Order cuts put brakes on wood enterprises

The decline in export orders and reduced working hours are widespread, especially in labour-intensive industries such as textiles, footwear, and wood. The situation is expected to last at least until the end of the year as demand in the main export markets, the United States and Europe, continues to fall. For Vietnam’s wood and timber industry, the sharp drop in orders dragging down the country’s export growth now heads into the third consecutive month.

In the five previous years, Vietnam’s wood export turnover increased by 10-21 per cent and many companies said they had expanded their investment, which gave hope for record growth in the coming years.

|

| The labour force in some of the top wood provinces in the country has been slashed as compared to 2019, Le Toan |

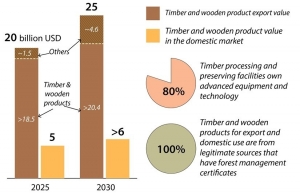

In May, Truong Thanh Wood Industry Group in the southern province of Binh Duong offered to sell 100 million new shares to spend part of the raised capital on buying 20 per cent of Natuzzi Singapore, an Italian furniture brand. In Binh Duong, the company also wanted to increase the capacity of factories and lease back an MDF board factory to be self-sufficient in raw materials. That was still the time when many Vietnamese wood companies heavily invested in expansion and believed that exports of timber and forest products would reach $20 billion by 2025.

However, despite the optimistic signs, Vietnam’s export turnover of wood and forest products has now decreased for three consecutive months, with exports in July only reaching $1.41 billion, down 5.5 per cent compared to June and 1.6 per cent over the same period in 2021, as data from the General Department of Forestry under the Ministry of Agriculture and Rural Development shows.

Orders declined in most of Vietnam’s main export markets, such as the US and EU. According to a quick survey in July by non-governmental organisation Forest Trends and wood associations conducted with 52 businesses, 33 out of 45 enterprises currently exporting to the US said their revenues had decreased by nearly 40 per cent. Compared to the first months of the year, only 10 enterprises reported an increase in revenue compared to the previous months, but the rise was very low, only around 11 per cent on average.

Firms exporting wooden furniture to the EU market are also in a similar situation. Among the 38 enterprises participating in this market, 24 reported that their revenue decreased by over 41 per cent compared to the previous months, and only four reported an increase in revenue at around 14 per cent.

The survey by Forest Trends also showed that 44.2 per cent of businesses said they could hold out for another 3-6 months, and 23.1 per cent said they could hold out for more than 12 months. However, 19.2 per cent said they could only survive for the next three months without new orders.

As more wood manuf acturers have to look for new markets to make up for the shortage of orders, there is another headache related to incomes and jobs for workers.

Since the end of June, Great Veca Co., Ltd. in the southern province of Dong Nai has cut production due to a sharp drop in orders. The company’s failure to better organise production has dragged down the income of employees to around $215 per month. Under normal order conditions, the basic salary of employees would be in the range of $300-430 per month.

Meanwhile, the situation in Binh Duong is also grey, where Thuan An Wood JSC has given employees a rotational leave in August. According to the company, since July orders from Europe, which account for over 90 per cent of its exports, decreased in almost all segments such as beds, cabinets, and chairs.

Nguyen Liem, chairman of the Binh Duong Wood Processing Association, said, “The labour force at wood enterprises in Binh Duong has now been reduced by 100,000 people compared to before the recent COVID-19 pandemic.”

Vietnam’s wood processing industry is mainly concentrated in Dong Nai, Binh Duong, Binh Dinh, and Ho Chi Minh City, striving to become an important economic sector by 2030 with an export turnover of over $20.4 billion.

However, Do Xuan Lap, chairman of the Vietnam Timber and Forest Product Association, said, “Companies are under a lot of pressure, such as from bank loans, input materials, and other costs like labour, exports, and transport. It will be very difficult to achieve the current export target of $16.5 billion in 2022.”

Although there is speculation about when the global market demand will recover, there is much consensus that export orders by the end of the year will not be as high as previously.

Forest Trend’s quick survey also backed up this trend as about 70 per cent of businesses said that orders until the end of the year will continue to decrease.

Truong Thanh Wood is now trying to diversify its markets by expanding exports to the Middle East and Russia to find a way to offset its losses.

At its recent AGM, the company’s president Mai Huu Tin said that the sales of over 41 million individual shares to Marina 2 JSC, a company that is developing a furniture retail system, would bring additional capital to buy shares of Tekom Central, a plywood manufacturing company in Vietnam.

Tin said he wanted to transform Truong Thanh into “the number one furniture company in Southeast Asia” with a value of billions of US dollars in the next 10 years.

| DOC not yet issued final decision for trade remedies on hardwood plywood The US Department of Commerce (DOC) has not yet issued the final determination on the imposition of anti-dumping and countervailing duties on certain hardwood plywood products and veneered panels exported from Vietnam. |

| Wood processing industry to be major economic sector by 2030 Vietnam eyes the wood processing industry to be a major economic sector by 2030. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Ho Chi Minh City launches plan for innovation and digital transformation (February 25, 2026 | 09:00)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

Tag:

Tag:

Mobile Version

Mobile Version