Interest on all fronts as nation takes centre stage

|

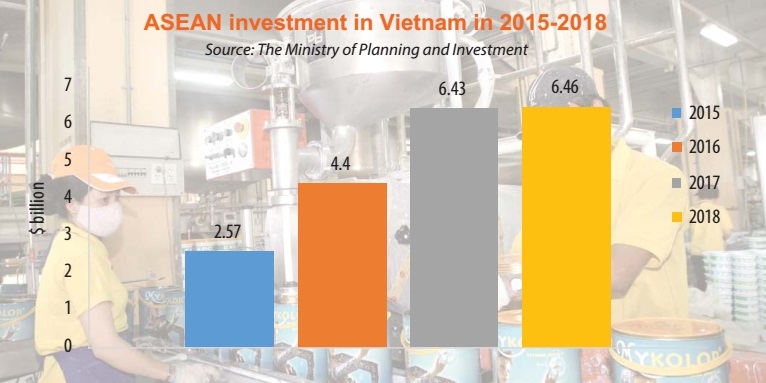

| As Vietnam becomes a focal point of the ASEAN in 2020, it is hoped that will add to strong investment into the country |

After months of proposals, Gulf Energy Development – the third-largest power generation company in Thailand – eventually signed an MoU with Vietnam’s central province of Ninh Thuan to develop the Ca Na liquefied natural gas (LNG) energy project there.

The $8 billion complex, including a 6,000MW combined-cycle gas power station and an adjacent LNG re-gas terminal, is the fourth power project that the Thai giant has invested in within Vietnam. The signing was witnessed by Prime Minister Nguyen Xuan Phuc on the sidelines of the 35th ASEAN Summit in Bangkok at the start of November.

“Both parties agreed to extend their co-operation to exchange studies and expertise in gas-fired power plants, an LNG terminal, and financing capacities for the development of the integrated LNG-to-power project,” said Yupapin Wangviwat, executive director of Gulf Energy Development.

On the same day, Thai power giant B.Grimm – the country’s largest small power producer, signed an MoU with Petrovietnam Power Corporation to study and implement development of integrated LNG projects.

The new developments are proving how attractive the Vietnamese energy market is to Thai investors, who are among the biggest ASEAN financers in the country.

Giants’ steps

It is easy to understand why the Thai energy giants want to deepen their footprint in Vietnam. Wangviwat of Gulf Energy Development said that it foresees rapid economic growth and electricity demand in the country’s fast-growing economy.

Now, energy has become an investment trend among ASEAN and global ventures. According to the United Nations Conference on Trade and Development’s (UNCTAD) World Investment Report 2019, the global total value of announced greenfield projects in services rose by 43 per cent to $473 billion. There were large increases in both construction and power generation, especially in developing countries like Vietnam.

In addition to growing attraction of energy manufacturing, the service sector is another receiving vast amounts of foreign direct investment in the ASEAN, including Vietnam.

As shown in the UNCTAD’s ASEAN Investment Report, in line with the global average, the share of the service sector in total FDI grew from 50 per cent in the 1999–2003 period to 66 per cent during 2014–2018.

In Vietnam, FDI is also found mostly in manufacturing, real estate, and wholesale and retail sectors, all of which received the higher FDI inflows last year than in 2017. Japan, South Korea, and the ASEAN (primarily Singapore, Malaysia, and Thailand) were the three largest investors during 2017.

Famous ASEAN brands in Vietnam’s realty sector include CapitaLand, Keppel Corporation, Frasers Property, Sembcorp, and Gamuda Land. They have made successes and are continuing to expand in the country. Meanwhile in the manufacturing and wholesale and retail spheres, businesses from Thailand are leading ASEAN investment in Vietnam.

One of the top names in wholesale and retail is Berli Jucker (BJC). On the heels of BJC, Central Group of the Chirathivat family – the richest in Thailand – set foot in Vietnam, while C.P. Group has entered the Vietnamese market via the agriculture sector, with its market share continuously rising rapidly.

Elsewhere, in the manufacturing sector, SCG has been present in the local market since 1992 and growing significantly since then.

