Industrial production shores up post-pandemic prospects

|

Having been operating in Hanoi for 13 years, Japanese-backed Walcom Industry in Hanoi last December had to halt imports of components and materials from Japan and a number of other overseas markets where production and supply chains were disrupted by COVID-19.

However, since this March, imports have been resumed as the foreign partners recovered and boosted exports. Walcom Industry, manufacturing vehicle components, is also increasing exports to Japan, China, and elsewhere in Southeast Asia.

“The company’s import volume has risen 10 per cent since March, and we are planning to open a new workshop to expand production,” said a Walcom Industry Vietnam representative. “The company’s six-month revenue is estimated to increase by 5 per cent on-year, and the rate may be the same for the whole year.”

Also based in Hanoi, Japanese-invested FCC Vietnam Co., Ltd. is expected to import six new lathes valued at over $1 million for one of its workshops by late September this year, meaning another about 25 new workers will be needed.

“The company has recently imported two lathes as it is expanding production. Over recent months, workers like me have become much busier as FCC Vietnam has landed many new orders from American partners who want to buy new products from the company,” worker Do Hong Minh told VIR. “More work means more money and I’m able to save for my upcoming wedding. My average monthly income has climbed by another VND1 million ($44), in comparison to that made in December.”

FCC Vietnam boasts 1,200 workers for three big workshops manufacturing vehicle clutches, and other spare parts of the automotive sector to supply for Yamaha, Suzuki, and Honda. The products are also exported to the US.

Previously, the health crisis forced FCC Vietnam to shrink production costs, with over 200 workers facing a layoff with 70 per cent of monthly salary. At present, all workers are working at full speed, with an increase in income.

These two firms are among many increasing imports for their manufacturing production in Vietnam over the past months. Under a recent survey by Japan’s Pasona Group Inc, about 57 per cent of Japanese businesses in Vietnam are planning to increase performance in the nation, with 43 per cent saying they had or will have a plan to expand their offices in the country.

According to the General Statistics Office (GSO), Japanese firms have greatly contributed to domestic industrial production, which is gradually improving because more and more materials and components are imported into Vietnam for production, and not for direct consumption.

The GSO reported that Vietnam’s import turnover, mostly for domestic production, hit $159.1 billion in the first half of this year, up 36.1 per cent on-year. In which, the figure was $75.31 billion in the first quarter, up 26.3 per cent, and $83.5 billion in the second quarter, up 45.7 per cent.

Meanwhile, the country’s six-month export turnover reached $157.63 billion, up 28.4 per cent on-year. In which, the figure was $77.34 billion in the first three months, up 22 per cent, and $79.23 billion in the second quarter, up 33.5 per cent.

“Amid the ongoing pandemic, business and production activities of enterprises in general and of manufacturing and processing firms in particular in the second quarter have shown positive signals,” said GSO general director Nguyen Thi Huong.

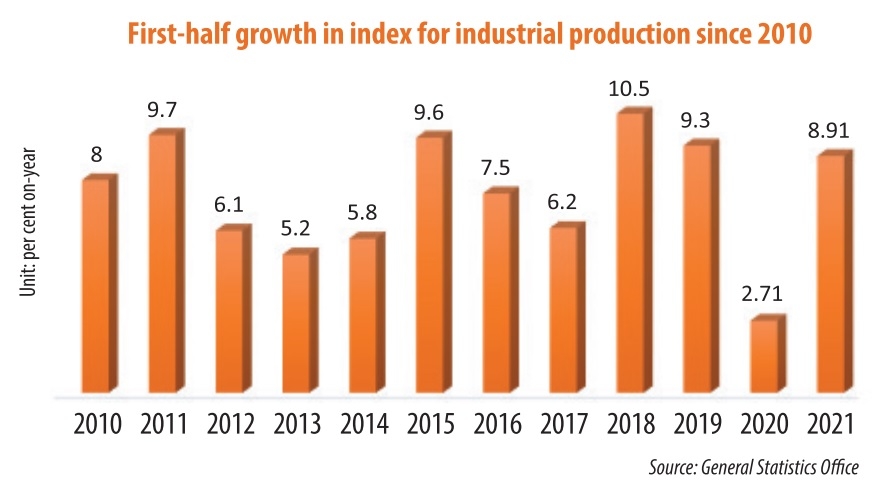

The GSO reported that after growing 6.29 per cent on-year in the first quarter, industrial production in the second quarter of 2021 saw positive growth of 11.45 per cent as compared to that of only 1.1 per cent in the same period last year.

