High inflation dragging down Vietnamese wood exports

About 80 per cent of tables, chairs, beds, and cabinets made by Toan Tam Phat Co., Ltd. in the southern province of Dong Nai are sold to the US market, with the rest of the company’s products exported to Europe.

|

| Order numbers of wood and wood products to the US are expected to fall in the remaining months of 2022, Le Toan |

Tran Van Thang, deputy director of the company, said, “In normal times, we need around 900 workers to produce all our goods. But orders have dropped sharply to about half the usual amount, so the company only employs half of its employees.”

He added, “Our output is challenging due to the impact of the high inflation in the US and Europe, leading to a sharp decrease in the demand for wooden furniture since April.”

In the US market, according to many analysts, the demand for wooden furniture often increases sharply in the last months of the year. But this year, the impact of high inflation and the continuous increase in interest rates by the US Federal Reserve further tightened people’s spending and reduced expenditure for non-essential items. This decline, combined with rising rents, drags down demand for furniture.

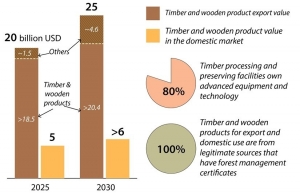

Vietnam’s wood industry was preparing itself for a market size of $20 billion in 2025. However, this aim is being affected by the reduction of purchases in most export markets, especially the US, which accounts for more than 60 per cent of the country’s total furniture export turnover. Vietnam’s wooden furniture exports to the US continued to decline, reaching only $1.41 billion in September, down over a fifth compared to August, as statistics from the General Department of Vietnam Customs (GDVC) showed.

The results of a quick survey of 52 timber enterprises conducted by US-based non-profit organisation Forest Trends and timber associations two months ago showed that, out of 45 enterprises exporting to the US, 33 confirmed that their revenue had decreased by nearly 40 per cent compared to the first months of the year.

Only 10 businesses said revenues increased compared to the previous months, but the increase was tiny, amounting to a meagre 11 per cent at best.

Warnings from domestic wood associations also indicated that the number of orders to the US market will continue to decline in the remaining months of the year, at an average rate of over 40 per cent. Meanwhile, about 60 per cent of enterprises surveyed said they were under financial pressure; and 70 per cent mostly due to costs for labour and input materials.

Nguyen Van Dien, director of the Forestry Production Development Department under the Ministry of Agriculture and Rural Development’s Vietnam Administration of Forestry, said, “The wood processing industry is facing double difficulties, including falling export orders and an investigation by the US Department of Commerce (DOC) on wooden cabinets imported from Vietnam.

Last week, a survey team of the DOC went to Vietnam, directly inspecting wood enterprises exporting to the US. About 40 enterprises did well, but with 36 enterprises, the DOC is considering a lack of cooperation. Vietnam’s wood industry is facing two cases of anti-circumvention investigation from the DOC, with plywood products and kitchen cabinets.

Regarding the investigation of plywood products using hardwood materials imported from Vietnam, companies that can provide explanations that they do not use Chinese raw materials, accounting for 80 per cent of plywood exports during the investigation period, are still certified to export to the US and are not subject to anti-circumvention tax.

The DOC also initiated a tax evasion investigation on wooden kitchen cabinets imported from Vietnam in June.

Many domestic analysts believe that the US needs to consider historical factors. Since 2018, when the US-China trade war escalated, the US applied anti-dumping tax of over 183 per cent and anti-subsidy tax ranging from 22-195 per cent on wood products from China.

This has pushed the US market to import more wood products from Vietnam. As of 2021, Vietnam’s export turnover for these products to the US has increased from $3.6 billion to $8.8 billion, a compound growth rate of 25 per cent according to data from the GDVC.

In 2021 alone, Vietnam’s export turnover to the US reached $14.12 billion, an increase of 17.6 per cent compared to 2020.

| Vietnam plans out domestic wood pivot To ease the dependence on imported wood and timber products, Vietnam aims to reduce the amount of imported material and instead strengthen the domestic supply – a goal the government aims to reach by applying a traditional carrot and stick approach. |

| Wood processing industry to be major economic sector by 2030 Vietnam eyes the wood processing industry to be a major economic sector by 2030. |

| Order cuts put brakes on wood enterprises Profits of many industrial sector companies are slowing down, preventing recovery of the economy, and wood and timber groups are feeling the pinch perhaps more so than others. |

| Wood exports reach $12.4 billion in first nine months Vietnam exported about $12.4 billion of wood and wood products in the first nine months of 2022, an increase of 7 per cent over the same period in 2021, according to the Ho Chi Minh City Handicraft and Woodworking Association. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Tag:

Tag:

Mobile Version

Mobile Version