Singaporean investors increasingly drawn to Vietnam

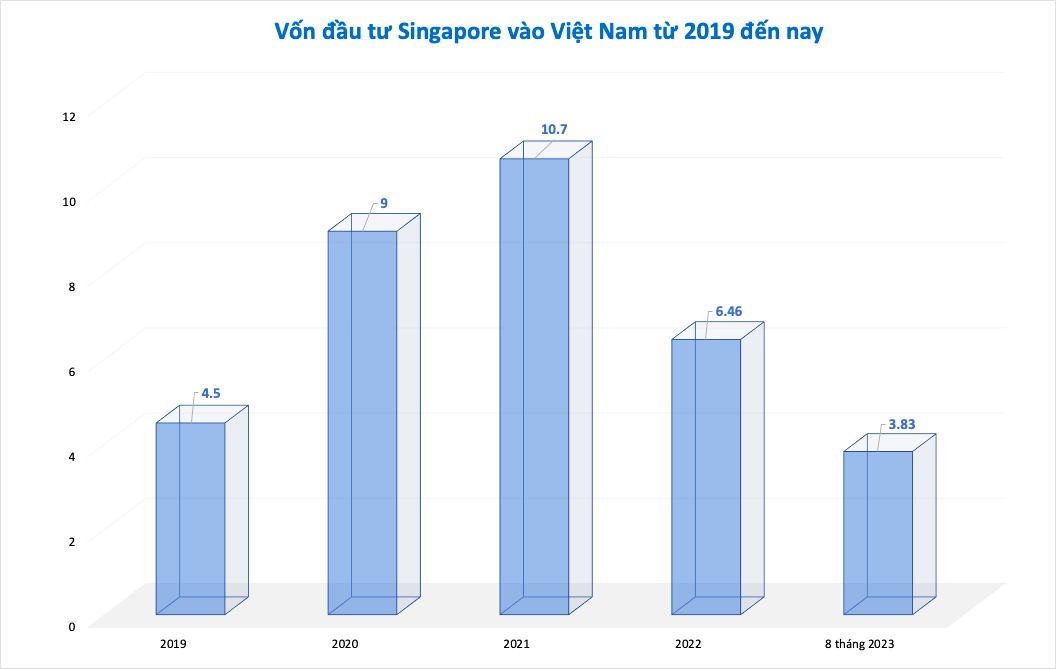

In the first eight months of 2023, Vietnam attracted over $18.15 billion in foreign investment, marking an 8 per cent on-year increase. Of this amount, Singaporean investment was at the forefront, accounting for $3.83 billion.

This underscores the strong confidence that investors from Singapore have in Vietnam's macroeconomic management and its fair and transparent investment environment.

Recently, Singapore has risen to become the leading foreign investor in the ASEAN region. Additionally, it ranks as the second-largest investor among 143 countries and territories investing in Vietnam, boasting a total of $70.8 billion in over 3,000 projects.

As per the latest figures from the Foreign Investment Agency, the real estate sector has particularly captured the interest of Singaporean investors, with a total registered capital of over $18 billion in more than 180 projects.

|

| Singaporean investment capital in Vietnam since 2019 |

A report from the Singapore Business Federation in 2022 revealed that, out of 690 surveyed Singaporean businesses, 28 per cent singled out Vietnam as their most promising investment destination. This figure significantly exceeded countries such as Malaysia, Indonesia, and Thailand, and even China, India, the United Kingdom, and Germany.

Experts predict that Vietnam will continue to attract the attention of Singaporean investors. Earlier this year, during an official visit to Singapore to commemorate the 50th anniversary of diplomatic relations and 10 years of strategic partnership between the countries, Prime Minister Pham Minh Chinh commented on the deepened mutual understanding, experience, confidence, and trust between the two nations thanks to their long-term business collaboration.

Similarly, during a recent visit to Vietnam, Singaporean Prime Minister Lee Hsien Loong highlighted, “Our bilateral relationship is rapidly developing. It has never been as strong and comprehensive as it is today.”

Vietnam and Singapore have mutually agreed to explore the possibility of elevating bilateral relations to a Comprehensive Strategic Partnership in the near future. Industry experts view this as a foundation to bolster economic ties between the investors of both countries, consolidating Vietnam's prominent position in the region and paving the way for new projects in sectors such as manufacturing, real estate, and renewable energy.

