Grade A apartments abandoned during pandemic

|

| The Grade A apartment segment was muted due to the pandemic |

In a talk with VIR, Hang Do Thi Thu, senior director of Advisory Services in Hanoi at Savills Vietnam said that the Grade A segment was completedly vacant during 2020.

In the second half of the year, the new supply of approximately 5,500 units from 10 launches and new phases of eight existing projects was up 79 per cent on-quarter but down 59 per cent on-year. The primary supply of 27,100 units was up 1 per cent on-quarter, but down 19 per cent on-year.

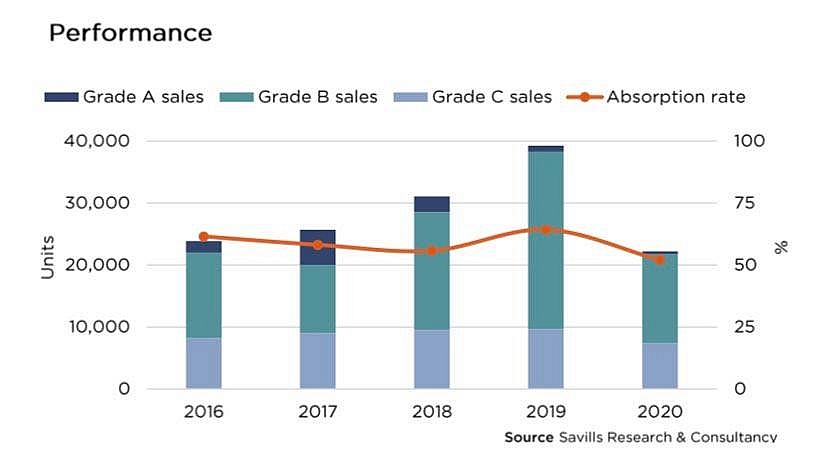

Pent-up demand has supported performance. Total sales of nearly 6,700 units were up 27 per cent on-quarter with an average absorption of 25 per cent. Performance improved in grades B and C.

The annual performance affected by the pandemic saw sales decreasing 43 per cent on-year to their lowest in five years. Grade B with 64 per cent of sales remained the lead performer.

"Grade A sales has been decreasing consecutively since 2017 and was the worst-hit segment by the pandemic in 2020," said Hang. Of this, a lot of high-end apartment projects of giant developers like Tan Hoang Minh Group, Sunshine Group, Sun Group, and Hateco Group, located in Ba Dinh, Tay Ho, and other districts, which launched in 2020 and earlier, could not sell out during the difficult year.

"The competition in this segment is quite fierce. Investors and buyers usually compare it with options like land plots, which can make more profit easier than Grade A apartments," said Hang.

The segment is forecast to face a lot of difficulties even in 2021, if the pandemic is not controlled and the global economy does not fully recover. "However, local demand remains steady, particularly for affordable units. Developers have started focusing on suburbs and surrounding provinces," senior director of Savills Hanoi said.

Savill Vietnam's spotlight for the second half of 2020 forecast unit prices to benefit further from infrastructure upgrades. Average asking prices have increased 4 per cent per year over the last five years. At the same time, infrastructure development eases living farther out. When complete, the metro and ring roads will see this trend accelerate. The framework for public-private partnerships was simplified in 2020. Political stability and speedier decision-making will see greater spending on key infrastructure projects. The GSO estimates that for every 1 per cent point increase in public investment, GDP will move up 0.06 per cent points.

In 2021, approximately 25,000 units from 25 project launches and two projects rolling out new phases will be rolled out onto the market. Grade B (accounting for 78 per cent of this) will continue to lead while experts see no brightening for the Grade A segment in the coming years.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version