Home firms make M&A presence felt

This growth was primarily driven by domestic investor-led megadeals, highlighting local corporations’ strategic restructuring efforts to optimise their focus on core businesses in a challenging operating environment.

|

| Nguyen Cong Ai, partner, Deal Advisory Strategy KPMG Tax & Advisory |

Vingroup, for example, closed two major transactions with a combined stated value of approximately $1.4 billion, accounting for nearly half of the market’s total deal value during this period. Without these two deals, Vietnam’s M&A market would have seen an 18.7 per cent on-year decline in deal value.

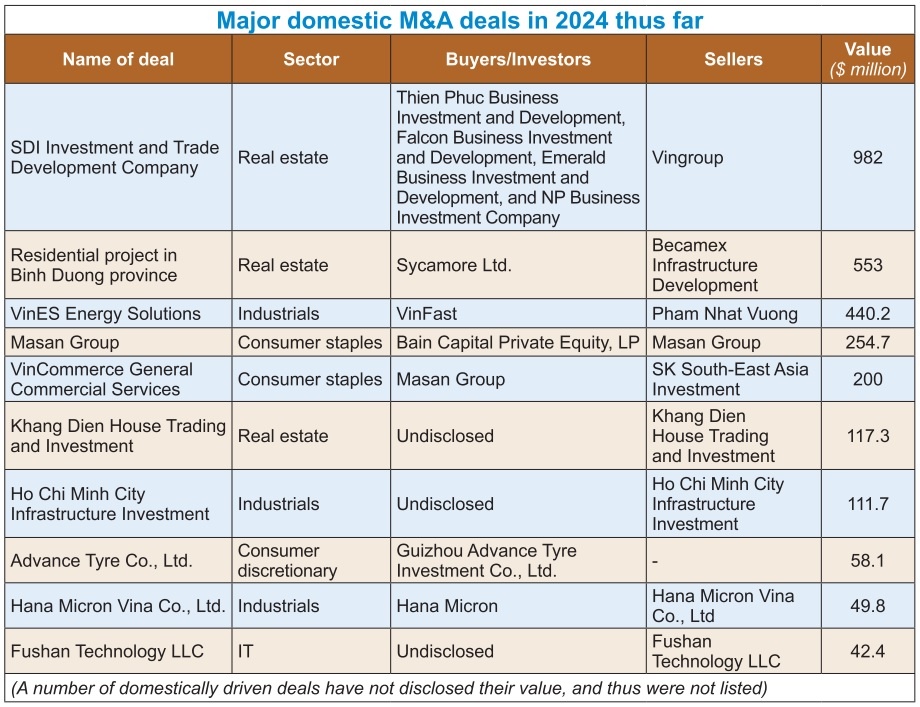

The top 10 transactions collectively contributed about $2.8 billion, representing 87 per cent of the total disclosed deal value in the first nine months of 2024. Compared to the past three years, the average deal size for disclosed transactions rose significantly, reaching $56.3 million during this period. This increase was driven by large deals, primarily by domestic investors, dominating the market. However, it is worth noting that many smaller transactions remain undisclosed, leaving their values unaccounted for.

Since 2020, domestic investors have played a pivotal role in boosting market value and transaction volume by focusing on expanding market share and enhancing vertical integration. This trend continued until late 2022, when domestic investors reached a peak, securing the largest share of deal values exceeding $1.3 billion.

In 2023, domestic investors adopted a more cautious approach, reassessing their strategies, while foreign investors dominated the market, taking all the top five spots by deal value. Japan, Singapore, and the United States were among the most active foreign investors, contributing the majority of the total reported deal value.

In 2024, domestic investors regained prominence, accounting for 53 per cent of the total disclosed deal value in the first nine months alone. Their contributions were roughly double those of the next four leading foreign investor countries combined. This shift reflects a focus on business consolidation and recalibration among local players, as well as a more cautious approach from foreign investors amid global economic uncertainties.

|

Domestic investors were the primary drivers of Vietnam’s M&A market in the first nine months of 2024, contributing significantly to year-on-year growth through high-value transactions in real estate, industrials, and consumer goods.