Over three decades of operating in Vietnam, Keppel, a global asset manager and operator headquartered in Singapore, has grown to become one of the nation's largest foreign real estate investors, with over 20 licensed projects and a total registered investment capital of about $3.5 billion.

Vietnam is one of Keppel’s key markets. As of December 31, 2022, its real estate division had $1.1 billion worth of assets in Vietnam, which made up over 12 per cent of the division’s total. It also recently invested $130.9 million to acquire stakes in two residential projects in Thu Duc city and made a $50.6 million investment in a retail property in Hanoi.

|

| At the signing of an MoU between Keppel and Khang Dien Group |

As a global asset manager and operator with strong expertise in sustainability-related solutions covering infrastructure, real estate, and connectivity, Keppel is well-poised to continue contributing to Vietnam's sustainable development. Specifically, the company can create value for investors and stakeholders through its quality investment platforms and diverse asset portfolios, including private funds, listed real estate, and business trusts.

A good example is the Keppel Vietnam Fund, a private fund that combines capital from Keppel and global institutional investors to co-invest in residential developments, commercial properties, and mixed-use projects and townships in Vietnam.

To date, the fund has invested alongside Keppel in five high-quality residential projects in Hanoi and Ho Chi Minh City. When fully leveraged and invested, the fund will potentially have assets under management of approximately $1 billion.

With a long-term commitment to Vietnam, the Singaporean investor plans to develop Real Estate-as-a-Service and leverage advanced technology with a customer-centric approach. At the same time, it aims to develop new growth areas, such as sustainable urban renewal, to boost its recurring income.

|

| Keppel’s Operations Nerve Centre in Thu Duc city |

Joseph Low, president of Real Estate at Keppel Corporation (Vietnam) said, "Along with real estate, Keppel sees promising opportunities in the energy and data centre sectors, given the growing emphasis on the green and circular economies in Vietnam."

"We are making significant progress in these sectors, notably, with the launch of our Operations Nerve Centre to offer long-term Energy-as-a-Service solutions to many domestic customers. This initiative not only delivers exceptional economic value to our customers but also contributes to enhancing community wellbeing and advancing Vietnam’s sustainable development," Low continued.

| Keppel Land invests $138 million in two residential projects with Khang Dien Keppel Corporation Ltd. (Keppel) and Keppel Vietnam Fund (KVF), jointly known as the Keppel Consortium, have entered into binding agreements to acquire a 49 per cent interest in two adjacent residential projects in Thu Duc City from the Khang Dien Group for an aggregate consideration of approximately $138 million. |

| Keppel Corporation acquires stake in a retail property in Hanoi Singaporean Keppel Corporation on July 6 announced that Keppel Land Ltd., through its wholly-owned subsidiary, VN Prime Vietnam Co., Ltd., is acquiring a 65 per cent stake in a company ProjectCo, which will hold a retail property in Hanoi. |

| Keppel expands its energy-as-a-service footprint in Asia Keppel Corporation, through its Infrastructure Division, has secured contracts worth over $70 million to provide long-term energy-as-a-service (EaaS) to Republic Holiday Inn, Republic Suite Plaza, and Estella Place in Ho Chi Minh City, as well as Grand Mercure Quang Binh. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

- Public investment is reshaping real estate’s role in Vietnam (January 21, 2026 | 10:04)

- Ho Chi Minh City seeks investor to revive Binh Quoi–Thanh Da project (January 19, 2026 | 11:58)

- Sun Group launches construction of Rach Chiec sports complex (January 16, 2026 | 16:17)

- CEO Group breaks ground on first industrial park in Haiphong Free Trade Zone (January 15, 2026 | 15:47)

- BRIGHTPARK Entertainment Complex opens in Ninh Binh (January 12, 2026 | 14:27)

- Ho Chi Minh City's industrial parks top $5.3 billion investment in 2025 (January 06, 2026 | 08:38)

- Why Vietnam must build a global strategy for its construction industry (December 31, 2025 | 18:57)

- Housing operations must be effective (December 29, 2025 | 10:00)

Tag:

Tag:

Mobile Version

Mobile Version