looking for a stable legal and regulatory framework and a risk allocation model that adequately allocates the risk between the private sector and government, and which will ultimately be acceptable to third-party lenders to the foreign investors. Ongoing regulatory reform will play an important part in supporting the growth of the LNG sector at a pace to meet Vietnam’s energy ambitions.

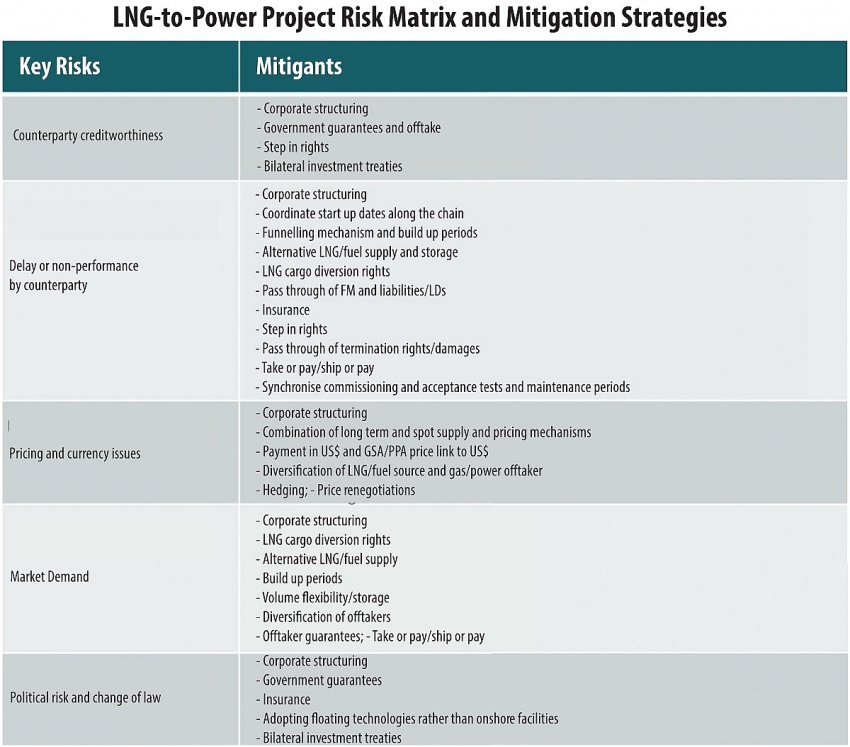

While the pipeline is full to the bursting, how these projects could meet their promise in time remains a question as LNG-to-power infrastructure projects are very complex to execute. These are multi-stage development projects with numerous moving parts and multiple risks – involving upstream, downstream, counterparty, and construction interests.

For instance, Sembcorp Group expressed interest in building a thermal power project, but then in 2017 suddenly changed direction to utilise gas from the Blue Whale field. The nuances of the switch have kept the project from taking shape ever since. The project is still preparing investment procedures and negotiating a build-operate-transfer contract with the Ministry of Industry and Trade.

The National Steering Committee for Power Development has issued a proposal to approve the mechanisms on electricity pricing and electricity market participation of LNG power plants ahead of schedule, as well as soon complete policies and mechanisms to promote the progress of Blue Whale gas resources and other power projects.

The latest draft National Power Development Plan 8 so far proposed a four-fold increase of the current gas-fired power capacity to 28GW by 2030, or 21 per cent of the system capacity. The majority of the new capacity is expected to be fuelled by imported LNG.

Market players will also be paying close attention to how senior decision-makers address actions that will determine the affordability of LNG and shape the economic impact of Vietnam’s pivot to gas. Regulators are aware of the cost implications of LNG-fired power plants, according to a report by the Institute for Energy Economics and Financial Analysis.

Asian LNG spot prices have soared in recent months as a reminder that LNG prices will almost certainly trend higher and experience continued volatility as the market seeks a new post-pandemic equilibrium, the report concluded.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: Sustainable Energy

- 16th national conference on nuclear science and technology opens in Danang

- Technology and Energy Forum 2023 to open in Quang Ninh

- Asia Clean Capital Vietnam receives backing from Swiss Investment Manager

- Amazon scales renewable energy to fight climate change

- Universal Alloy Corporation Vietnam partners with Asia Clean Capital Vietnam

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version