In the first half of this year, the rate was 8.91 per cent on-year, in which the growth rate of the manufacturing and processing sector – which creates 80 per cent of industrial growth – climbed 11.42 per cent as compared to that of 5.06 per cent in the corresponding period of 2020.

Under a recent GSO survey of nearly 5,700 manufacturing and processing enterprises nationwide, 68 per cent of respondents said their second-quarter performance has been better than that in the first quarter. The businesses’ confidence in the government’s direction of the economy has risen significantly, with 78 per cent of respondents forecasting that their performance will be better in the third quarter than in the second quarter. Only 22 per cent predicting that they will be more difficult in the third quarter.

Moreover, up to 70 per cent of enterprises said their orders increased in the second quarter as compared to those in the first quarter. Some 79 per cent of surveyed firms expected that their orders will be increased and maintained in the third quarter. About 83 per cent predicted their new orders in the second half of 2021 will be increased and maintained.

Meanwhile, Minh from FCC Vietnam also told VIR that he felt optimistic over his work, and believed in the economy’s prospects.

“Our company is expanding its workshops, meaning we will have more work to do,” Minh said. “My sister is also working for a foreign company in Hanoi producing garments. She is working at full speed, with an income in the first half of 2021 at VND1.5 million ($65) higher than that in the same period last year.”

According to the GSO’s survey, the respondents in the garment sector said their company’s orders increased 36.1 per cent in the second quarter of 2021 as compared to the first three months.

In a specific case, Nguyen Viet Thang, director of No.26 JSC, said that the company is expanding operations, and in need of new workers. “We currently have over 1,000 workers and is recruiting more,” Thang explained. “All products are locally consumed and exported.”

The GSO reported that in the first half of 2021, Vietnam’s total garment and textile export turnover hit $15.2 billion, up 14.9 per cent on-year.

Figures from the GSO also showed that in the first half of 2021, the economy witnessed 67,100 businesses newly established, registered at VND942.6 trillion ($41 billion) and employing 484.3 new labourers, up 8.1 per cent in the number of businesses, and 34.3 per cent in registered capital.

However, also in this period, 60,300 businesses halted operations and awaited disbandment, up 24.9 per cent on-year.

The government has enacted Resolution No.63/NQ-CP on boosting economic growth, disbursement of public investment, and sustainable exports in the remaining months of 2021 and into 2022.

The resolution focused on many varying solutions such as combating the pandemic and facilitating socioeconomic development; maintaining macroeconomic stability and ensuring major balances of the economy; fostering administrative reform and digital transformation; removing institutional barriers; speeding up public investment disbursement; boosting import and export towards a harmonious and sustainable trade balance; and also supporting both individuals and businesses, among many others.

| Policy recommendations from the International Monetary Fund Given Vietnam’s overall successful containment of COVID-19, the near-term policy imperative is to limit permanent scarring and support a robust recovery. Over time, policies should centre on achieving sustained, inclusive, and greener growth. Provide fiscal support and improve execution: Available fiscal space should be flexibly deployed to support vulnerable households and distressed, but viable firms, with improvement of execution as a priority. Fiscal support should remain in place until the recovery is cemented, with the emphasis thereafter pivoting to revenue mobilisation for financing productive and green infrastructure investment and strengthening social protection systems. Maintain monetary support and modernise the policy framework: Monetary policy should remain supportive while allowing for greater two-way exchange rate flexibility. Reforms to modernise the monetary policy framework and improve policy transmission should continue. Safeguard financial stability: Corporate sector support should be targeted and timebound, and debt restructuring mechanisms strengthened. Exceptional policy support should be gradually phased out and financial stability risks closely monitored. Fragilities in the banking system should be addressed, including rebuilding capital buffers and facilitating Basel II adoption once the crisis abates. Boost productivity and lift growth potential: Decisive structural reforms are needed to make the most of Vietnam’s considerable potential, with priority given to ensuring a level playing field for small- and medium-sized enterprises, lowering the regulatory burden and reducing corruption, alleviating labour skill mismatches, and tackling informality. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version