Furthermore, Thailand’s largest industrial estate operator, Amata Corporation, has become famous in Vietnam with its industrial park projects.

The trend continued in the first 10 months of this year when the sectors retained the most attention among international ventures in Vietnam. Manufacturing with energy production lured $18.83 billion worth of FDI, followed by property, and wholesale and retail activities. ASEAN-led Singapore still holds the third position with total pledged FDI of $5.2 billion.

Experts said attributed the higher ASEAN investment inflows into Vietnam to the improved business climate, with a number of programmes to simplify business administration, tax cuts, and removal of business conditions, as well as amendment and issuance of legal documents to further facilitate business and investment activities within the ASEAN Economic Community (AEC).

A senior official of the Ministry of Planning and Investment said, “The integration into the ASEAN economy has brought about positive impacts on Vietnam’s exports, helped local businesses improve their competitiveness, and created changes in building and perfecting policies, laws, and procedures regarding investment, towards an open and transparent business environment and thus contributing to luring more foreign investment.”

According to a recent report by the ASEAN Secretariat on the implementation of solutions within the AEC development roadmap, the ASEAN has carried out 91.5 per cent of the prioritised solutions with great impacts on trade and investment. And Vietnam is one of the countries taking the lead with an implementation rate of 94.5 per cent.

Also important is continuous growth, and Vietnam is committed to rolling out an ambitious investment plan to develop overall infrastructure in major industrial arenas, which will ease doing business and improve logistics. These factors are helping the country improve its ranking tremendously year by year.

This fruition is noted in the US News & World Report, in which Vietnam surpassed its Southeast Asian neighbours including Malaysia, Indonesia, and Singapore, ranking eighth among the best economies to invest in this year, massively improving on its ranking of 23rd last year.

New prospects ahead

The opportunities for Vietnam to lure more ASEAN investment are widening into next year as the country takes the bloc’s chairmanship. Besides traditional interests, healthcare, tourism and hospitality, and construction will be special priorities.

The ASEAN Community focuses on three pillars: economy, politics-security, and culture-society. As the chairmanship will officially begin on January 1, 2020, Vietnam will take measures to become an effective bridge to connect the ASEAN with countries in the wider world.

Other important careful preparations for Vietnam’s new task have been made to further its contributions to regional peace and security with a people-centred approach, according to the Ministry of Foreign Affairs.

2020 will be also an important year for Vietnam’s trade and investment when the landmark enforcement of the EU-Vietnam Free Trade Agreement (EVFTA) takes effect, which will help Vietnam enjoy increased investment attraction from the ASEAN – a common market of 600 million people and total GDP of nearly $3 trillion.

In addition to the EVFTA, two other agreements that are expected to liberalise investment and services trade within the ASEAN are the Trade in Services Agreement (ATISA) and the fourth protocol amending the ASEAN Comprehensive Investment Agreement (ACIA), which were officially signed in April this year.

The fourth amendment to the ACIA protocol is an investment agreement in the ASEAN region consisting of four aspects – protection, promotion, facilitation, and liberalisation of investment. The ACIA contains a prohibition on performance requirements as well as elements of the trade related investment measures regime set by the World Trade Organization.

With this, the fourth protocol amendment shall create a stable and predictable climate for trade service and prepare for the integration and liberalisation of the services sector.

The initial ACIA was signed in 2009 and entered into force three years later, aimed at creating a free and open investment environment through consolidation and expansion of previous agreements between the ASEAN member countries. The agreement will allow ASEAN investors to find further opportunities to invest in sectors such as healthcare, and tourism and hospitality within the region.

Meanwhile, the ATISA will replace the ASEAN Framework Agreement on Services that took effect in 1995, benefiting services in healthcare, tourism, accommodation, construction, and convention and exhibition services.

The ATISA, scheduled to enter into force in the next six months, aims to improve standards and effectiveness of regulations of services in ASEAN member states and reduce trade barriers, as well as strengthen transparency in trade and services within the bloc.

It is expected that all the attributes will encourage more new ASEAN giants like Gulf Energy Development and B.Grimm to Vietnam in the future.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Themes: EVFTA & EVIPA

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Mobile Version

Mobile Version