The largest deal during this period involved a consortium of Vietnam-based companies acquiring a 55 per cent stake in Vingroup’s subsidiary, SDI Investment and Trade Development Company, which holds an indirect 41.5 per cent ownership in Vincom Retail. This transaction, valued at $982 million, highlighted domestic investors’ strategic ambitions in real estate.

The second-largest deal was also in the real estate sector, with Becamex Infrastructure Development JSC transferring a residential project in Binh Duong province worth $553 million to Sycamore Limited, a subsidiary of Singapore’s CapitaLand Group.

In the consumer staples sector, Masan Group saw significant activity. US-based Bain Capital invested $255 million in the company through a private placement, while Masan Group reacquired a $200 million stake in VinCommerce General Commercial Services JSC from SK South-East Asia Investment.

In the industrial sector, VinFast Auto Ltd. completed a $440 million deal to acquire VinES Energy Solutions JSC from Pham Nhat Vuong, further consolidating its operations. Additionally, several other sizable transactions, ranging from $40 million to $112 million, were recorded in the industrial and IT sectors, underscoring diverse investment opportunities across industries.

Vietnam’s M&A landscape in the remaining months of 2024 and into 2025 presents compelling opportunities for investors navigating a dynamic regional environment. While deal activity in 2024 may proceed with caution due to global economic pressures, Vietnam’s strong economic fundamentals and supportive macroeconomic framework provide a solid foundation for growth.

Key sectors such as real estate, manufacturing, technology, and consumer goods remain attractive to both strategic acquirers and private equity firms. These industries demonstrate robust potential, supported by Vietnam’s resilience and long-term growth prospects.

As we move into 2025, a resurgence in M&A activity is anticipated. Previously deferred transactions are likely to return, driven by renewed investor confidence in Vietnam’s stable economic outlook and proactive government policies. Traditional investors from Japan, South Korea, Singapore, and the United States, which have historically dominated dealmaking activities in Vietnam, are expected to re-enter the market and potentially outpace domestic players in leading M&A transactions.

Tax incentives, regulatory reforms, and strategic support for high-growth sectors such as technology and manufacturing are positioning Vietnam as an increasingly attractive destination for cross-border capital.

These initiatives, combined with ongoing investments in infrastructure and digital modernisation, are likely to bolster the country’s M&A potential.

Vietnam’s alignment of economic stability, policy clarity, and sectoral growth opportunities provides a compelling narrative for investors seeking durable, long-term returns in one of Asia’s most dynamic markets.

| Vietnam well-placed to remain strategic M&A leader A number of potential deals in the pipeline signifies bright prospects for Vietnam’s mergers and acquisitions landscape. |

| Traditional M&A entities buoyed by positive outlook Several notable deals have emerged in Vietnam’s dealmaking landscape, signalling a rebound in such activities. |

| M&As pick up pace in sectors from food to energy A raft of transactions are still taking place in the Vietnamese market across different industries, from food to renewable energy, signalling improved sentiment from investors. |

| M&A figures can be rejuvenated through stability Mergers and acquisitions activity saw a decline during the first nine months of 2024, as rising inflation and economic slowdowns affected dealmaking confidence. Masataka “Sam” Yoshida, head of the Cross-border Division of RECOF Corporation, spoke with VIR’s Thanh Van about how this trend is expected to be temporary. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- Vietnam’s IFC creates bigger stage for M&As (February 01, 2026 | 08:16)

- Game startup Panthera raises $1.5 million in seed funding (January 29, 2026 | 15:13)

- Cool Japan Fund transfers shares of CLK Cold Storage (January 28, 2026 | 17:16)

- Nissha acquires majority stake in Vietnam medical device maker (January 26, 2026 | 15:40)

- BJC to spend $723 million acquiring MM Mega Market Vietnam (January 22, 2026 | 20:29)

- NamiTech raises $4 million in funding (January 20, 2026 | 16:33)

- Livzon subsidiary seeks control of Imexpharm (January 17, 2026 | 15:54)

- Consumer deals drive Vietnam’s M&A rebound in December (January 16, 2026 | 16:08)

- Southeast Asia tech funding rebounds on late-stage deals (January 08, 2026 | 10:35)

Tag:

Tag:

Mobile Version

Mobile Version