Healthcare groups bring expertise and innovation

|

| Healthcare groups bring expertise and innovation, illustration photo/ Source: freepik.com |

Following the strategic partnership with FPT Long Chau earlier this year, IHH Healthcare Singapore, Singapore’s largest private healthcare provider, is exploring new opportunities in Vietnam.

Jeffrey Law, chief commercial officer of IHH Healthcare Singapore, said it is constantly seeking like-minded partners. “It is important for us to support patients who wish to seek care in Singapore and, for those unable due to affordability or mobility, to allow them access to quality care back in Vietnam. We do not yet have an operating model in mind, but we are actively seeking opportunities to become more involved in the local market,” Law said.

“While we are seeing rapid growth in the number of new hospitals and medical centres, the number remains small relative to the size and demand of the market. The under-penetration of health insurance also signals potential for growth, as this will likely change as the market matures. Growth in insurance penetration will open access and can catalyse growth in healthcare services,” Law added.

The healthcare sector remains an area of interest for Singaporean investors, spearheaded by key deals such as Thomson Medical Group’s purchase of a controlling stake in FV Hospital for more than $380 million, as well as Raffles Medical Group’s strategic cooperation agreement with a local investor to take over the operations of American International Hospital, valued at approximately $46 million.

Besides healthcare companies, Singapore private equity firms are also eyeing Vietnamese healthcare assets. Earlier this year, Singapore-headquartered private equity firm TVM Capital Healthcare invested in the Vietnamese eye-care business Alina Vision. The investment provided growth capital to support a specialty ophthalmology hospital chain that reaches underserved Vietnamese communities.

The investment aligns with TVM Capital Healthcare’s goal to provide more affordable and high-quality medical services, including those with a strong impact on women’s health. Alina Vision provides treatment for cataracts, the most common cause of blindness among those over 50 in Vietnam, predominantly affecting women.

Hoda Abou-Jamra, founding partner and managing director of TVM Capital Healthcare in Southeast Asia, said, “We will continue our active involvement in the Vietnamese healthcare sector, with teams based in Ho Chi Minh City and Singapore. Our goal is to bring in expertise, fostering innovation, and ensuring high-quality services are accessible to more people.”

Similarly, Singapore investment firm Sweef Capital has made a strategic investment in Vietnam-based USM Healthcare to increase access to affordable medical devices and orthopaedic products.

Jennifer Buckley, managing director of Singapore-based Sweef Capital, said, “We’re excited by what we see in Vietnam. Sweef Capital was established to support local companies in Asia-Pacific, and Vietnam is a priority market for us because of the dynamic leadership and innovation we see there. We have extensive expertise in healthcare, and it aligns well with our impact investment focus, targeting well-led businesses in industries that employ large numbers of women and deliver social benefits as well as strong financial returns.”

According to a report published by the National Innovation Centre and Do Ventures in April, Vietnam’s healthcare sector witnessed record-high investment in 2023, with on-year growth of 391 per cent, making it the most funded sector. In April, Singapore’s sovereign wealth fund GIC Pte doubled down on its investment in Vietnam-based pediatric and maternity clinic chain operator Nhi Dong 315.

However, besides that deal, there have been few announcements in the first half of 2024.

Abou-Jamra from TVM Capital Healthcare said the current dip in the number of deals is a short-term adjustment rather than a reflection of waning interest.

"The fundamental attractiveness of Vietnam's healthcare market remains strong, and we expect to continue seeing steady interest from investors. The slowdown in deal activity in the first half of 2024 is part of a broader trend in Southeast Asia, largely tied to the current fundraising market,” Abou-Jamra said.

Additionally, the high valuations achieved in 2023 have set ambitious expectations for sellers this year, misaligned with current investor demand. This has naturally led to a temporary lull as the market adjusts. TVM Capital Healthcare expects deal activity to pick up as market conditions stabilise and valuations align more closely with investor expectations.

“Southeast Asia isn’t immune to the economic headwinds experienced elsewhere, but we maintain considerable optimism for healthcare performance in Vietnam,” said Buckley of Sweef Capital. “This is driven by continued innovation to address unmet medical needs. Despite recent macroeconomic considerations, leading healthcare companies continue to allocate capital towards innovative service offerings, providing substantive improvements in Vietnam in both the public and private sectors.”

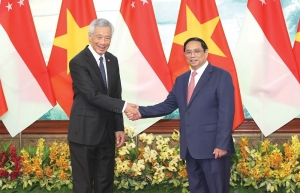

| Singapore and Vietnam enter new phase of relations Prime Minister of Singapore, Lee Hsien Loong, will pay an official visit to Vietnam this week. Tan See Leng, Singapore’s Minister for Manpower and Second Minister for Trade and Industry, writes about how both economies can bring their economic ties to greater heights. |

| Interest rises for Singapore’s businesses Vietnam and Singapore have upgraded their bilateral connectivity framework agreement to include new areas, making it more favourable for businesses of both nations to intensify trade and investment ties. |

| Singapore’s unemployment rate increases The number of retrenchments and unemployed residents in Singapore rose in the third quarter of 2023 as a weaker economic outlook dragged down sectors such as wholesale trade, according to the Ministry of Manpower (MOM)'s statistics. |

| Abundant potential for Vietnam-Singapore relations Vietnam and Singapore have been working closely to strengthen bilateral ties in the green and digital economy. Gan Kim Yong, Singapore Minister for Trade and Industry, spoke with VIR’s Minh Anh on the sidelines of the Singapore Week of Technology and Innovation 2023, about the next steps for bilateral relations. |

| Singaporean investors increasingly drawn to Vietnam Thanks to the open economic landscape and enormous growth potential in various sectors, Vietnam has always been on the list of favourable destinations for Singaporean investors, who have consistently been among the leaders in terms of foreign capital inflows into the country. |

| Singaporean investors prioritise HCM City in expansion plans Many Singaporean businesses and investors have given priority to Ho Chi Minh City in their operational expansion plans, especially in the fields of finance, trade and high technology. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Ho Chi Minh City launches plan for innovation and digital transformation (February 25, 2026 | 09:00)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

Tag:

Tag:

Mobile Version

Mobile Version